- Canada

- /

- Commercial Services

- /

- NEOE:BCBN

June 2025 TSX Penny Stocks Worth Watching

Reviewed by Simply Wall St

The Canadian market is navigating a landscape marked by steady interest rates and geopolitical uncertainties, with the Bank of Canada further along in its easing cycle compared to its U.S. counterpart. Amid these broader economic conditions, investors might consider exploring penny stocks—an investment area often associated with smaller or newer companies that can still offer intriguing growth opportunities. Despite their outdated name, penny stocks may provide value when backed by solid financial health and long-term potential.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.60 | CA$61.7M | ✅ 3 ⚠️ 3 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.67 | CA$621.92M | ✅ 3 ⚠️ 4 View Analysis > |

| illumin Holdings (TSX:ILLM) | CA$1.87 | CA$95.97M | ✅ 4 ⚠️ 1 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.03 | CA$2.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.43 | CA$12.32M | ✅ 2 ⚠️ 4 View Analysis > |

| Mandalay Resources (TSX:MND) | CA$4.87 | CA$459.71M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.78 | CA$518.93M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.99 | CA$19.62M | ✅ 2 ⚠️ 4 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.86 | CA$182.21M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.10 | CA$6.57M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 457 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Base Carbon (NEOE:BCBN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Base Carbon Inc., along with its subsidiaries, offers capital, development expertise, and management operating resources, with a market cap of CA$85.55 million.

Operations: No revenue segments have been reported for this company.

Market Cap: CA$85.55M

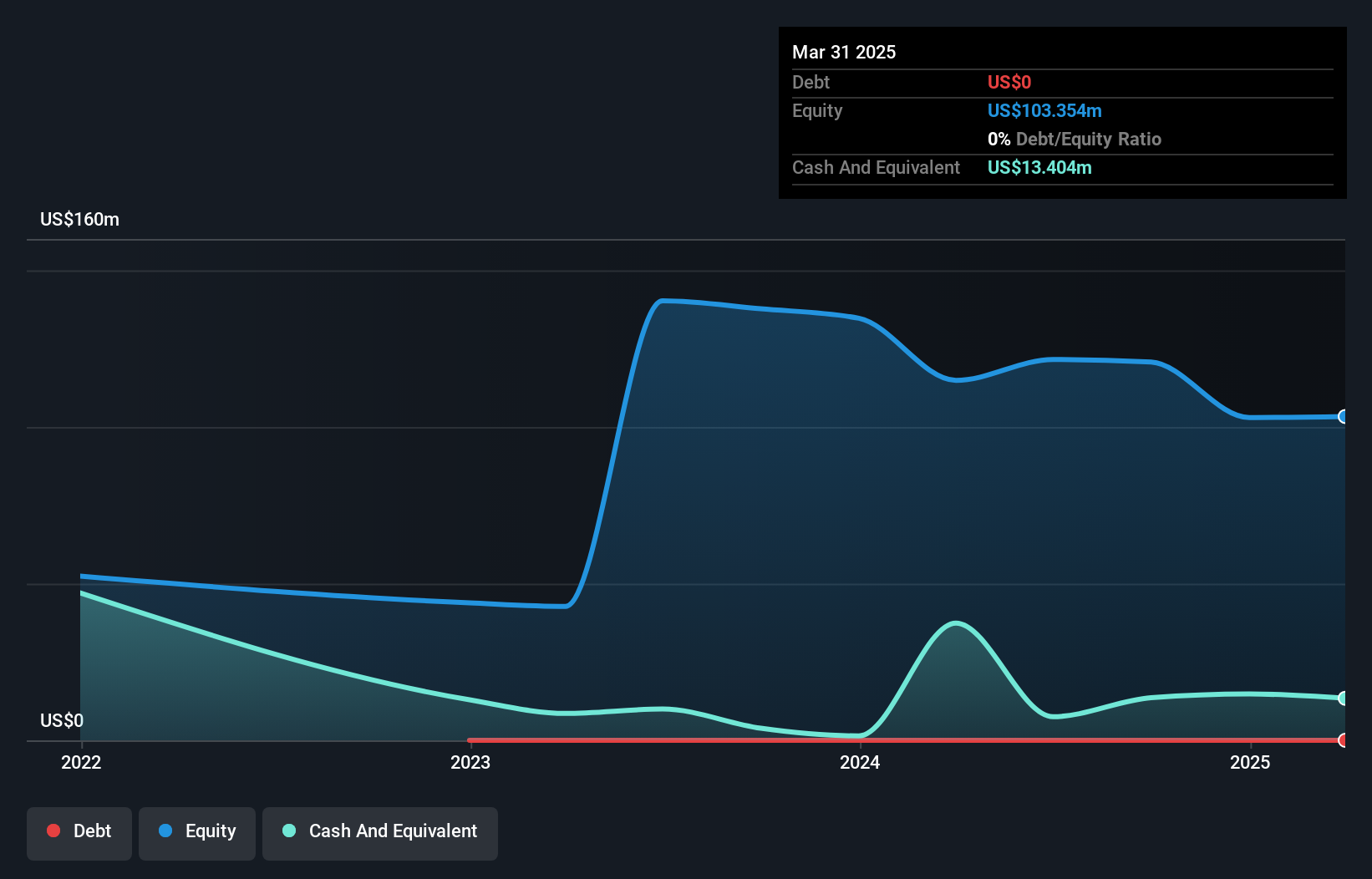

Base Carbon Inc., with a market cap of CA$85.55 million, remains pre-revenue and currently unprofitable, facing challenges such as a negative return on equity of -8.27%. Despite this, the company is debt-free and its short-term assets significantly exceed liabilities, providing a stable financial footing. Recent developments include the initiation of a share repurchase program to buy back up to 6.38% of its issued shares by June 2026, which could potentially enhance shareholder value but also highlights ongoing concerns about future profitability given past losses and an auditor's going concern doubts for 2024.

- Unlock comprehensive insights into our analysis of Base Carbon stock in this financial health report.

- Learn about Base Carbon's historical performance here.

Colabor Group (TSX:GCL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Colabor Group Inc., along with its subsidiaries, operates in Canada by marketing, distributing, and wholesaling food and food-related products, with a market cap of CA$88.75 million.

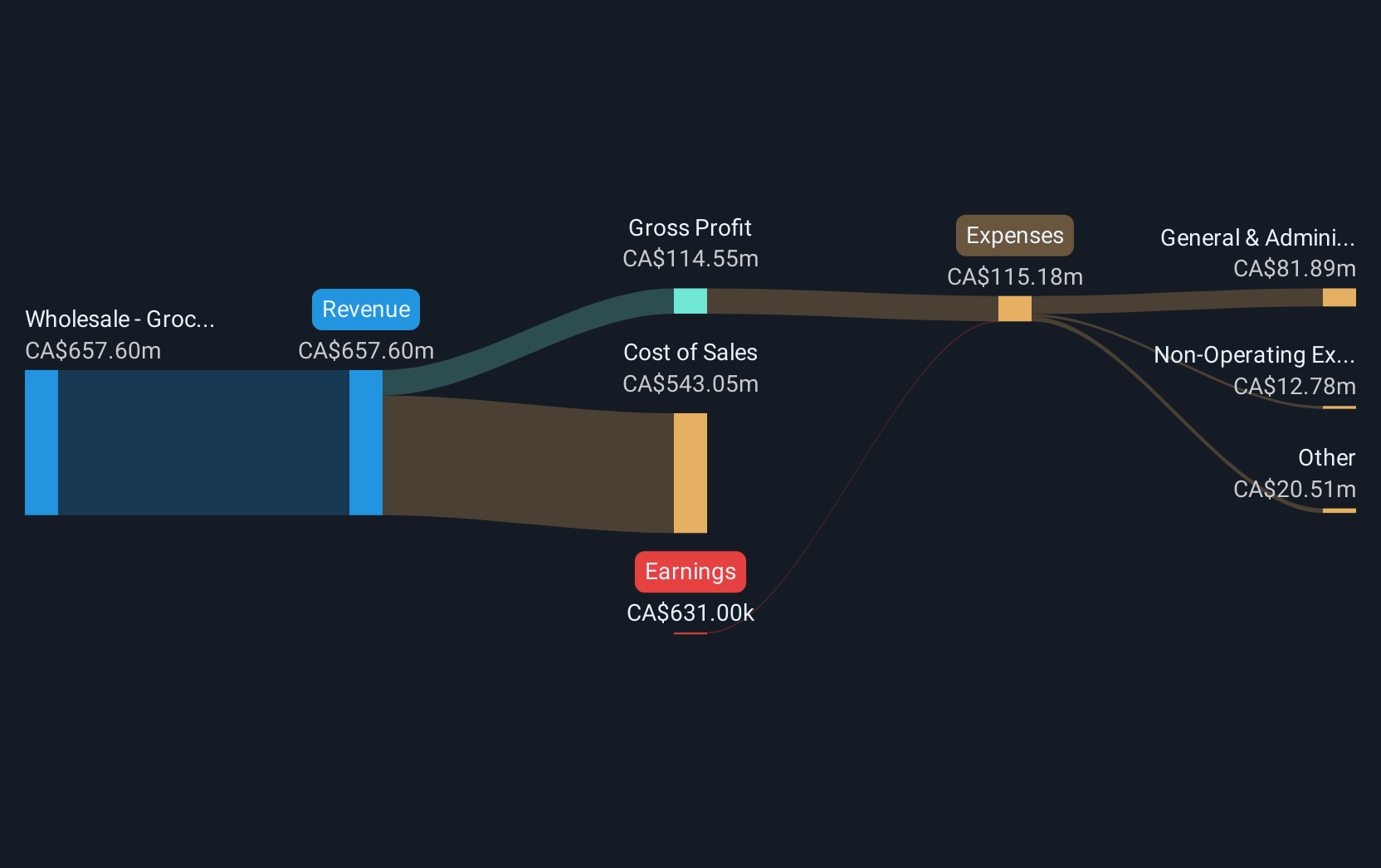

Operations: The company generates revenue primarily through its wholesale groceries segment, which amounts to CA$657.60 million.

Market Cap: CA$88.75M

Colabor Group Inc., with a market cap of CA$88.75 million, is unprofitable but maintains a stable financial position with sufficient cash runway for over three years despite increased losses. The company reported first-quarter sales of CA$131.7 million, slightly up from the previous year, though net losses widened to CA$4.02 million. While its short-term assets cover immediate liabilities, they fall short against long-term obligations. The recent resignation of key executive Pierre Blanchette may impact operations in the near term. Nonetheless, Colabor trades at a significant discount to estimated fair value and analysts expect substantial price appreciation potential.

- Click here to discover the nuances of Colabor Group with our detailed analytical financial health report.

- Gain insights into Colabor Group's outlook and expected performance with our report on the company's earnings estimates.

Thor Explorations (TSXV:THX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Thor Explorations Ltd., along with its subsidiaries, operates as a gold producer and explorer with a market capitalization of CA$518.93 million.

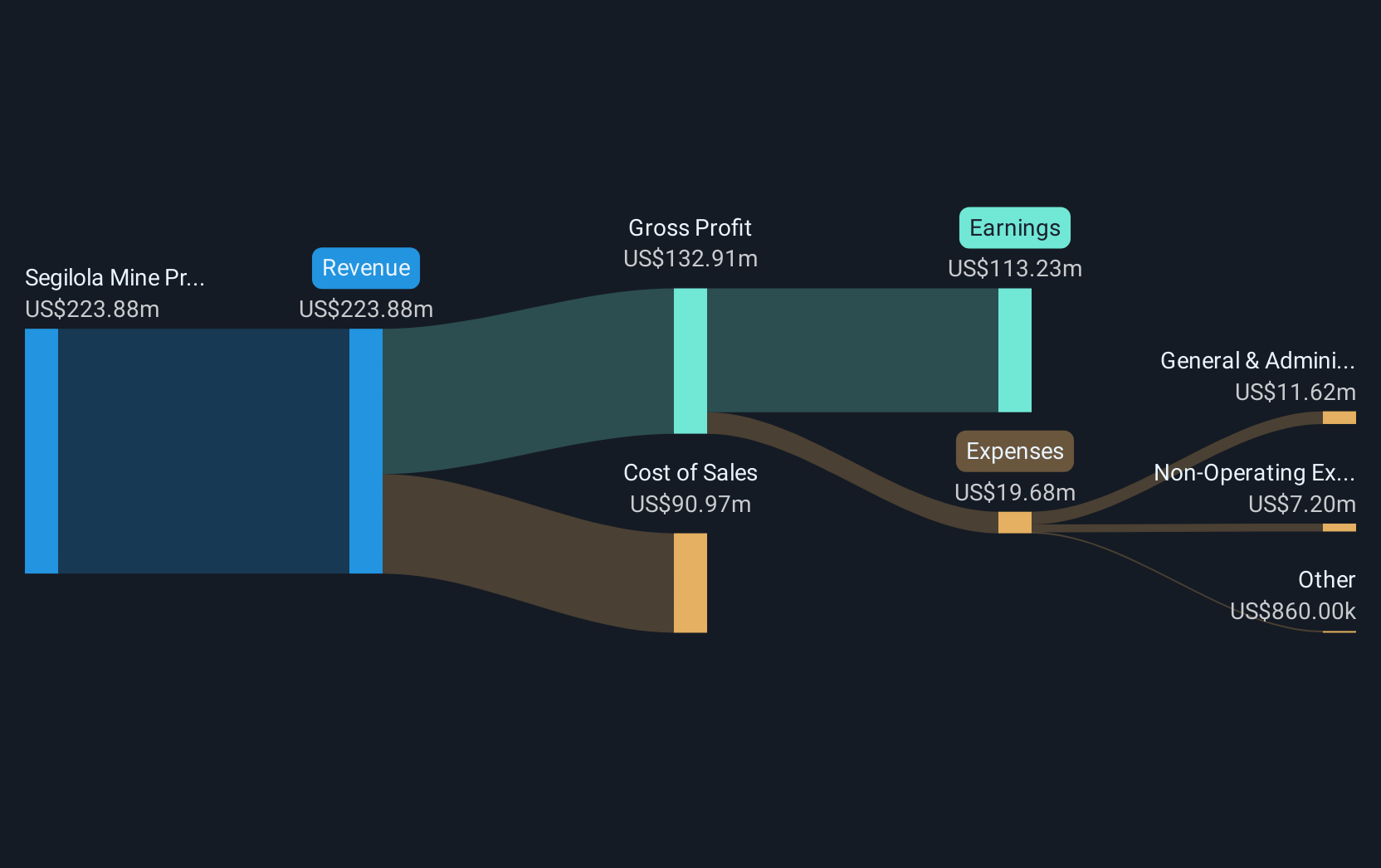

Operations: The company generates revenue primarily from the Segilola Mine Project, which contributed $223.88 million.

Market Cap: CA$518.93M

Thor Explorations Ltd., with a market cap of CA$518.93 million, has shown impressive financial performance, particularly in the first quarter of 2025. The company reported sales of US$64.06 million and net income of US$34.48 million, reflecting substantial growth from the previous year. Its return on equity stands at an outstanding 47.7%, and it remains debt-free with short-term assets exceeding liabilities by a comfortable margin. Thor's production guidance for 2025 is set between 85,000 to 95,000 ounces of gold with competitive all-in sustaining costs (AISC). The newly adopted dividend policy indicates potential shareholder returns amidst its strong earnings trajectory.

- Get an in-depth perspective on Thor Explorations' performance by reading our balance sheet health report here.

- Evaluate Thor Explorations' prospects by accessing our earnings growth report.

Summing It All Up

- Unlock more gems! Our TSX Penny Stocks screener has unearthed 454 more companies for you to explore.Click here to unveil our expertly curated list of 457 TSX Penny Stocks.

- Seeking Other Investments? We've found 18 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Base Carbon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NEOE:BCBN

Base Carbon

Provides capital, development expertise, and management operating resources.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives