- Canada

- /

- Commercial Services

- /

- TSX:BDI

Black Diamond Group (TSX:BDI) Revenue, Profit Outlook Surpasses Market Expectations—Despite Slowing Margins

Reviewed by Simply Wall St

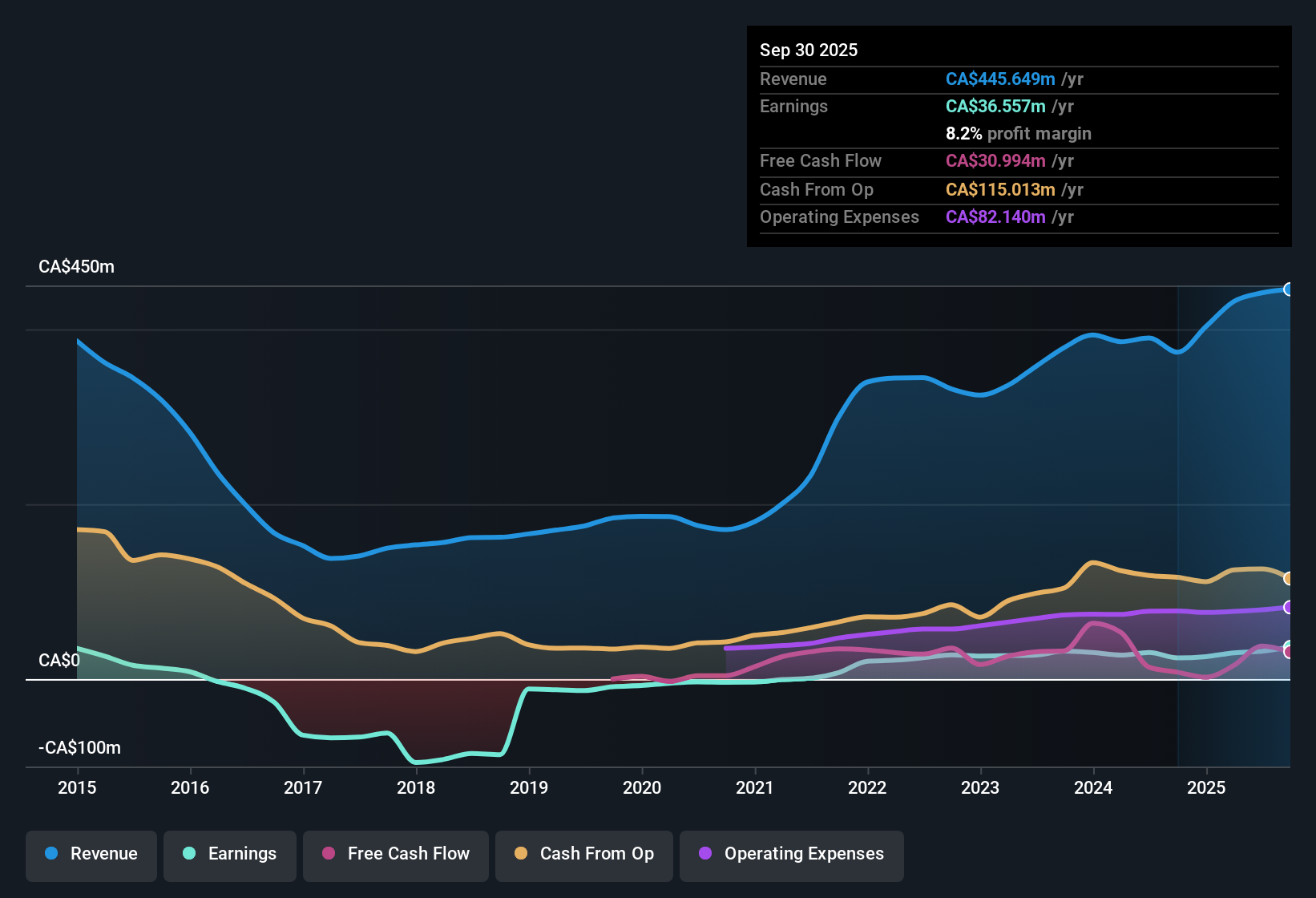

Black Diamond Group (TSX:BDI) posted a solid set of numbers, with annual earnings forecast to grow 19.6% and revenue expected to rise 15.8% per year. Both of these figures outpace the Canadian market’s projected growth rates. Net profit margins remain positive at 7.2%, though this is slightly lower than last year’s 7.8%. Recent annual earnings growth of 4.5% has also moderated compared to its five-year compound growth rate of 33.5%. Investors will be weighing robust growth forecasts and quality past performance against the recent slowdown in margin and earnings momentum.

See our full analysis for Black Diamond Group.Now, let’s see how these earnings stack up against the most widely held narratives, and where the results might challenge the consensus.

See what the community is saying about Black Diamond Group

DCF Fair Value Shows Big Upside Gap

- Shares trade at CA$14.95, far below the discounted cash flow (DCF) fair value estimate of CA$51.49, indicating a sizable gap between market price and modeled long-term worth.

- Analysts' consensus view highlights that, while Black Diamond's price-to-earnings ratio stands at an above-peer 31.5x, fundamental estimates back higher valuations if forecast margin expansion (from 7.2% to 10.6% over three years) materializes.

- Consensus projects earnings to increase from CA$31.7 million now to CA$50.7 million by 2028, supporting a higher valuation multiple if achieved.

- The combination of strong profit momentum and a favorable infrastructure project outlook underpins analysts' confidence. However, this assumes sustained sector tailwinds and successful capital deployment.

- To see whether the broader market agrees with this perspective, dig into the full consensus narrative for Black Diamond Group and spot where analysts are aligned or divided on valuation drivers. 📊 Read the full Black Diamond Group Consensus Narrative.

Modular Solutions Segment Lifts Margins

- The Modular Space Solutions segment has delivered record rental revenue, up 19% year over year, with scale helping to broaden company-wide margins, defying the mild slip in overall net profit margins to 7.2%.

- Analysts' consensus view notes a structurally higher margin profile, thanks in part to the segment's recurring revenues and operating leverage, which could offset cyclical headwinds or pricing plateaus in other business lines.

- This margin expansion trend supports forecasts for company-wide margin growth, reinforcing the earnings durability narrative even as broader commercial services face margin compression.

- However, the consensus narrative also flags risk if pricing momentum in modulars slows, making continued positive surprise crucial to justifying premium multiples.

Share Dilution Tied to Growth Initiatives

- Analysts expect the number of shares outstanding to rise 7% per year over the next three years as Black Diamond funds expansion with new equity. This is an unusually brisk pace versus most industry peers.

- According to the consensus narrative, this planned dilution is offset by a reinforced balance sheet and lower debt levels, giving the company strategic flexibility for M&A and ongoing capital investment.

- Consensus acknowledges that while dilution can dampen per-share gains, successful deal execution and higher asset efficiency can more than compensate if future growth targets are met.

- That leaves future returns tightly linked to management's discipline in deploying new capital and sustaining elevated project momentum.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Black Diamond Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do the figures suggest a different story to you? Put your own spin on the outlook and share your perspective in just a few minutes. Do it your way

A great starting point for your Black Diamond Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While Black Diamond Group boasts robust growth forecasts, its rapid share dilution and recent slowdown in profit margins could undermine per-share returns for investors.

If steadier performance and proven resilience appeal to you, check out stable growth stocks screener (2103 results) to focus on companies delivering consistent growth without the same volatility.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Black Diamond Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BDI

Black Diamond Group

Black Diamond Group Limited rents and sells modular space and workforce accommodation solutions in Canada, the United States, and Australia.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives