- Canada

- /

- Commercial Services

- /

- TSX:KBL

Imagine Owning K-Bro Linen (TSE:KBL) And Wondering If The 17% Share Price Slide Is Justified

While not a mind-blowing move, it is good to see that the K-Bro Linen Inc. (TSE:KBL) share price has gained 15% in the last three months. But that cannot eclipse the less-than-impressive returns over the last three years. After all, the share price is down 17% in the last three years, significantly under-performing the market.

Check out our latest analysis for K-Bro Linen

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

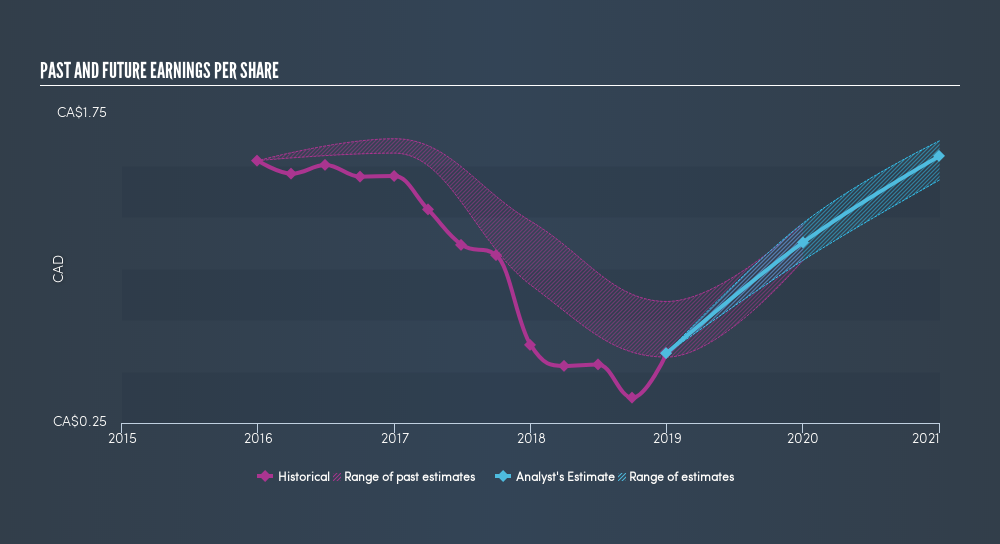

K-Bro Linen saw its EPS decline at a compound rate of 27% per year, over the last three years. This fall in the EPS is worse than the 6.1% compound annual share price fall. This suggests that the market retains some optimism around long term earnings stability, despite past EPS declines. This positive sentiment is also reflected in the generous P/E ratio of 62.57.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. Dive deeper into the earnings by checking this interactive graph of K-Bro Linen's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of K-Bro Linen, it has a TSR of -9.3% for the last 3 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

K-Bro Linen shareholders gained a total return of 4.4% during the year. But that return falls short of the market. On the bright side, that's still a gain, and it's actually better than the average return of 1.9% over half a decade It is possible that returns will improve along with the business fundamentals. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of K-Bro Linen by clicking this link.

K-Bro Linen is not the only stock insiders are buying. So take a peek at this freelist of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:KBL

K-Bro Linen

Provides laundry and linen services to healthcare institutions, hotels, and other commercial organizations in Canada and the United Kingdom.

Reasonable growth potential average dividend payer.

Market Insights

Community Narratives