- Canada

- /

- Metals and Mining

- /

- TSX:WRN

3 Promising TSX Penny Stocks With Market Caps Under CA$600M

Reviewed by Simply Wall St

As the U.S. government shutdown unfolds, its immediate impact on economic data releases has left markets in a state of uncertainty, though the resilient consumer spending and robust AI investments continue to support growth. Amid these conditions, investors might find value in exploring penny stocks—an investment area that remains relevant despite its somewhat outdated terminology. These smaller or newer companies can offer unique opportunities for growth when backed by strong financials, and we will highlight three such promising Canadian penny stocks that stand out for their potential long-term success.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.80 | CA$77.86M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$22.73M | ✅ 2 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.425 | CA$4.59M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.36 | CA$54.82M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.43 | CA$911.46M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.14 | CA$22.99M | ✅ 2 ⚠️ 3 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.72 | CA$445.72M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.43 | CA$178.15M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.22 | CA$207.9M | ✅ 3 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.79 | CA$9.96M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 417 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Britannia Life Sciences (CNSX:BLAB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Britannia Life Sciences Inc. provides product testing, safety assessment, and manufacturing services in the UK and internationally, with a market cap of CA$22.72 million.

Operations: The company generates revenue from its Medical Labs & Research segment, which amounted to CA$0.38 million.

Market Cap: CA$22.72M

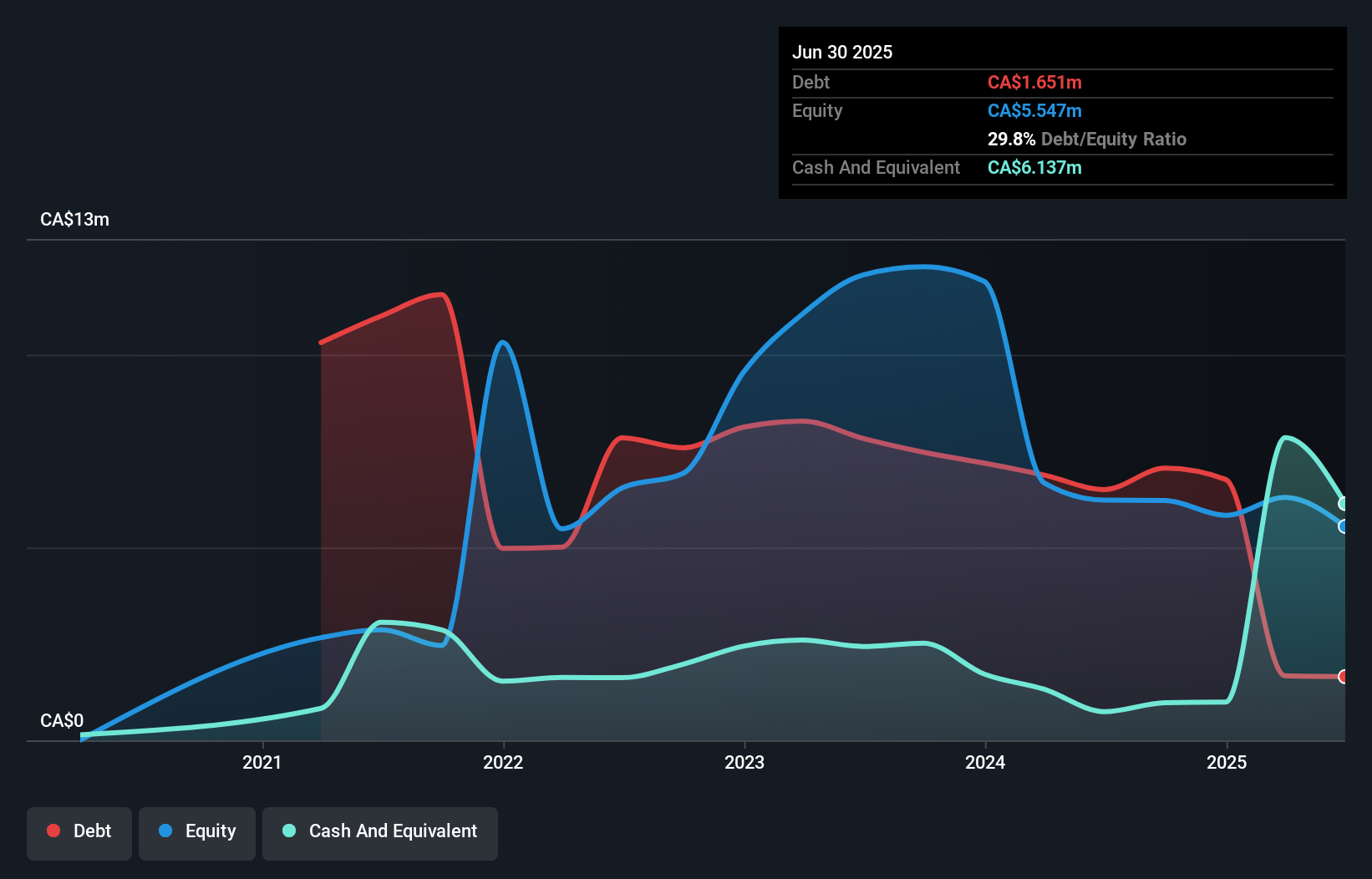

Britannia Life Sciences Inc., with a market cap of CA$22.72 million, is pre-revenue, generating only CA$0.38 million. Despite its unprofitability and high volatility, the company has reduced its debt to equity ratio significantly over five years and maintains more cash than total debt. Its short-term assets cover liabilities comfortably, providing some financial stability amidst concerns about its ability to continue as a going concern raised by auditors. Recent initiatives include a private placement offering for up to CA$10 million in debentures aimed at expanding into specialty finance, which could potentially diversify income streams if successful.

- Dive into the specifics of Britannia Life Sciences here with our thorough balance sheet health report.

- Understand Britannia Life Sciences' track record by examining our performance history report.

California Nanotechnologies (TSXV:CNO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: California Nanotechnologies Corp. focuses on the research, development, and production of nanocrystalline materials through grain size reduction, with a market cap of CA$22.11 million.

Operations: There are no specific revenue segments reported for the company.

Market Cap: CA$22.11M

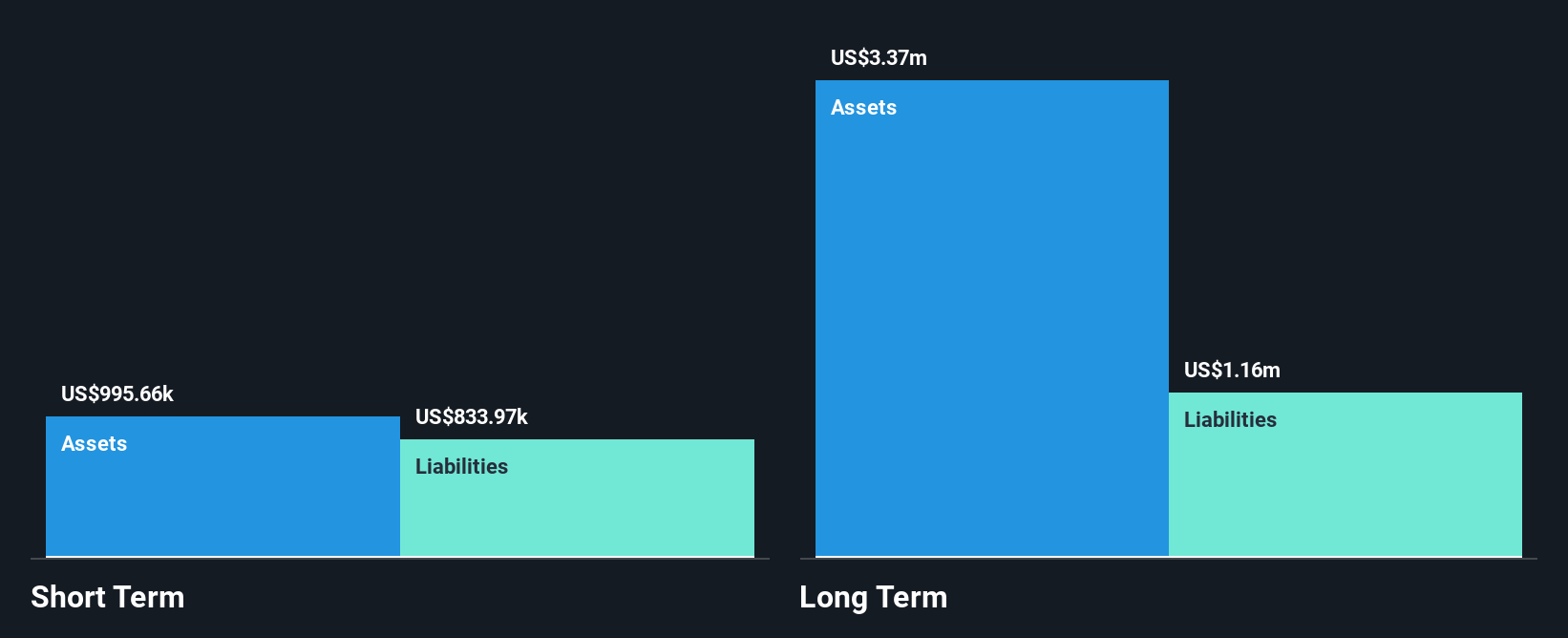

California Nanotechnologies Corp., with a market cap of CA$22.11 million, is pre-revenue, reporting sales of US$0.72 million for Q1 2025 and a net loss of US$0.45 million. Despite being unprofitable, the company is trading at 71.1% below its estimated fair value and has no debt, providing some financial flexibility. Its cash runway exceeds three years due to positive free cash flow growth of 33.8% annually, though short-term assets fall short in covering liabilities by US$0.1 million. Share price volatility remains high over recent months but hasn't led to significant shareholder dilution recently.

- Take a closer look at California Nanotechnologies' potential here in our financial health report.

- Gain insights into California Nanotechnologies' future direction by reviewing our growth report.

Western Copper and Gold (TSX:WRN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Western Copper and Gold Corporation is an exploration stage company focused on the exploration and development of mineral properties in Canada, with a market cap of CA$560.58 million.

Operations: Western Copper and Gold Corporation does not report any revenue segments as it is an exploration stage company focused on developing mineral properties in Canada.

Market Cap: CA$560.58M

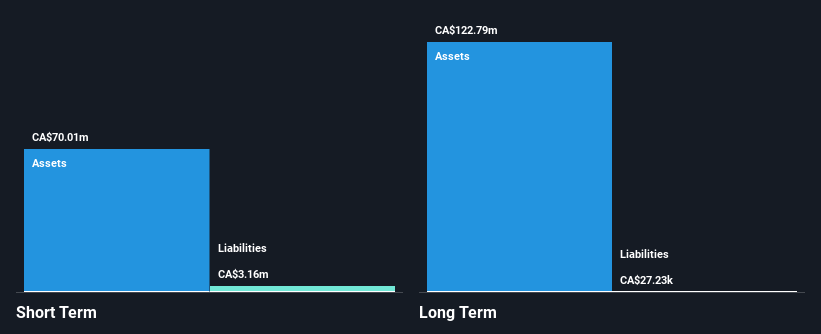

Western Copper and Gold Corporation, with a market cap of CA$560.58 million, remains pre-revenue as it focuses on mineral exploration in Canada. The company has no debt and maintains sufficient short-term assets (CA$61.5M) to cover both its short-term (CA$5.3M) and long-term liabilities (CA$123.7K). Despite being unprofitable with increasing losses over the past five years, Western's inclusion in the S&P Global BMI Index signals some market confidence. Recent presentations at industry summits highlight ongoing engagement efforts for its Casino Project, although management and board experience is limited with average tenures under two years.

- Get an in-depth perspective on Western Copper and Gold's performance by reading our balance sheet health report here.

- Evaluate Western Copper and Gold's prospects by accessing our earnings growth report.

Next Steps

- Discover the full array of 417 TSX Penny Stocks right here.

- Seeking Other Investments? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Western Copper and Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WRN

Western Copper and Gold

An exploration stage company, engages in the exploration and development of mineral properties in Canada.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives