Of late the Calian Group (TSE:CGY) share price has softened like an ice cream in the sun, melting a full . But plenty of shareholders will still be smiling, given that the stock is up 16% over the last quarter. The stock has been solid, longer term, gaining 33% in the last year.

Assuming no other changes, a sharply higher share price makes a stock less attractive to potential buyers. While the market sentiment towards a stock is very changeable, in the long run, the share price will tend to move in the same direction as earnings per share. So some would prefer to hold off buying when there is a lot of optimism towards a stock. One way to gauge market expectations of a stock is to look at its Price to Earnings Ratio (PE Ratio). A high P/E ratio means that investors have a high expectation about future growth, while a low P/E ratio means they have low expectations about future growth.

View our latest analysis for Calian Group

How Does Calian Group's P/E Ratio Compare To Its Peers?

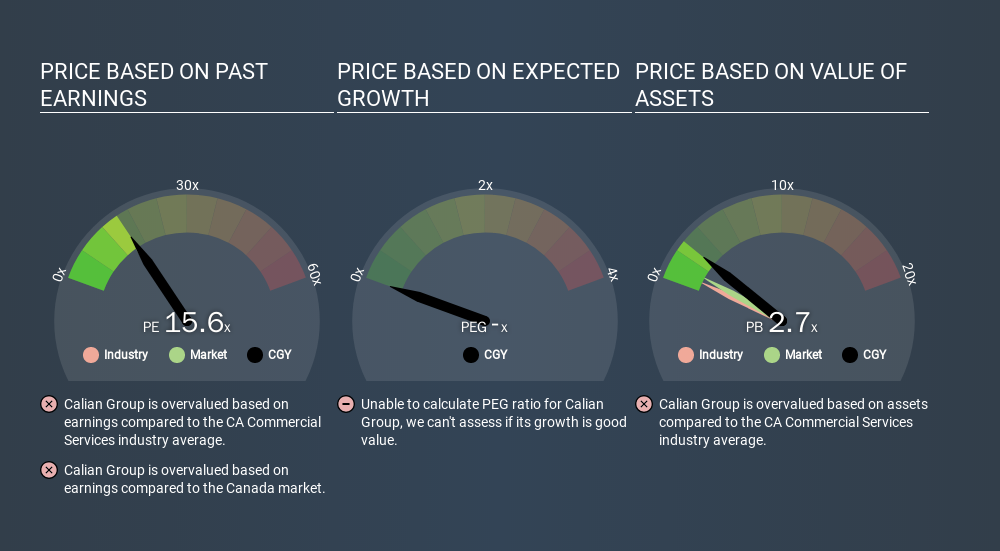

Calian Group's P/E is 15.57. The image below shows that Calian Group has a P/E ratio that is roughly in line with the commercial services industry average (15.5).

Its P/E ratio suggests that Calian Group shareholders think that in the future it will perform about the same as other companies in its industry classification.

How Growth Rates Impact P/E Ratios

Probably the most important factor in determining what P/E a company trades on is the earnings growth. When earnings grow, the 'E' increases, over time. That means unless the share price increases, the P/E will reduce in a few years. So while a stock may look expensive based on past earnings, it could be cheap based on future earnings.

Most would be impressed by Calian Group earnings growth of 21% in the last year. And it has bolstered its earnings per share by 12% per year over the last five years. So one might expect an above average P/E ratio. The market might expect further growth, but it isn't guaranteed. So investors should delve deeper. I like to check if company insiders have been buying or selling.

Remember: P/E Ratios Don't Consider The Balance Sheet

Don't forget that the P/E ratio considers market capitalization. In other words, it does not consider any debt or cash that the company may have on the balance sheet. Hypothetically, a company could reduce its future P/E ratio by spending its cash (or taking on debt) to achieve higher earnings.

Such expenditure might be good or bad, in the long term, but the point here is that the balance sheet is not reflected by this ratio.

Calian Group's Balance Sheet

Calian Group has net cash of CA$4.1m. That should lead to a higher P/E than if it did have debt, because its strong balance sheets gives it more options.

The Bottom Line On Calian Group's P/E Ratio

Calian Group has a P/E of 15.6. That's around the same as the average in the CA market, which is 14.7. With a strong balance sheet combined with recent growth, the P/E implies the market is quite pessimistic. What can be absolutely certain is that the market has become less optimistic about Calian Group over the last month, with the P/E ratio falling from 15.6 back then to 15.6 today. For those who don't like to trade against momentum, that could be a warning sign, but a contrarian investor might want to take a closer look.

Investors should be looking to buy stocks that the market is wrong about. As value investor Benjamin Graham famously said, 'In the short run, the market is a voting machine but in the long run, it is a weighing machine. So this free visual report on analyst forecasts could hold the key to an excellent investment decision.

But note: Calian Group may not be the best stock to buy. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20).

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:CGY

Calian Group

Provides business services and solutions in Canada and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)