- Canada

- /

- Trade Distributors

- /

- TSXV:ZDC

3 TSX Growth Stocks With High Insider Ownership And Up To 122% Earnings Growth

Reviewed by Simply Wall St

As the Canadian market navigates a noisy end to 2025, investors are encouraged by signs of easing inflation and stabilizing labor markets, setting a constructive tone for 2026. In such an environment, growth companies with high insider ownership can be particularly appealing as they often align management's interests with those of shareholders, potentially leading to robust earnings growth even amidst broader market rotations.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Zedcor (TSXV:ZDC) | 19.2% | 122.6% |

| West Red Lake Gold Mines (TSXV:WRLG) | 11.1% | 78% |

| Stingray Group (TSX:RAY.A) | 22.9% | 33.9% |

| Robex Resources (TSXV:RBX) | 20.6% | 97.7% |

| Propel Holdings (TSX:PRL) | 30.1% | 30.6% |

| goeasy (TSX:GSY) | 21.7% | 27.3% |

| Enterprise Group (TSX:E) | 34.3% | 33.8% |

| Electrovaya (TSX:ELVA) | 28.1% | 37.8% |

| CEMATRIX (TSX:CEMX) | 10.6% | 58.3% |

| Almonty Industries (TSX:AII) | 11.2% | 63.5% |

Let's explore several standout options from the results in the screener.

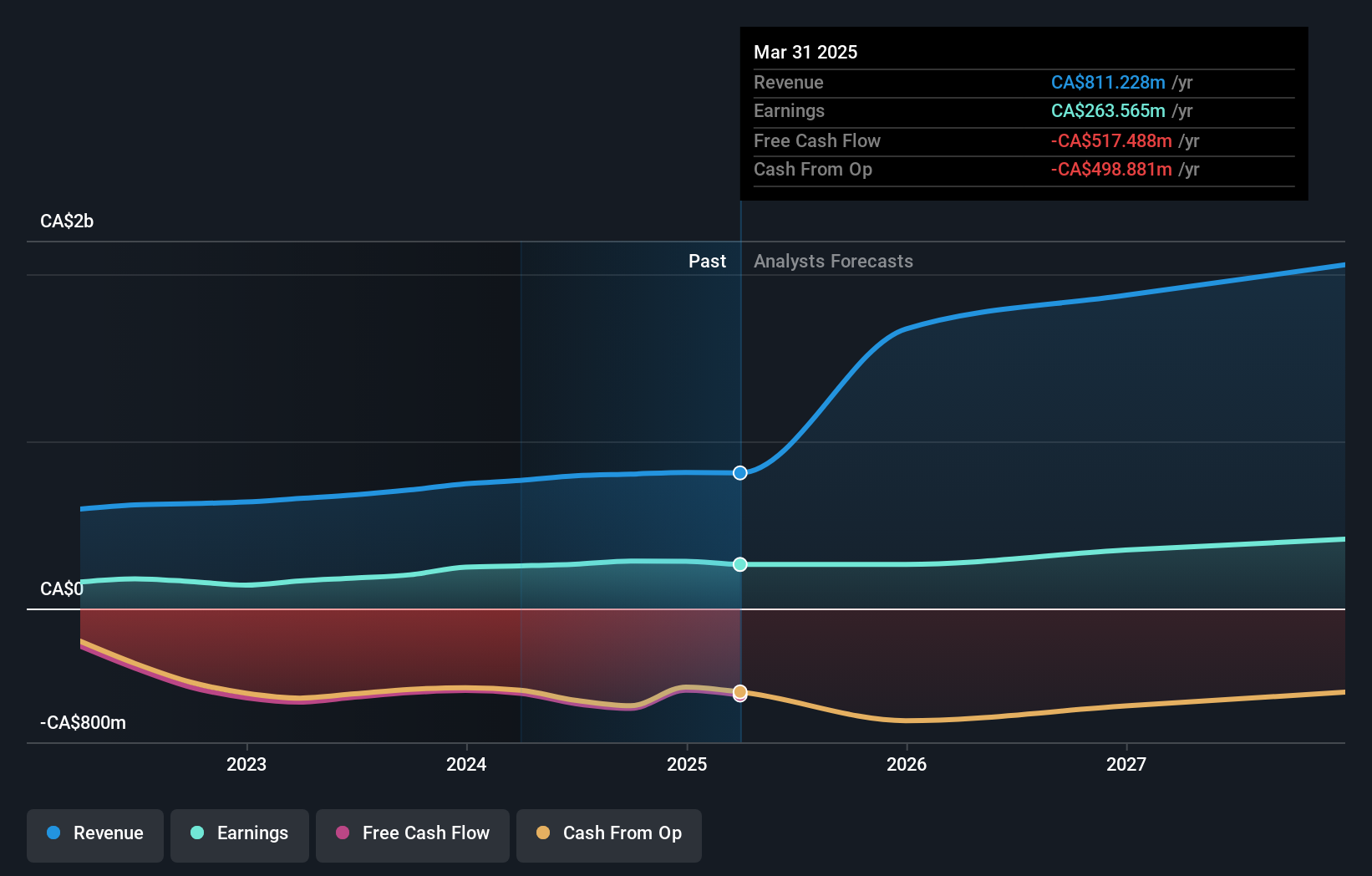

goeasy (TSX:GSY)

Simply Wall St Growth Rating: ★★★★★★

Overview: goeasy Ltd. operates in Canada, offering non-prime leasing and lending services through its easyhome, easyfinancial, and LendCare brands, with a market cap of CA$2.11 billion.

Operations: The company generates revenue from its Easyhome segment, amounting to CA$149.89 million, and its Easyfinancial segment, which contributes CA$1.51 billion.

Insider Ownership: 21.7%

Earnings Growth Forecast: 27.3% p.a.

goeasy is positioned for robust growth, with revenue and earnings forecast to significantly outpace the Canadian market. Despite challenges in covering debt with operating cash flow and a dividend not fully backed by free cash flows, its shares are trading well below estimated fair value. Recent strategic executive changes and a share buyback plan highlight strong insider confidence, while the company continues leveraging its securitization facility to support expansion.

- Click here to discover the nuances of goeasy with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, goeasy's share price might be too pessimistic.

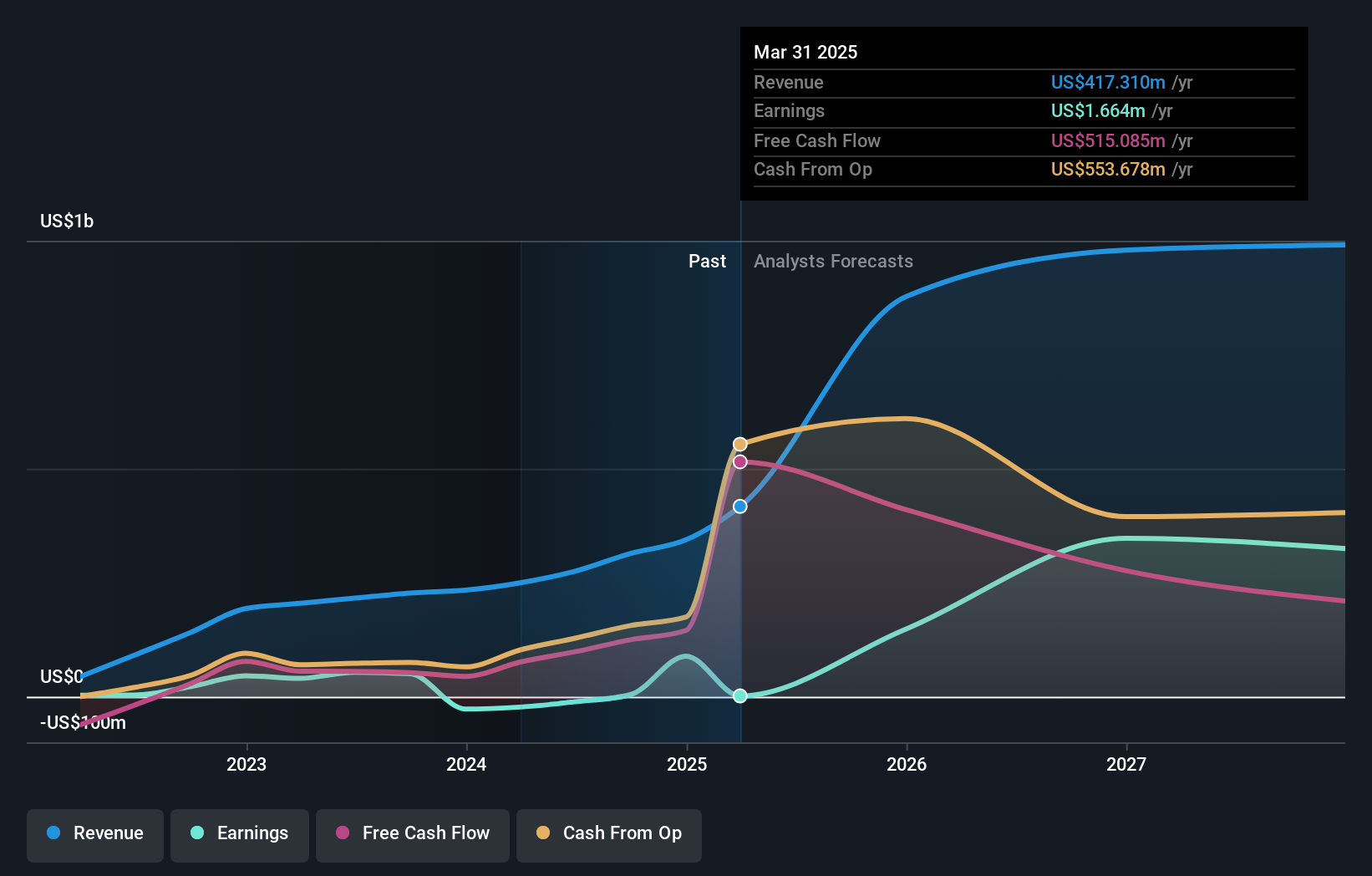

Orla Mining (TSX:OLA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Orla Mining Ltd. is engaged in the acquisition, exploration, development, and exploitation of mineral properties with a market cap of CA$6.64 billion.

Operations: Orla Mining Ltd. generates its revenue primarily through the acquisition, exploration, development, and exploitation of mineral properties.

Insider Ownership: 10.3%

Earnings Growth Forecast: 33.9% p.a.

Orla Mining is poised for significant earnings growth, outpacing the Canadian market. Despite slower revenue growth, its shares trade significantly below estimated fair value. Recent board changes with Ms. Joanna Pearson's appointment and substantial insider transactions underscore strategic confidence. Exploration at South Carlin and Musselwhite indicates potential resource expansion, enhancing long-term prospects. The recent dividend initiation reflects financial stability, while the acquisition of a 7.35% stake by an undisclosed buyer highlights investor interest in Orla's future trajectory.

- Take a closer look at Orla Mining's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Orla Mining shares in the market.

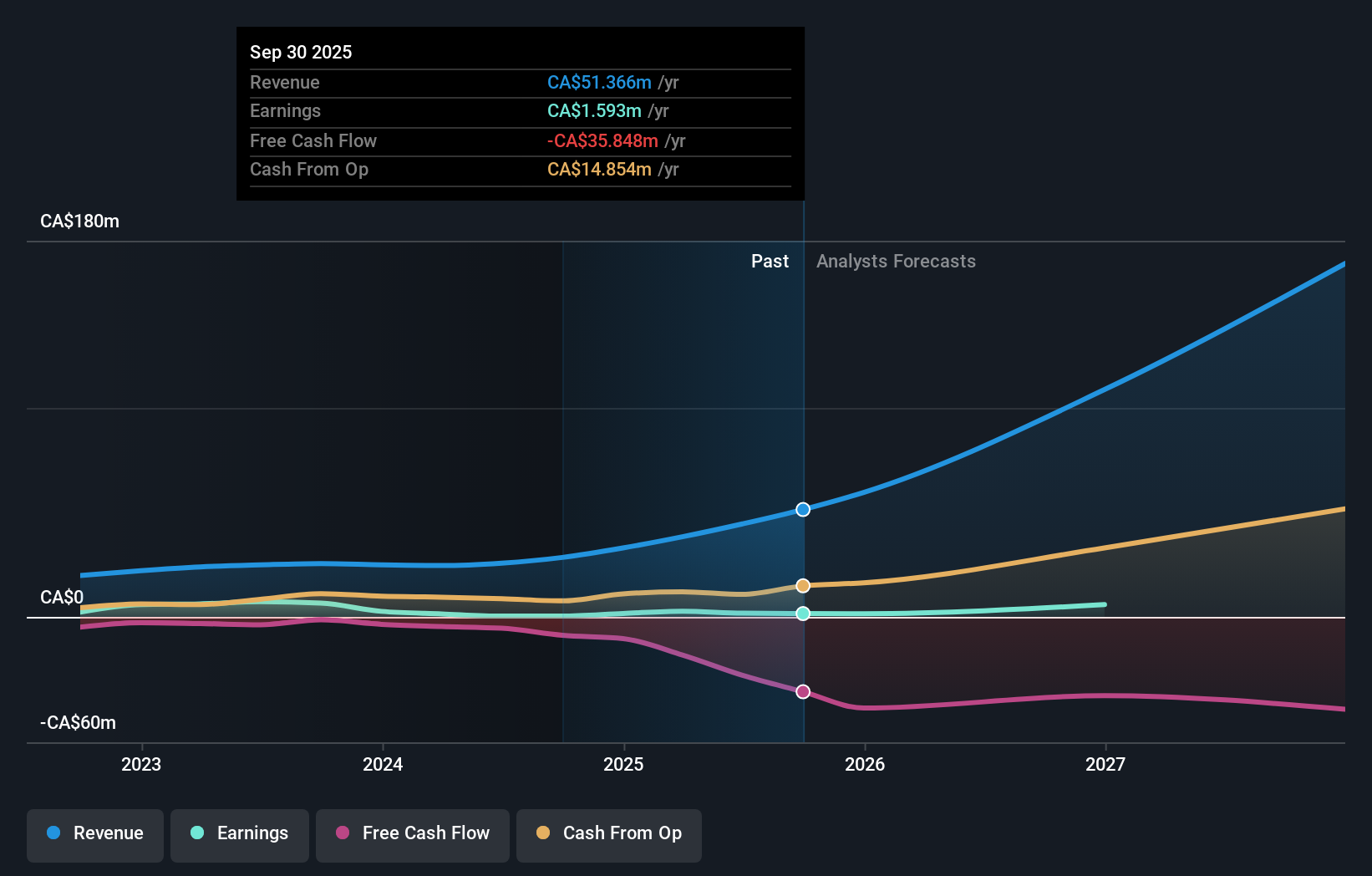

Zedcor (TSXV:ZDC)

Simply Wall St Growth Rating: ★★★★★★

Overview: Zedcor Inc. offers turnkey and customized mobile surveillance and live monitoring solutions across Canada and the United States, with a market cap of CA$615.91 million.

Operations: The company generates revenue of CA$51.37 million from its Security & Surveillance segment, providing specialized mobile surveillance and live monitoring services in Canada and the United States.

Insider Ownership: 19.2%

Earnings Growth Forecast: 122.6% p.a.

Zedcor's earnings are forecast to grow significantly, outpacing the Canadian market. Insiders have shown confidence with more substantial buying than selling recently. Revenue is expected to increase rapidly, supported by a new CAD 50 million credit facility enhancing financial flexibility for growth initiatives. Despite trading below analyst price targets, recent earnings results show mixed performance with increased sales but stable net income year-over-year. The company's strategic focus on expansion is reinforced by improved access to non-dilutive capital.

- Click to explore a detailed breakdown of our findings in Zedcor's earnings growth report.

- The analysis detailed in our Zedcor valuation report hints at an inflated share price compared to its estimated value.

Where To Now?

- Unlock our comprehensive list of 47 Fast Growing TSX Companies With High Insider Ownership by clicking here.

- Ready For A Different Approach? Uncover 13 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Zedcor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ZDC

Zedcor

Provides turnkey and customized mobile surveillance and live monitoring solutions in Canada and the United States.

Exceptional growth potential with proven track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion