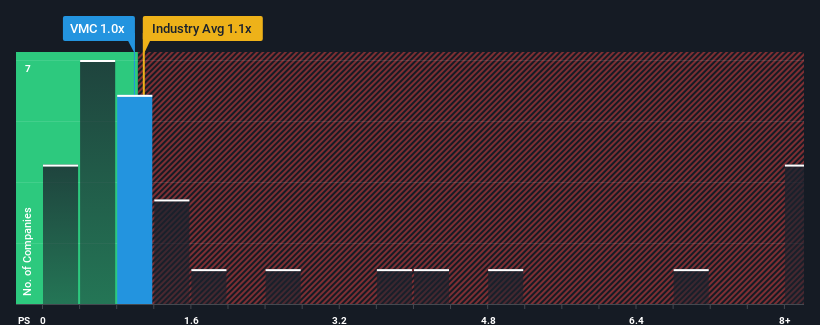

It's not a stretch to say that Vicinity Motor Corp.'s (CVE:VMC) price-to-sales (or "P/S") ratio of 1x right now seems quite "middle-of-the-road" for companies in the Machinery industry in Canada, where the median P/S ratio is around 1.1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Vicinity Motor

How Vicinity Motor Has Been Performing

Recent times have been advantageous for Vicinity Motor as its revenues have been rising faster than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Vicinity Motor will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Vicinity Motor?

In order to justify its P/S ratio, Vicinity Motor would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 65%. However, this wasn't enough as the latest three year period has seen the company endure a nasty 22% drop in revenue in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 233% during the coming year according to the lone analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 8.1%, which is noticeably less attractive.

In light of this, it's curious that Vicinity Motor's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Vicinity Motor's P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Vicinity Motor currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Vicinity Motor (3 are concerning) you should be aware of.

If you're unsure about the strength of Vicinity Motor's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:VMC

Vicinity Motor

Designs, builds, and distributes a suite of transit buses for public and commercial use under the Vicinity brand in the United States and Canada.

Slight and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026