- Canada

- /

- Commercial Services

- /

- TSX:GFL

How Investors May Respond To GFL Environmental (TSX:GFL) Surging Q3 Earnings and Revenue Growth

Reviewed by Sasha Jovanovic

- GFL Environmental Inc. recently announced its third-quarter and nine-month results for 2025, reporting sales of CA$1.69 billion and net income of CA$114.3 million for the quarter, with both figures higher than the same period last year.

- Basic earnings per share from continuing operations rose to CA$0.28 this quarter, reflecting a significant increase compared to CA$0.06 a year ago.

- We’ll examine what the strong improvement in earnings and sales means for the company’s investment case going forward.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

GFL Environmental Investment Narrative Recap

Being a GFL Environmental shareholder means believing in the company’s ability to drive margin growth through operational efficiency, higher-quality revenue, and sustainability investments, even as it transitions out of certain business lines. The stronger Q3 results do not materially change the short-term picture: the most important catalyst remains further progress on balance sheet improvements and capital returns, with the biggest immediate risk still being earnings pressure from the sale of the Environmental Services business and commodity price headwinds.

One of the most relevant recent announcements is the October 2025 dividend declaration, which underlines GFL’s ongoing commitment to capital returns despite recent changes to business structure. This highlights the company's willingness to maintain regular shareholder distributions while managing through transitions, supporting the core thesis that balance sheet strength can translate into value for shareholders even during periods of business realignment.

But it's important to recognize that, despite these positive signals, investors should be aware of the potential impact from lost revenue streams if the ES business divestiture results in...

Read the full narrative on GFL Environmental (it's free!)

GFL Environmental's narrative projects CA$8.0 billion revenue and CA$111.1 million earnings by 2028. This requires a -0.2% yearly revenue decline and a CA$924.6 million increase in earnings from CA$-813.5 million today.

Uncover how GFL Environmental's forecasts yield a CA$75.52 fair value, a 22% upside to its current price.

Exploring Other Perspectives

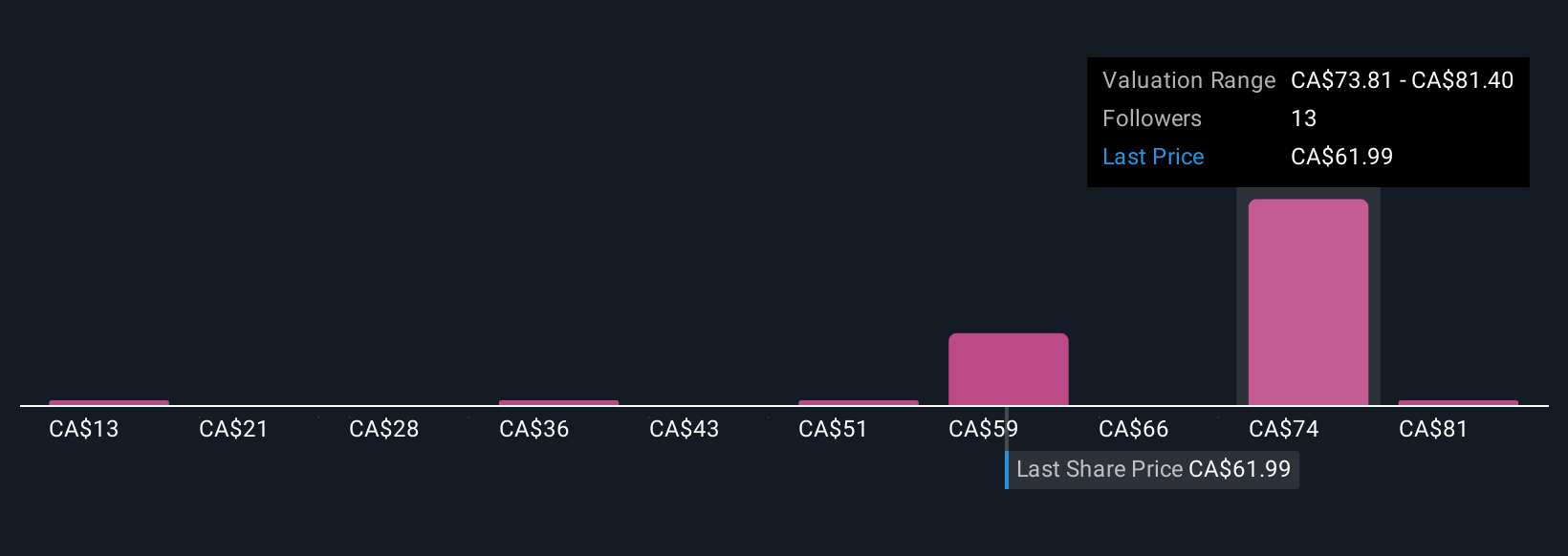

Six members of the Simply Wall St Community have published fair value estimates for GFL Environmental, ranging from CA$13.04 to CA$89 per share. While many see potential, others remain cautious given risks such as possible revenue and earnings volatility after major business sales, reminding you that market opinions can be highly varied and worth comparing.

Explore 6 other fair value estimates on GFL Environmental - why the stock might be worth less than half the current price!

Build Your Own GFL Environmental Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GFL Environmental research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free GFL Environmental research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GFL Environmental's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GFL

GFL Environmental

Provides non-hazardous solid waste management and environmental services in Canada and the United States.

Good value with slight risk.

Similar Companies

Market Insights

Community Narratives