- Canada

- /

- Metals and Mining

- /

- TSXV:TIN

3 TSX Penny Stocks With Market Caps Up To CA$40M

Reviewed by Simply Wall St

As we enter 2025, the Canadian market is navigating a landscape marked by higher government bond yields and political transitions, which have influenced investor sentiment and stock valuations. Despite these challenges, the fundamentals of financial markets remain driven by solid economic indicators such as a robust labor market and positive earnings growth. In this context, penny stocks—often smaller or newer companies—continue to offer intriguing opportunities for investors seeking growth at lower price points. While the term "penny stock" may seem outdated, these investments can reveal hidden value when built on strong financials and sound fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Mandalay Resources (TSX:MND) | CA$4.18 | CA$392.54M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.46 | CA$13.18M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.46 | CA$125.06M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.36 | CA$948.57M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.69 | CA$629.3M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.29 | CA$225.41M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.11 | CA$29.82M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.045 | CA$4.07M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.85 | CA$180.43M | ★★★★★☆ |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$0.97 | CA$133.43M | ★★★★★☆ |

Click here to see the full list of 944 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Caldwell Partners International (TSX:CWL)

Simply Wall St Financial Health Rating: ★★★★★★

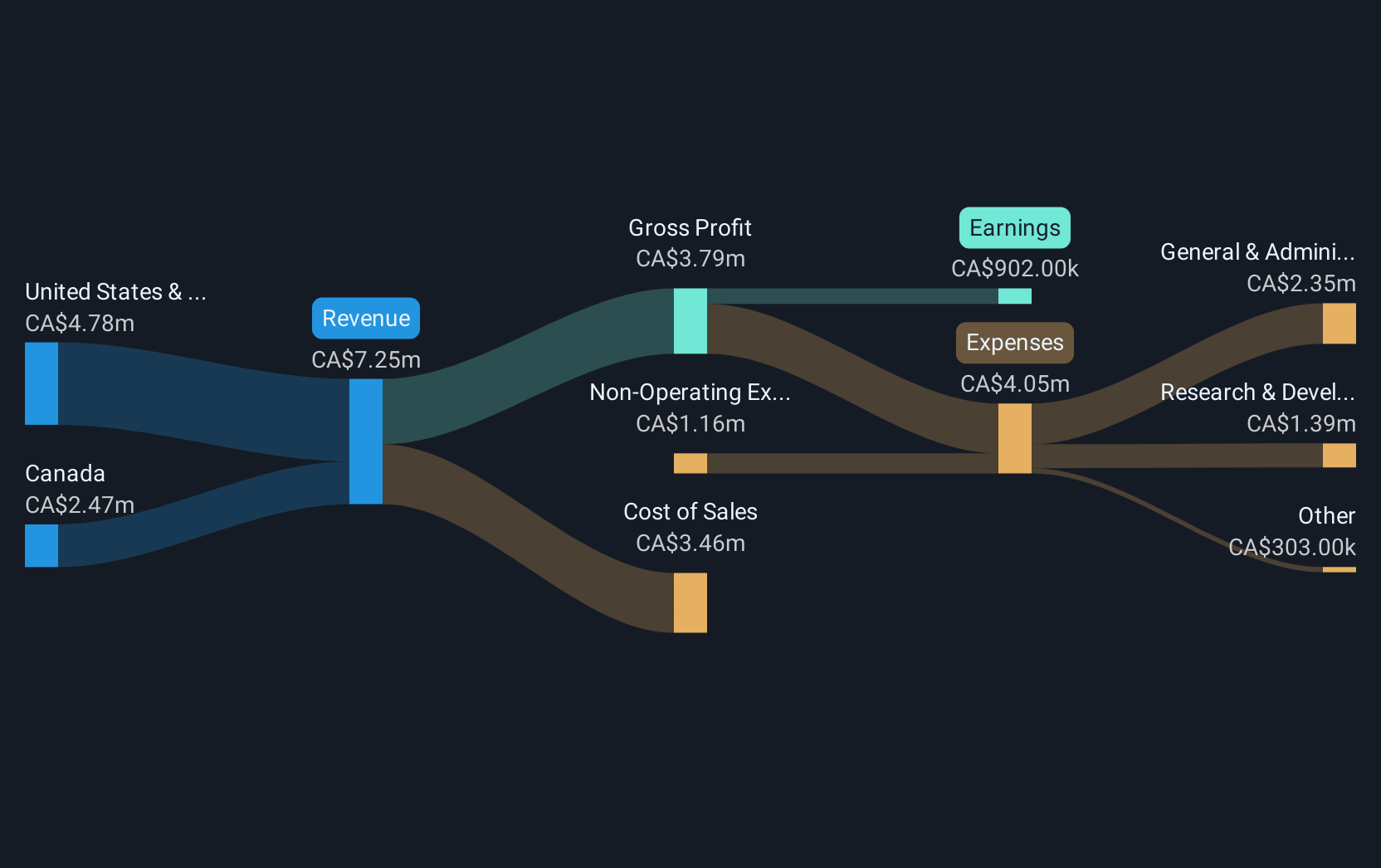

Overview: The Caldwell Partners International Inc. offers candidate research and sourcing services across Canada, the United States, the United Kingdom, and other European countries, with a market cap of CA$36.95 million.

Operations: Caldwell Partners International has not reported specific revenue segments.

Market Cap: CA$36.95M

Caldwell Partners International, with a market cap of CA$36.95 million, has recently turned profitable after reporting a net income of CA$4.19 million for the year ended August 31, 2024. The company is debt-free and maintains strong short-term assets exceeding both its short and long-term liabilities. However, its earnings were impacted by a large one-off gain of CA$8 million, which may not reflect ongoing business performance. Recent strategic hires aim to enhance recruiting capabilities in industrial sectors and academic healthcare practices. Despite these positive changes, Caldwell's return on equity remains low at 2.6%, suggesting room for improvement in profitability metrics.

- Click to explore a detailed breakdown of our findings in Caldwell Partners International's financial health report.

- Review our historical performance report to gain insights into Caldwell Partners International's track record.

Tincorp Metals (TSXV:TIN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tincorp Metals Inc. is involved in the exploration and development of mineral properties, with a market cap of CA$12.04 million.

Operations: No revenue segments have been reported for Tincorp Metals Inc.

Market Cap: CA$12.04M

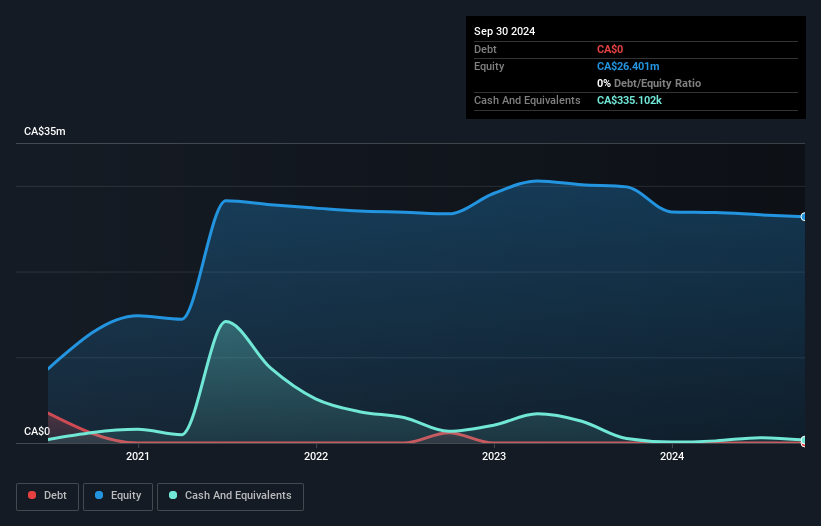

Tincorp Metals Inc., with a market cap of CA$12.04 million, remains pre-revenue and unprofitable, reporting a net loss of CA$0.32 million for Q3 2024. The company is debt-free but faces challenges with short-term assets (CA$384K) insufficient to cover liabilities (CA$2.3M). Recent private placements aim to raise CA$139,999.95 through share issuance at CAD 0.1125 per share, pending TSX Venture Exchange approval. Despite stable weekly volatility over the past year, Tincorp's stock price has been highly volatile in recent months, reflecting its speculative nature within the penny stock domain in Canada.

- Click here to discover the nuances of Tincorp Metals with our detailed analytical financial health report.

- Gain insights into Tincorp Metals' past trends and performance with our report on the company's historical track record.

Titan Logix (TSXV:TLA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Titan Logix Corp. develops, manufactures, and markets technology fluid management solutions in Canada, the United States, and internationally with a market cap of CA$21.40 million.

Operations: The company's revenue is primarily derived from its Mobile Liquid Measurement Solutions segment, which generated CA$6.86 million.

Market Cap: CA$21.4M

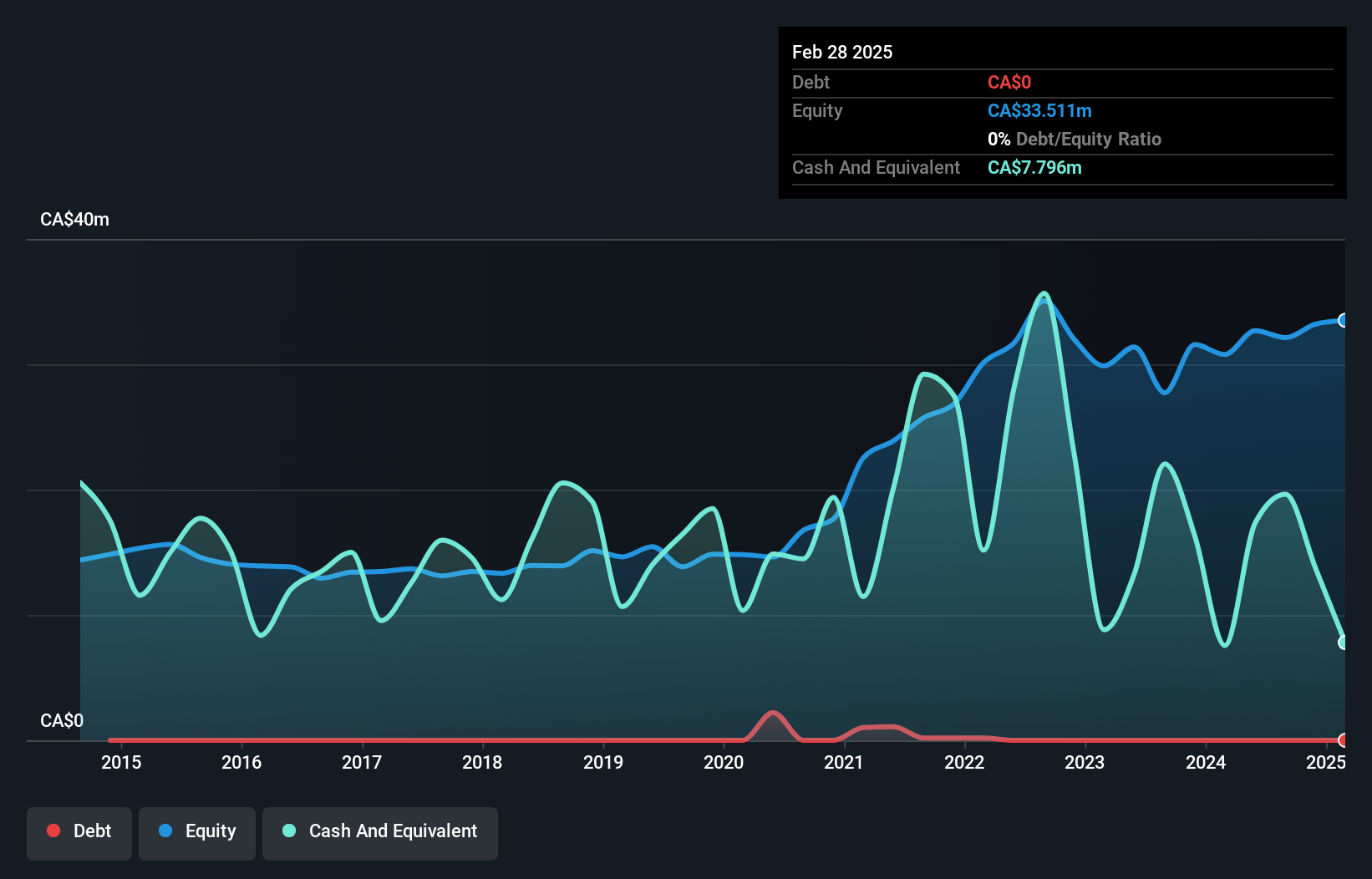

Titan Logix Corp., with a market cap of CA$21.40 million, has shown financial stability and growth potential within the penny stock sector. The company reported sales of CA$6.86 million for the year ended August 31, 2024, up from CA$6.21 million the previous year, while net income increased to CA$0.546 million from CA$0.083 million. Titan Logix is debt-free and its short-term assets (CA$15.1M) comfortably cover both short-term (CA$920K) and long-term liabilities (CA$600K). Despite a low return on equity at 3.1%, earnings have grown significantly by over 500% in the past year compared to industry averages, reflecting strong operational performance amidst stable weekly volatility at 11%.

- Navigate through the intricacies of Titan Logix with our comprehensive balance sheet health report here.

- Gain insights into Titan Logix's historical outcomes by reviewing our past performance report.

Summing It All Up

- Explore the 944 names from our TSX Penny Stocks screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tincorp Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:TIN

Tincorp Metals

Engages in the exploration and development of mineral properties.

Moderate risk with mediocre balance sheet.

Market Insights

Community Narratives