- Canada

- /

- Oil and Gas

- /

- TSXV:MCS

McChip Resources And 2 Other TSX Penny Stocks Worth Considering

Reviewed by Simply Wall St

As global economic dynamics shift, Canadian markets face a complex landscape shaped by international trade tensions and evolving fiscal policies. Amid these changes, investors looking beyond traditional large-cap stocks might find intriguing opportunities in penny stocks—smaller or newer companies that can offer unique growth potential. While the term "penny stocks" may seem outdated, it still captures a segment of the market where financial resilience and strategic positioning can lead to compelling investment prospects.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.73 | CA$73.84M | ✅ 3 ⚠️ 3 View Analysis > |

| illumin Holdings (TSX:ILLM) | CA$2.17 | CA$112M | ✅ 4 ⚠️ 1 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.03 | CA$2.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.42 | CA$12.03M | ✅ 2 ⚠️ 4 View Analysis > |

| Mandalay Resources (TSX:MND) | CA$4.60 | CA$436.01M | ✅ 4 ⚠️ 0 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.765 | CA$508.95M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.94 | CA$18.63M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.52 | CA$178.66M | ✅ 1 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.88 | CA$179.43M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.98 | CA$11.31M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 445 stocks from our TSX Penny Stocks screener.

We'll examine a selection from our screener results.

McChip Resources (TSXV:MCS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: McChip Resources Inc. operates in the natural resource industry in Canada and has a market capitalization of CA$11.31 million.

Operations: The company generates revenue from its Oil & Gas - Exploration & Production segment, amounting to CA$4.08 million.

Market Cap: CA$11.31M

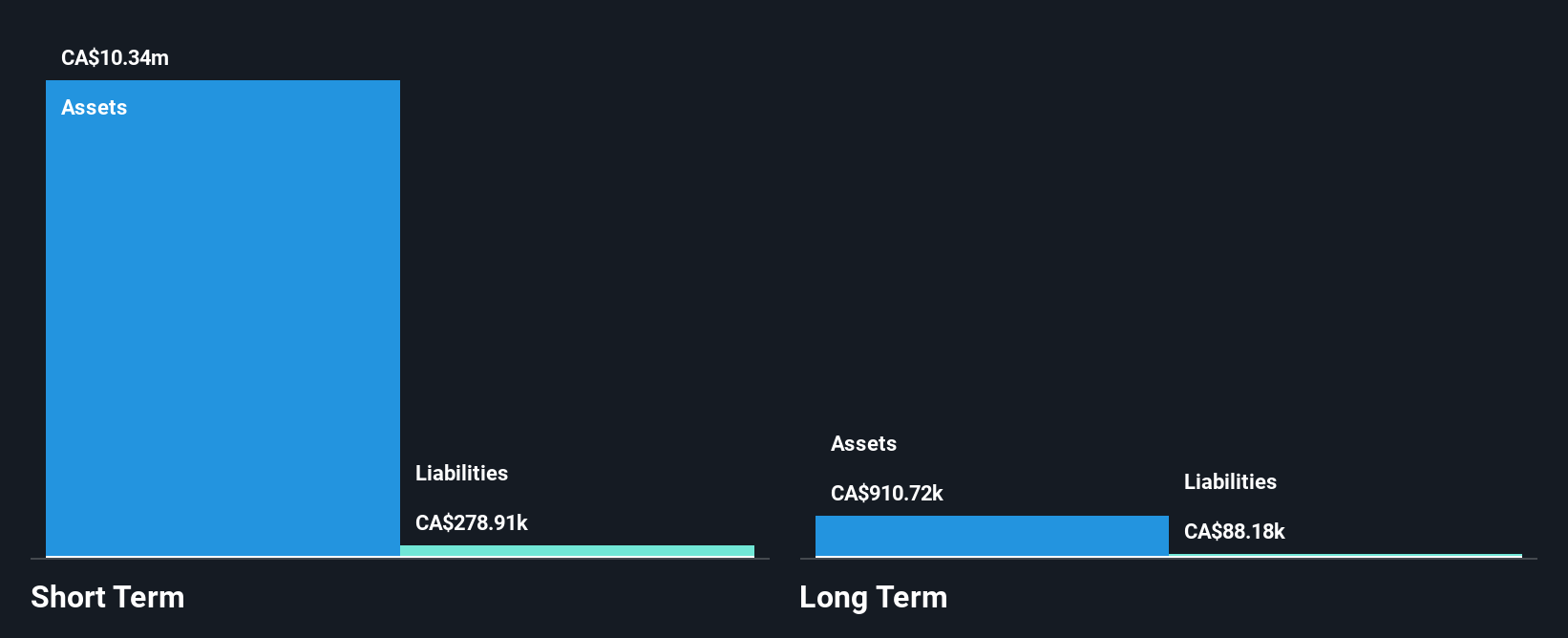

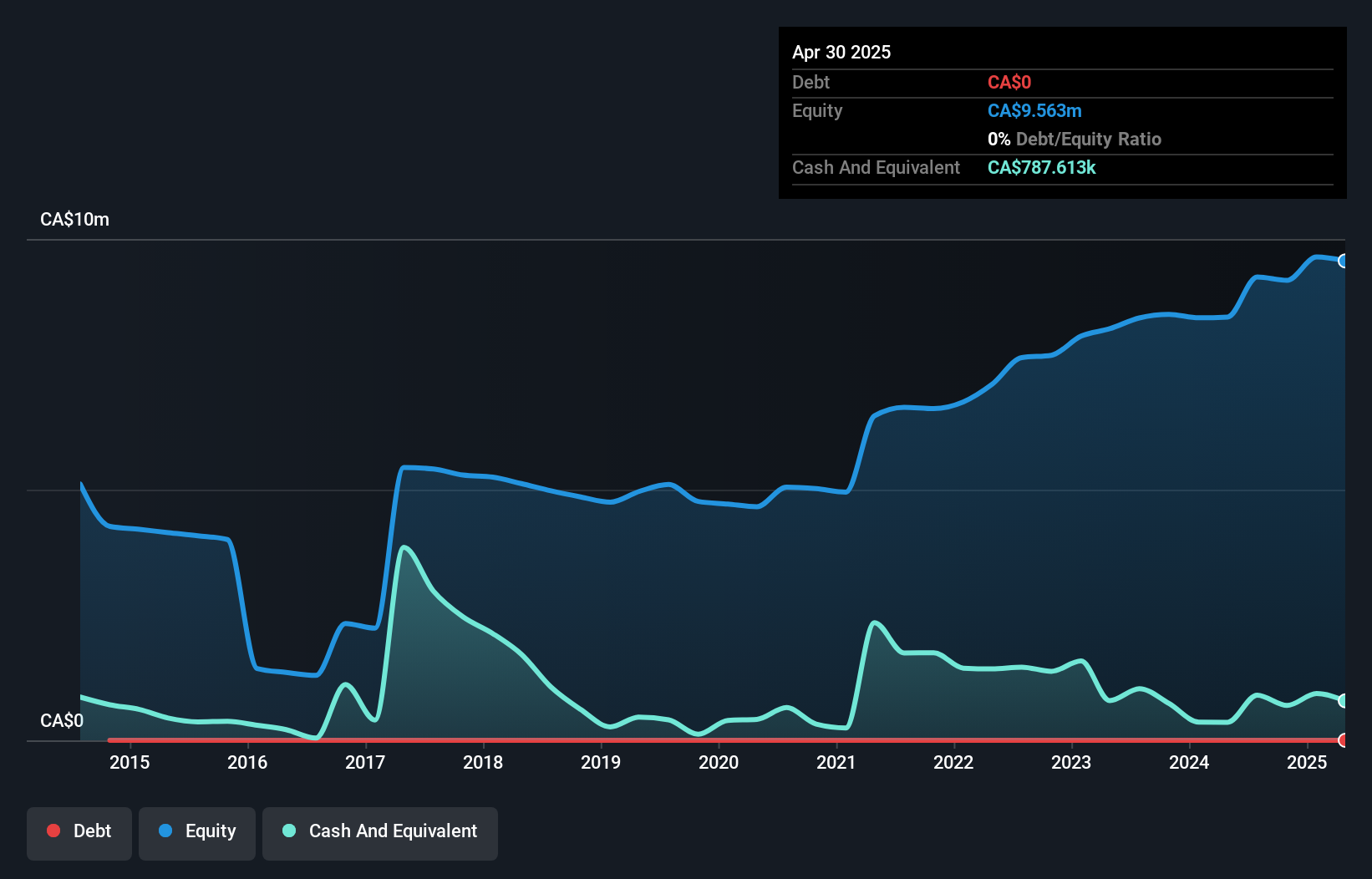

McChip Resources Inc. presents a compelling case within the penny stock landscape due to its strong financial health and impressive earnings growth. With no debt and short-term assets of CA$10.3 million surpassing both short-term and long-term liabilities, the company is financially robust. Recent earnings growth of 693.5% highlights significant operational improvements, with net profit margins rising to 75.5%. Despite its small market capitalization of CA$11.31 million, McChip Resources has demonstrated substantial revenue generation from its Oil & Gas segment, amounting to CA$4 million annually, indicating meaningful progress beyond pre-revenue status in this volatile sector.

- Click to explore a detailed breakdown of our findings in McChip Resources' financial health report.

- Understand McChip Resources' track record by examining our performance history report.

Omni-Lite Industries Canada (TSXV:OML)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Omni-Lite Industries Canada Inc. is a company that manufactures and sells metal alloys, composite components, and fastener systems in the United States and Canada, with a market cap of CA$23.68 million.

Operations: The company's revenue is primarily derived from the United States at $10.82 million and Canada at $4.08 million.

Market Cap: CA$23.68M

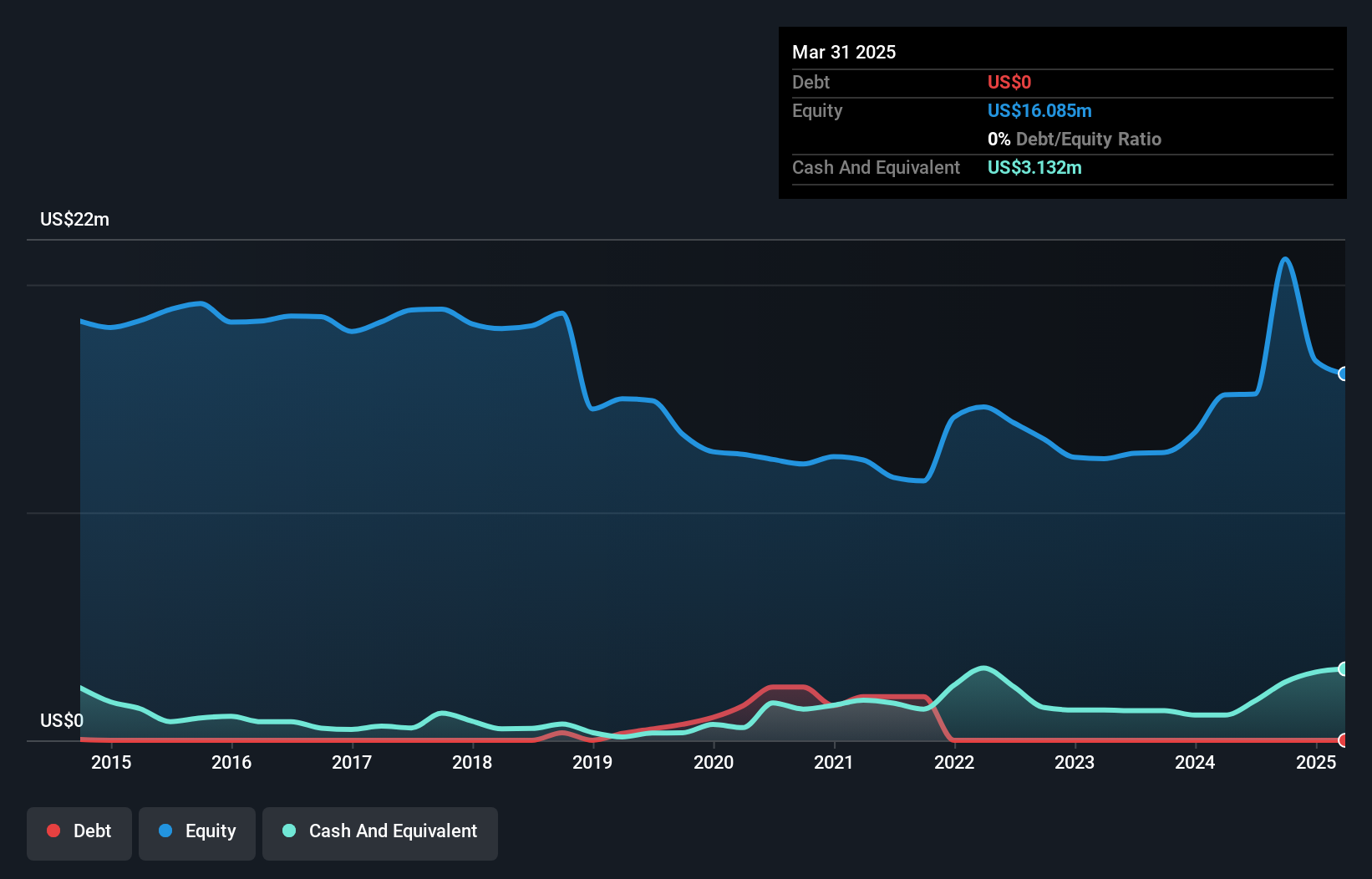

Omni-Lite Industries Canada Inc. offers a mixed picture within the penny stock domain, with a market cap of CA$23.68 million and stable financial health due to its debt-free status. The company's short-term assets of US$10.3M exceed both short-term and long-term liabilities, indicating solid liquidity management. However, recent earnings results show challenges; Q1 2025 sales declined to US$3.31 million from US$4.29 million year-over-year, with net income dropping significantly as well. Despite high-quality past earnings and no shareholder dilution over the past year, profitability pressures remain evident in decreasing net profit margins from 4.6% to 2.1%.

- Unlock comprehensive insights into our analysis of Omni-Lite Industries Canada stock in this financial health report.

- Evaluate Omni-Lite Industries Canada's historical performance by accessing our past performance report.

Tower Resources (TSXV:TWR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tower Resources Ltd. is involved in the acquisition, evaluation, and exploration of mineral properties in Canada with a market cap of CA$22.56 million.

Operations: Tower Resources Ltd. does not have any reported revenue segments.

Market Cap: CA$22.56M

Tower Resources Ltd., with a market cap of CA$22.56 million, is pre-revenue and actively engaged in exploring its Rabbit North property. Recent drilling results revealed promising gold assays, including an exceptional 23.63 g/t Au over 6.02 metres, extending the Blue Sky gold zone significantly. Despite these encouraging exploration outcomes, the company faces financial constraints with less than a year of cash runway and ongoing unprofitability, highlighted by increased losses over five years at a rate of 0.03% annually. Nonetheless, Tower Resources remains debt-free and maintains experienced management and board teams to navigate its strategic exploration endeavors.

- Get an in-depth perspective on Tower Resources' performance by reading our balance sheet health report here.

- Gain insights into Tower Resources' historical outcomes by reviewing our past performance report.

Summing It All Up

- Take a closer look at our TSX Penny Stocks list of 445 companies by clicking here.

- Looking For Alternative Opportunities? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 23 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:MCS

Flawless balance sheet and good value.

Market Insights

Community Narratives