- Canada

- /

- Commercial Services

- /

- TSX:DCM

DATA Communications Management (TSE:DCM) Takes On Some Risk With Its Use Of Debt

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, DATA Communications Management Corp. (TSE:DCM) does carry debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for DATA Communications Management

How Much Debt Does DATA Communications Management Carry?

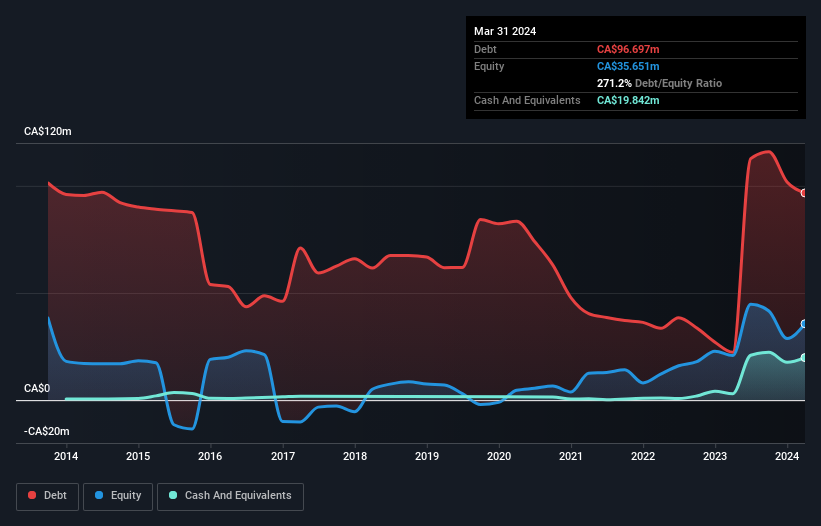

The image below, which you can click on for greater detail, shows that at March 2024 DATA Communications Management had debt of CA$96.7m, up from CA$22.3m in one year. However, because it has a cash reserve of CA$19.8m, its net debt is less, at about CA$76.9m.

A Look At DATA Communications Management's Liabilities

The latest balance sheet data shows that DATA Communications Management had liabilities of CA$109.5m due within a year, and liabilities of CA$260.9m falling due after that. Offsetting these obligations, it had cash of CA$19.8m as well as receivables valued at CA$108.4m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CA$242.2m.

This deficit casts a shadow over the CA$154.9m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. At the end of the day, DATA Communications Management would probably need a major re-capitalization if its creditors were to demand repayment.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

DATA Communications Management has net debt worth 1.8 times EBITDA, which isn't too much, but its interest cover looks a bit on the low side, with EBIT at only 2.8 times the interest expense. While these numbers do not alarm us, it's worth noting that the cost of the company's debt is having a real impact. Notably DATA Communications Management's EBIT was pretty flat over the last year. We would prefer to see some earnings growth, because that always helps diminish debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if DATA Communications Management can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. During the last three years, DATA Communications Management generated free cash flow amounting to a very robust 83% of its EBIT, more than we'd expect. That positions it well to pay down debt if desirable to do so.

Our View

We'd go so far as to say DATA Communications Management's level of total liabilities was disappointing. But at least it's pretty decent at converting EBIT to free cash flow; that's encouraging. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making DATA Communications Management stock a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. In light of our reservations about the company's balance sheet, it seems sensible to check if insiders have been selling shares recently.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DCM

DATA Communications Management

Provides print and digital solution to simplify complex marketing communication and operations workflows in the United States and Canada.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion