- Canada

- /

- Metals and Mining

- /

- TSXV:CKG

3 TSX Penny Stocks With Market Caps Under CA$400M

Reviewed by Simply Wall St

The TSX is having a strong year, up more than 17%, reflecting the broader market's impressive performance driven by a growing economy, favorable interest-rate policies, and rising corporate profits. In this context, identifying stocks with solid fundamentals becomes crucial for investors looking to capitalize on market opportunities. Although the term "penny stocks" might seem outdated, it still denotes smaller or emerging companies that can offer significant value; focusing on those with robust financials and growth potential can uncover promising investment opportunities.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.68 | CA$620.88M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.41 | CA$11.75M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.165 | CA$4.4M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.24 | CA$297.04M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.29 | CA$119.71M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.80 | CA$303.41M | ★★★★★☆ |

| Foraco International (TSX:FAR) | CA$2.40 | CA$221.84M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.035 | CA$3.17M | ★★★★★★ |

| Newport Exploration (TSXV:NWX) | CA$0.115 | CA$12.14M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.11 | CA$30.89M | ★★★★★★ |

Click here to see the full list of 947 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

DATA Communications Management (TSX:DCM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: DATA Communications Management Corp. offers solutions to streamline complex marketing and communication workflows primarily in the United States and Canada, with a market cap of CA$153.76 million.

Operations: The company generates revenue of CA$507.69 million from its Printing & Publishing segment.

Market Cap: CA$153.76M

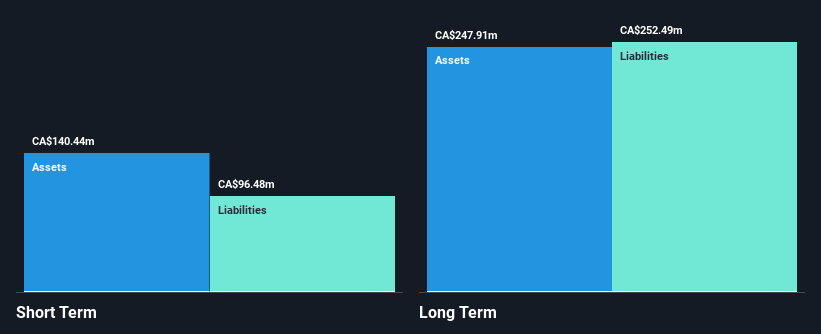

DATA Communications Management Corp. has shown resilience in its financial performance, with recent quarterly sales increasing to CA$125.75 million and a return to profitability with a net income of CA$4.06 million. The company is actively restructuring, consolidating its production facilities from 14 to 10, which could enhance operational efficiency following the acquisition of Moore Canada Corporation. Despite being unprofitable overall, DCM maintains a positive cash flow and sufficient runway for over three years. However, it faces challenges with high long-term liabilities (CA$251.3M) exceeding short-term assets (CA$144.9M).

- Click here and access our complete financial health analysis report to understand the dynamics of DATA Communications Management.

- Evaluate DATA Communications Management's prospects by accessing our earnings growth report.

Hamilton Thorne (TSX:HTL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hamilton Thorne Ltd. specializes in creating and distributing precision instruments, laboratory equipment, consumables, software, and services for the assisted reproductive technologies (ART), research, and cell biology markets with a market cap of CA$342.43 million.

Operations: The company generates $72.57 million in revenue from its sales to the assisted reproductive technologies, research, and cell biology markets.

Market Cap: CA$342.43M

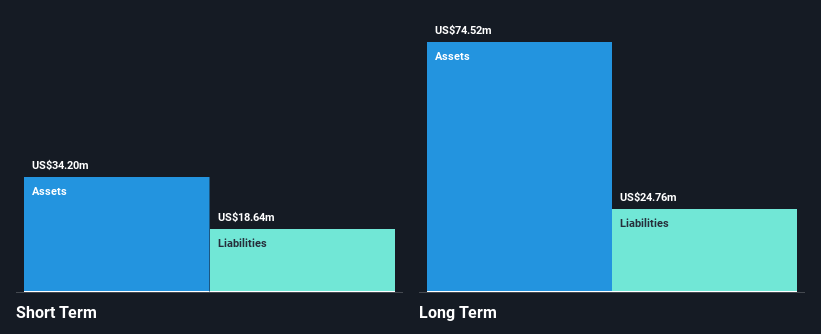

Hamilton Thorne Ltd. is navigating financial challenges, with recent quarterly sales rising to US$19.08 million, yet it remains unprofitable with a net loss of US$0.51 million for the quarter. The company’s short-term assets of $35.1 million effectively cover both its short-term and long-term liabilities, indicating solid liquidity management despite increased debt levels over five years. However, its share price has been highly volatile recently and interest coverage remains weak at 0.3 times EBIT. An acquisition by Astorg could lead to delisting from the TSX as part of a strategic shift in ownership structure at C$2.25 per share.

- Take a closer look at Hamilton Thorne's potential here in our financial health report.

- Learn about Hamilton Thorne's future growth trajectory here.

Chesapeake Gold (TSXV:CKG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Chesapeake Gold Corp. is a mineral exploration and evaluation company that focuses on acquiring, evaluating, and developing precious metal deposits in North and Central America, with a market cap of CA$127.90 million.

Operations: Chesapeake Gold Corp. does not report any revenue segments.

Market Cap: CA$127.9M

Chesapeake Gold Corp. remains a pre-revenue entity, with no significant revenue streams reported and a market cap of CA$127.90 million. Despite being debt-free, the company has experienced increased losses over the past five years at an annual rate of 28.8%. Its short-term assets (CA$16.4 million) comfortably cover both short-term liabilities (CA$2.1 million) and long-term liabilities (CA$11.1 million), suggesting robust liquidity management in the absence of debt obligations. The management team is relatively experienced with an average tenure of 2.1 years, while shareholders have not faced significant dilution recently, maintaining stock stability amidst volatility challenges.

- Click to explore a detailed breakdown of our findings in Chesapeake Gold's financial health report.

- Gain insights into Chesapeake Gold's historical outcomes by reviewing our past performance report.

Turning Ideas Into Actions

- Navigate through the entire inventory of 947 TSX Penny Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:CKG

Chesapeake Gold

A mineral exploration and evaluation company, focuses on acquisition, evaluation, and development of precious metal deposits in North and Central America.

Flawless balance sheet low.