Zedcor Inc.'s (CVE:ZDC) weak earnings were disregarded by the market. While shares were up, we believe there are some factors in the earnings report that might cause investors some concerns.

See our latest analysis for Zedcor

Zooming In On Zedcor's Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

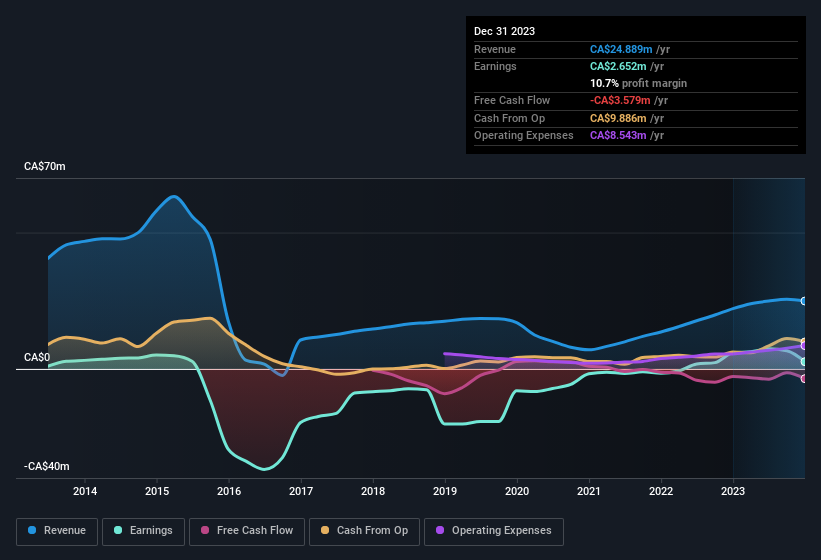

For the year to December 2023, Zedcor had an accrual ratio of 0.24. We can therefore deduce that its free cash flow fell well short of covering its statutory profit. Even though it reported a profit of CA$2.65m, a look at free cash flow indicates it actually burnt through CA$3.6m in the last year. Coming off the back of negative free cash flow last year, we imagine some shareholders might wonder if its cash burn of CA$3.6m, this year, indicates high risk. However, that's not the end of the story. We must also consider the impact of unusual items on statutory profit (and thus the accrual ratio), as well as note the ramifications of the company issuing new shares.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. Zedcor expanded the number of shares on issue by 6.1% over the last year. Therefore, each share now receives a smaller portion of profit. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. Check out Zedcor's historical EPS growth by clicking on this link.

How Is Dilution Impacting Zedcor's Earnings Per Share (EPS)?

Zedcor was losing money three years ago. Even looking at the last year, profit was still down 55%. Sadly, earnings per share fell further, down a full 59% in that time. Therefore, the dilution is having a noteworthy influence on shareholder returns.

In the long term, if Zedcor's earnings per share can increase, then the share price should too. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

How Do Unusual Items Influence Profit?

The fact that the company had unusual items boosting profit by CA$2.1m, in the last year, probably goes some way to explain why its accrual ratio was so weak. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's as you'd expect, given these boosts are described as 'unusual'. We can see that Zedcor's positive unusual items were quite significant relative to its profit in the year to December 2023. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Our Take On Zedcor's Profit Performance

In conclusion, Zedcor's weak accrual ratio suggested its statutory earnings have been inflated by the unusual items. Meanwhile, the new shares issued mean that shareholders now own less of the company, unless they tipped in more cash themselves. For all the reasons mentioned above, we think that, at a glance, Zedcor's statutory profits could be considered to be low quality, because they are likely to give investors an overly positive impression of the company. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. Every company has risks, and we've spotted 6 warning signs for Zedcor (of which 2 don't sit too well with us!) you should know about.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if Zedcor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:ZDC

Zedcor

Provides turnkey and customized mobile surveillance and live monitoring solutions in Canada and the United States.

Exceptional growth potential with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026