- Canada

- /

- Commercial Services

- /

- TSX:DXT

Dexterra Group (TSX:DXT) Margins Climb, Challenging Bearish Narratives on Profitability

Reviewed by Simply Wall St

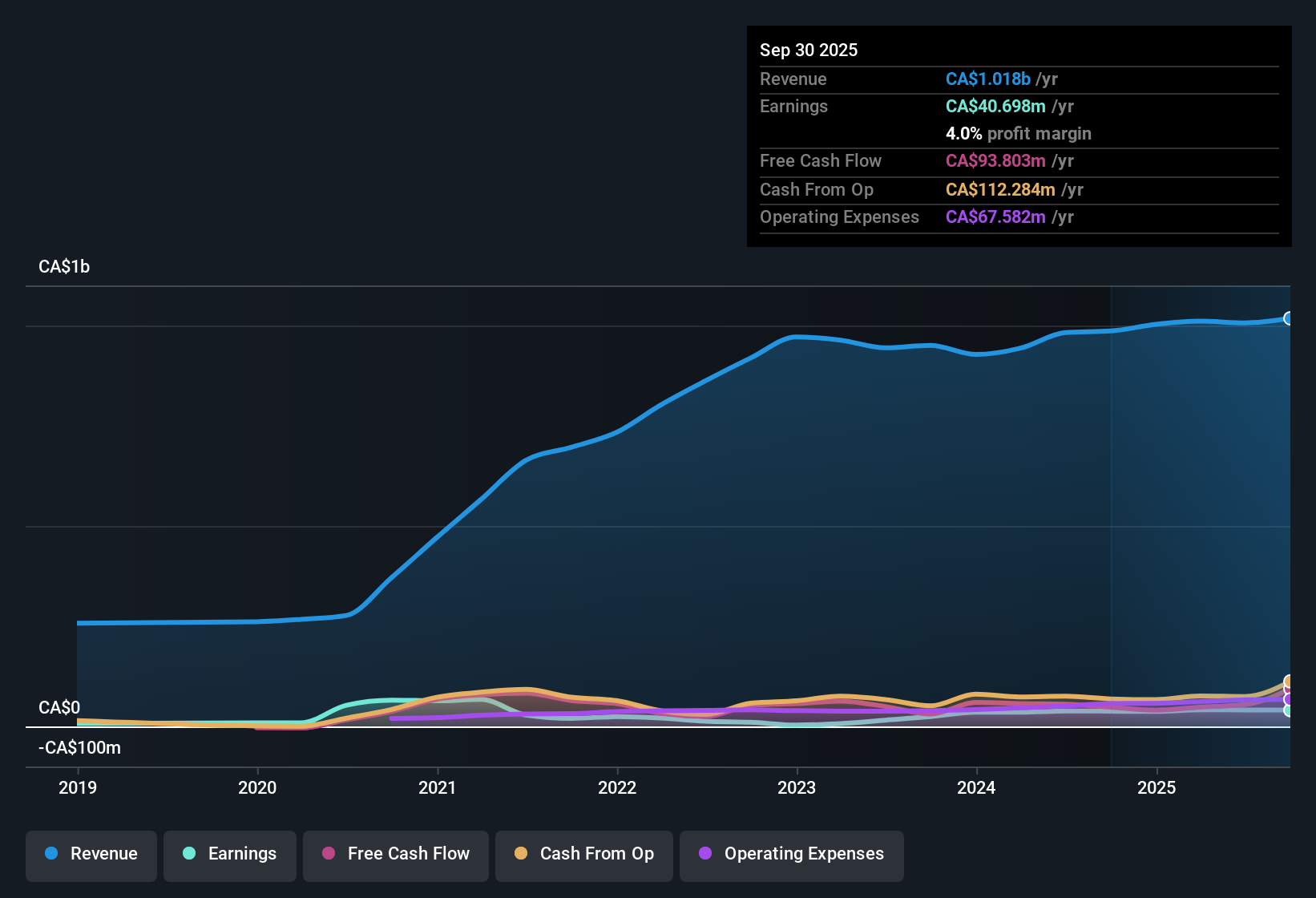

Dexterra Group (TSX:DXT) posted a 7.2% annual revenue growth forecast, handily outpacing the Canadian market average of 5.1%. After five years of declining earnings, the most recent period saw a 6.6% rebound in EPS, while net profit margins edged up to 4.1% from 3.9% last year, hinting at gently improving profitability. With shares currently trading at CA$10.52, below a fair value estimate of CA$38.71, investors may be warming to Dexterra’s relative undervaluation and the reversal in earnings momentum.

See our full analysis for Dexterra Group.Next, we will see how these results compare with the prevailing narratives on Dexterra and where market expectations may need a rethink.

See what the community is saying about Dexterra Group

Contract Pipeline Boosts Predictable Cash Flow

- Analysts expect Dexterra’s profit margins to grow from 4.1% today to 5.9% within three years, driven by a robust contract pipeline and recurring revenue from recent acquisitions.

- Analysts' consensus view heavily emphasizes that ongoing integration of new service divisions and the acquisition of Pleasant Valley Corporation are set to expand Dexterra’s exposure to long-term government and private sector contracts,

- This diversification supports cash flow stability and insulates against sector downturns, which is considered a backbone for long-range earnings growth in the consensus narrative.

- Consensus also notes operational efficiency improvements are expected to help preserve EBITDA margins despite anticipated labor and supply cost fluctuations.

- For investors, analysts argue that earnings are projected to climb from CA$41.2 million to CA$72.6 million by 2028, giving the company a degree of resilience against cyclical swings in core markets. 📊 Read the full Dexterra Group Consensus Narrative.

Acquisitions Make Growth More Attractive but Riskier

- Dexterra’s recent acquisition of RIGHT CHOICE Camps & Catering introduces high-quality, underutilized mobile assets, opening up redeployment opportunities across Canada to capture new demand, but simultaneously increases exposure to industry cycles linked to resource and infrastructure projects.

- Consensus narrative draws attention to the fact that climbing capital outlays and the use of expanded credit facilities for these deals add to financial risk,

- Should anticipated synergies and cross-selling not materialize, Dexterra could face constraints on free cash flow, as highlighted in the consensus view.

- Bears in particular warn that heavy reliance on remote accommodations makes Dexterra's growth trajectory more vulnerable to macroeconomic shifts and downturns in major projects.

Valuation Gap Versus Peers Remains Wide

- Dexterra trades at a Price-To-Earnings ratio of 15.9x, which is below peer and North American industry averages, with a share price of CA$10.52 that sits well under both the DCF fair value of CA$38.71 and the analyst price target of CA$13.07.

- Consensus narrative points out that to deliver on its expected upside, Dexterra will need to meet or beat consensus forecasts for $1.2 billion revenue and a sustainable profit margin above 5.9% by 2028,

- Consensus also highlights that the current analyst price target, at CA$13.07, offers potential upside of over 24% from today’s share price, but this relies on reaching both growth and margin targets despite competitive and cyclical risks.

- This wide valuation gap signals a market expectation reset. Any miss on these future metrics could compress the gap quickly.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Dexterra Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do these numbers tell you a different story? Share your perspective and contribute your own narrative in just a few minutes. Do it your way.

A great starting point for your Dexterra Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Dexterra’s aggressive growth through acquisitions has increased its financial risk. This approach makes future cash flow and profit margins vulnerable if integration stumbles or economic cycles turn.

If you want more stable opportunities, check out stable growth stocks screener (2074 results) to focus on companies that consistently grow earnings and revenue even when the market gets unpredictable.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DXT

Dexterra Group

Engages in the provision of support services for the creation, management, and operation of infrastructure in Canada.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives