- Canada

- /

- Commercial Services

- /

- TSX:BDI

Why We Think Black Diamond Group Limited's (TSE:BDI) CEO Compensation Is Not Excessive At All

Key Insights

- Black Diamond Group to hold its Annual General Meeting on 13th of May

- Salary of CA$621.0k is part of CEO Trevor Haynes's total remuneration

- The overall pay is comparable to the industry average

- Black Diamond Group's EPS grew by 9.4% over the past three years while total shareholder return over the past three years was 137%

CEO Trevor Haynes has done a decent job of delivering relatively good performance at Black Diamond Group Limited (TSE:BDI) recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 13th of May. Based on our analysis of the data below, we think CEO compensation seems reasonable for now.

View our latest analysis for Black Diamond Group

Comparing Black Diamond Group Limited's CEO Compensation With The Industry

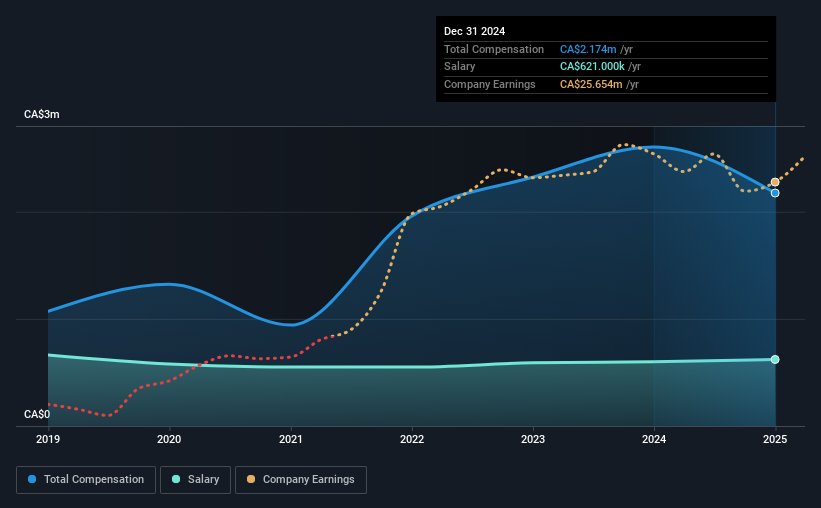

According to our data, Black Diamond Group Limited has a market capitalization of CA$534m, and paid its CEO total annual compensation worth CA$2.2m over the year to December 2024. We note that's a decrease of 17% compared to last year. We think total compensation is more important but our data shows that the CEO salary is lower, at CA$621k.

For comparison, other companies in the Canadian Commercial Services industry with market capitalizations ranging between CA$275m and CA$1.1b had a median total CEO compensation of CA$2.2m. From this we gather that Trevor Haynes is paid around the median for CEOs in the industry. Furthermore, Trevor Haynes directly owns CA$44m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | CA$621k | CA$600k | 29% |

| Other | CA$1.6m | CA$2.0m | 71% |

| Total Compensation | CA$2.2m | CA$2.6m | 100% |

Talking in terms of the industry, salary represented approximately 40% of total compensation out of all the companies we analyzed, while other remuneration made up 60% of the pie. It's interesting to note that Black Diamond Group allocates a smaller portion of compensation to salary in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Black Diamond Group Limited's Growth

Over the past three years, Black Diamond Group Limited has seen its earnings per share (EPS) grow by 9.4% per year. In the last year, its revenue is up 12%.

This revenue growth could really point to a brighter future. And the modest growth in EPS isn't bad, either. Although we'll stop short of calling the stock a top performer, we think the company has potential. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Black Diamond Group Limited Been A Good Investment?

Most shareholders would probably be pleased with Black Diamond Group Limited for providing a total return of 137% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. Despite the pleasing results, we still think that any proposed increases to CEO compensation will be examined based on a case by case basis and linked to performance outcomes.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 2 warning signs for Black Diamond Group that you should be aware of before investing.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Black Diamond Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:BDI

Black Diamond Group

Black Diamond Group Limited rents and sells modular space and workforce accommodation solutions in Canada, the United States, and Australia.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success