- Canada

- /

- Metals and Mining

- /

- TSXV:AMZ

TSX Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

Following a decisive U.S. election, the Canadian market has been buoyed by favorable fundamentals, with the TSX reaching multiple record highs this year. Amid this backdrop, investors might find opportunities in penny stocks—smaller or newer companies that can offer surprising value despite their outdated name. These stocks often present growth potential at lower price points, and when supported by strong balance sheets and solid fundamentals, they may offer upside with reduced risk compared to traditional perceptions of this investment category.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.67 | CA$593.32M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.67 | CA$285.18M | ★★★★★☆ |

| Alvopetro Energy (TSXV:ALV) | CA$4.91 | CA$180.11M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.30 | CA$117.56M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.425 | CA$11.75M | ★★★★★☆ |

| Mandalay Resources (TSX:MND) | CA$3.31 | CA$316.75M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.155 | CA$5.03M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.22 | CA$228.59M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.13 | CA$30.62M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.035 | CA$3.62M | ★★★★★★ |

Click here to see the full list of 961 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Caldwell Partners International (TSX:CWL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The Caldwell Partners International Inc. offers candidate research and sourcing services across Canada, the United States, the United Kingdom, and other European countries with a market cap of CA$30.15 million.

Operations: The company generates revenue from its Caldwell segment amounting to CA$77.45 million and its IQTalent segment contributing CA$12.75 million.

Market Cap: CA$30.15M

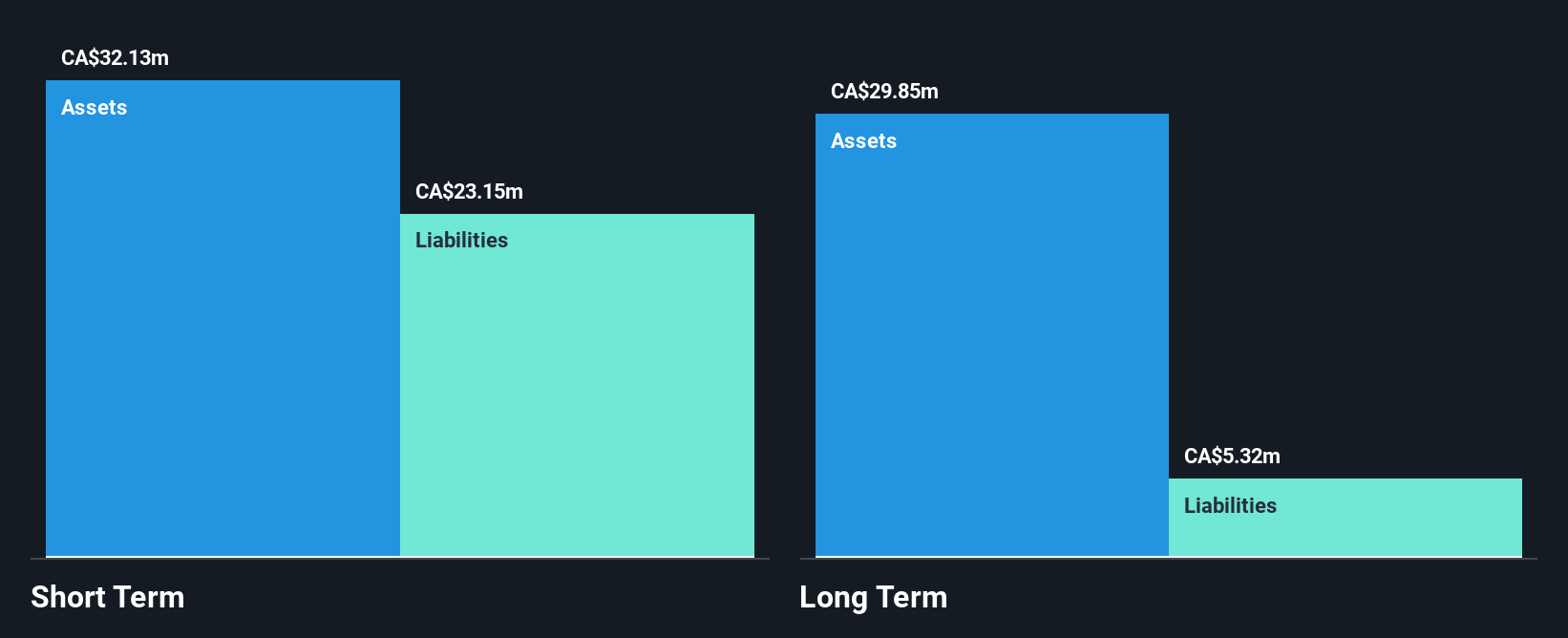

Caldwell Partners International Inc., with a market cap of CA$30.15 million, recently launched its Academic Healthcare Practice to address leadership challenges in academic health systems, leveraging scientific assessments for effective hiring. Despite generating revenue from its Caldwell and IQTalent segments, the company remains unprofitable with a negative return on equity of -5.65%. However, it maintains financial stability with short-term assets exceeding both long-term and short-term liabilities and operates debt-free. Recent executive changes include Chris Beck's appointment as CEO, indicating strategic shifts that may impact future performance amidst current volatility in weekly returns.

- Take a closer look at Caldwell Partners International's potential here in our financial health report.

- Assess Caldwell Partners International's previous results with our detailed historical performance reports.

Azucar Minerals (TSXV:AMZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Azucar Minerals Ltd. is engaged in the acquisition, exploration, and development of mineral resource properties in Mexico with a market cap of CA$1.85 million.

Operations: Azucar Minerals Ltd. does not have any reported revenue segments.

Market Cap: CA$1.85M

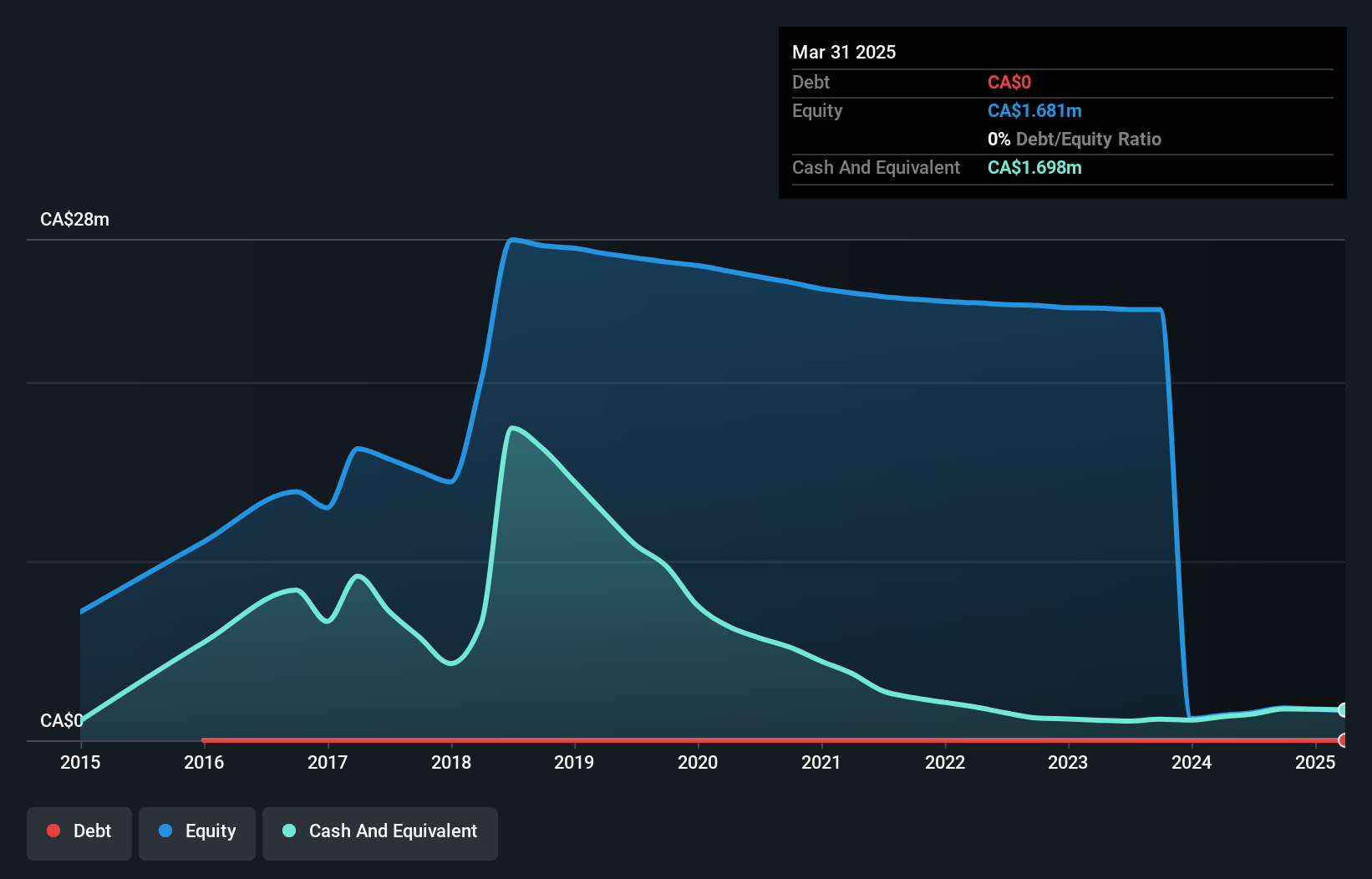

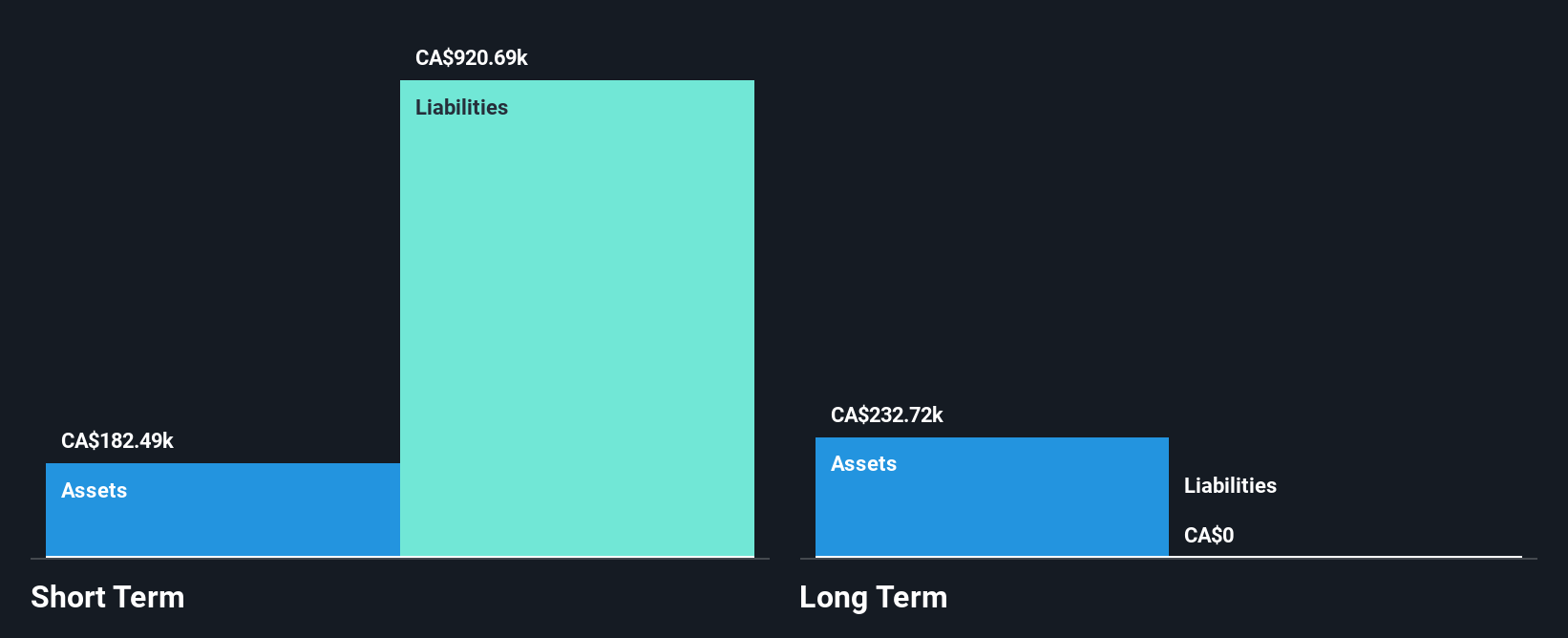

Azucar Minerals Ltd., with a market cap of CA$1.85 million, is pre-revenue and currently unprofitable, though it reported a net income of CA$0.14 million for the second quarter of 2024. The company has no debt and its short-term assets significantly exceed liabilities, providing a stable financial footing despite high volatility in its share price over the past three months. Azucar's cash runway extends beyond three years if historical free cash flow growth continues, offering some financial resilience amidst challenges in achieving profitability and earnings growth compared to industry standards.

- Click to explore a detailed breakdown of our findings in Azucar Minerals' financial health report.

- Learn about Azucar Minerals' historical performance here.

Palamina (TSXV:PA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Palamina Corp. is involved in the exploration of mineral deposits in Peru and Mexico, with a market cap of CA$10.75 million.

Operations: Currently, there are no reported revenue segments for this company.

Market Cap: CA$10.75M

Palamina Corp., with a market cap of CA$10.75 million, is pre-revenue and has recently become profitable, though its financial results were impacted by a large one-off gain of CA$307.4K. The company is debt-free, with short-term assets (CA$1.9M) comfortably exceeding liabilities (CA$509.9K). Palamina's ongoing drilling at the Usicayos Gold Project in Peru and its strategic acquisition of Sociedad Minera Vicus Exploraciones S.A.C., expanding copper-silver project holdings, highlight its exploration focus in under-explored regions. However, the stock remains highly volatile despite an outstanding Return on Equity (100.4%).

- Dive into the specifics of Palamina here with our thorough balance sheet health report.

- Understand Palamina's track record by examining our performance history report.

Taking Advantage

- Click here to access our complete index of 961 TSX Penny Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:AMZ

Azucar Minerals

Engages in the exploration and development of mineral resource properties in Mexico.

Flawless balance sheet slight.

Market Insights

Community Narratives