CanAlaska Uranium And 2 Other Promising TSX Penny Stocks To Consider

Reviewed by Simply Wall St

The Canadian market has been navigating a complex landscape of economic trends and portfolio strategies, as analyzed by experts like Angelo Kourkafas. Despite the term 'penny stocks' sounding somewhat outdated, these investments still hold potential for growth when backed by strong financials. This article will explore three penny stocks that exhibit financial strength and promise, offering investors a chance to uncover hidden value in quality companies.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Findev (TSXV:FDI) | CA$0.465 | CA$13.61M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.26 | CA$115M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.59 | CA$528.97M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.30 | CA$221.48M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.475 | CA$948.57M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.23 | CA$33.04M | ★★★★★★ |

| New Gold (TSX:NGD) | CA$4.08 | CA$3.11B | ★★★★★☆ |

| Hemisphere Energy (TSXV:HME) | CA$1.84 | CA$179.46M | ★★★★★☆ |

| Enterprise Group (TSX:E) | CA$1.79 | CA$108.95M | ★★★★☆☆ |

Click here to see the full list of 935 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

CanAlaska Uranium (TSXV:CVV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CanAlaska Uranium Ltd. is an exploration stage company focused on acquiring and exploring mineral properties in Canada, with a market cap of CA$126.29 million.

Operations: CanAlaska Uranium Ltd. does not have reported revenue segments as it is an exploration stage company.

Market Cap: CA$126.29M

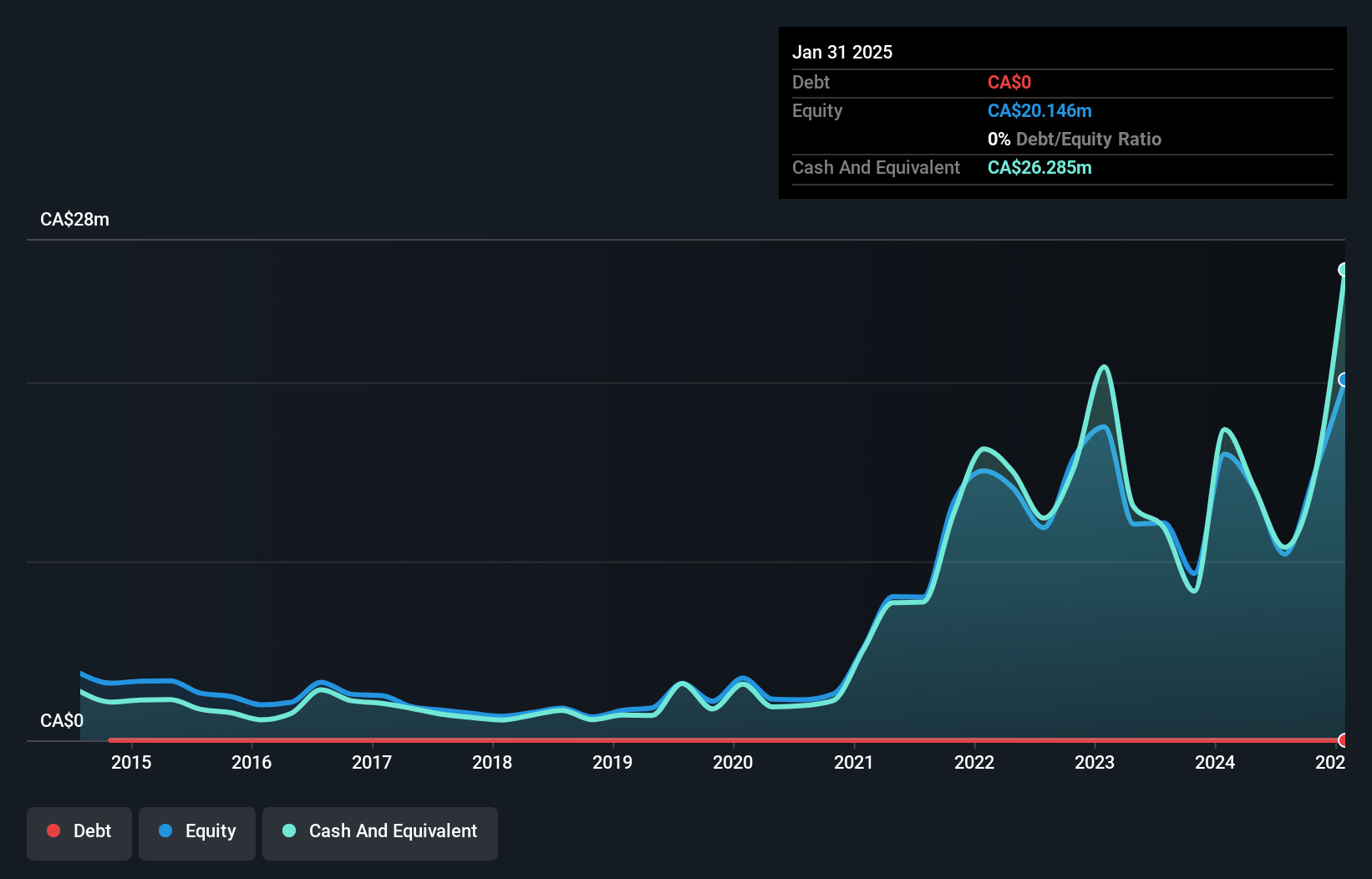

CanAlaska Uranium Ltd., with a market cap of CA$126.29 million, is a pre-revenue exploration stage company primarily focused on uranium projects in Canada. Recent high-grade assay results from its West McArthur Joint Venture project highlight significant uranium mineralization potential, with intersections showing very large grades of U3O8. Despite being debt-free and having short-term assets exceeding liabilities, the company remains unprofitable and has experienced shareholder dilution due to recent capital raises totaling CA$9.99 million through private placements. The management team and board are seasoned, contributing to strategic planning for future exploration programs.

- Navigate through the intricacies of CanAlaska Uranium with our comprehensive balance sheet health report here.

- Gain insights into CanAlaska Uranium's past trends and performance with our report on the company's historical track record.

Metalla Royalty & Streaming (TSXV:MTA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Metalla Royalty & Streaming Ltd. is a precious metals royalty and streaming company focused on acquiring and managing gold, silver, and copper royalties and streams in Canada, with a market cap of CA$371.10 million.

Operations: The company's revenue is derived from the acquisition and management of precious metal royalties, streams, and similar production-based interests amounting to $5.05 million.

Market Cap: CA$371.1M

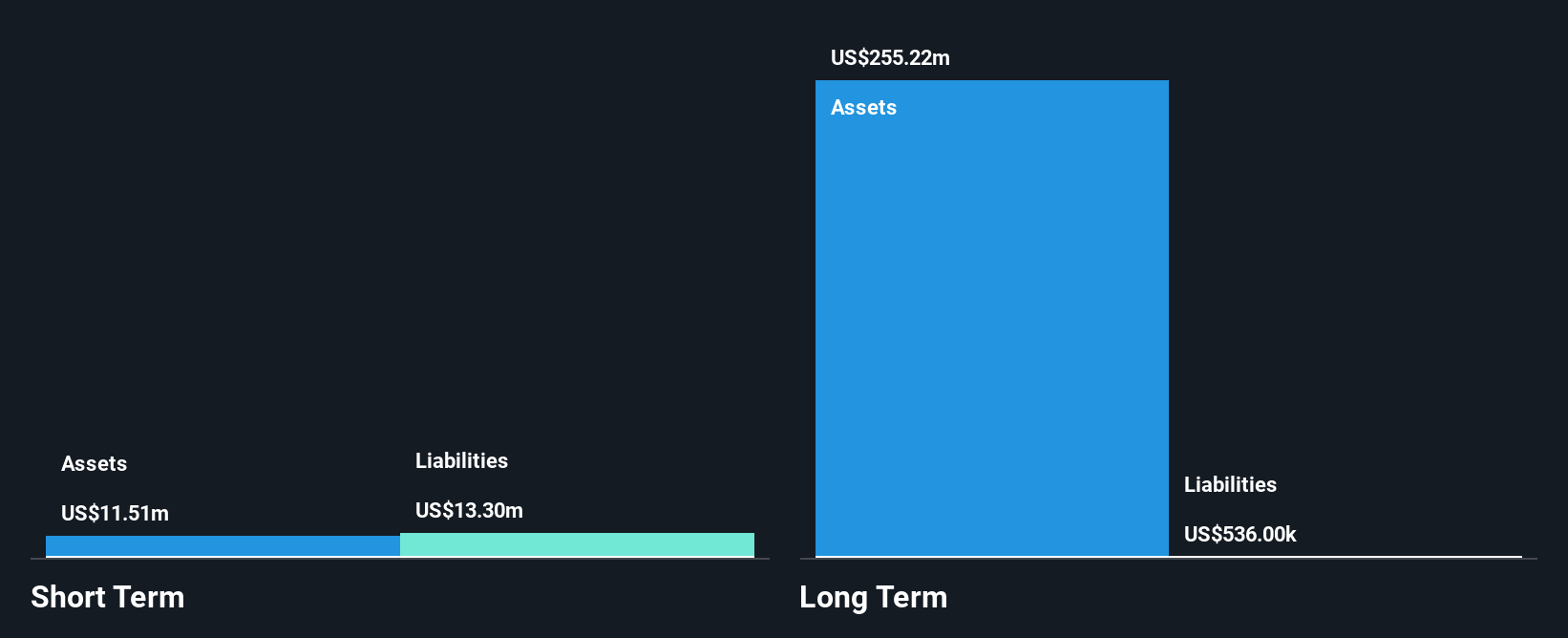

Metalla Royalty & Streaming Ltd., with a market cap of CA$371.10 million, focuses on acquiring and managing precious metal royalties and streams, generating US$5.05 million in revenue. The company operates at a net loss, reporting a third-quarter loss of US$1.17 million, though this is an improvement from the previous year. Despite its unprofitability and short-term liabilities exceeding assets by US$1.5 million, Metalla maintains a satisfactory net debt to equity ratio of 1.2% and has sufficient cash runway for over a year based on current free cash flow levels. The board's recent addition of Chris Beer enhances its mining finance expertise significantly.

- Jump into the full analysis health report here for a deeper understanding of Metalla Royalty & Streaming.

- Examine Metalla Royalty & Streaming's earnings growth report to understand how analysts expect it to perform.

Next Hydrogen Solutions (TSXV:NXH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Next Hydrogen Solutions Inc. develops and produces water electrolyzers designed to integrate with intermittent renewable energy, with a market cap of CA$11.45 million.

Operations: The company's revenue is generated from the development and sale of electrolyzers and balance of plant equipment, amounting to CA$2.06 million.

Market Cap: CA$11.45M

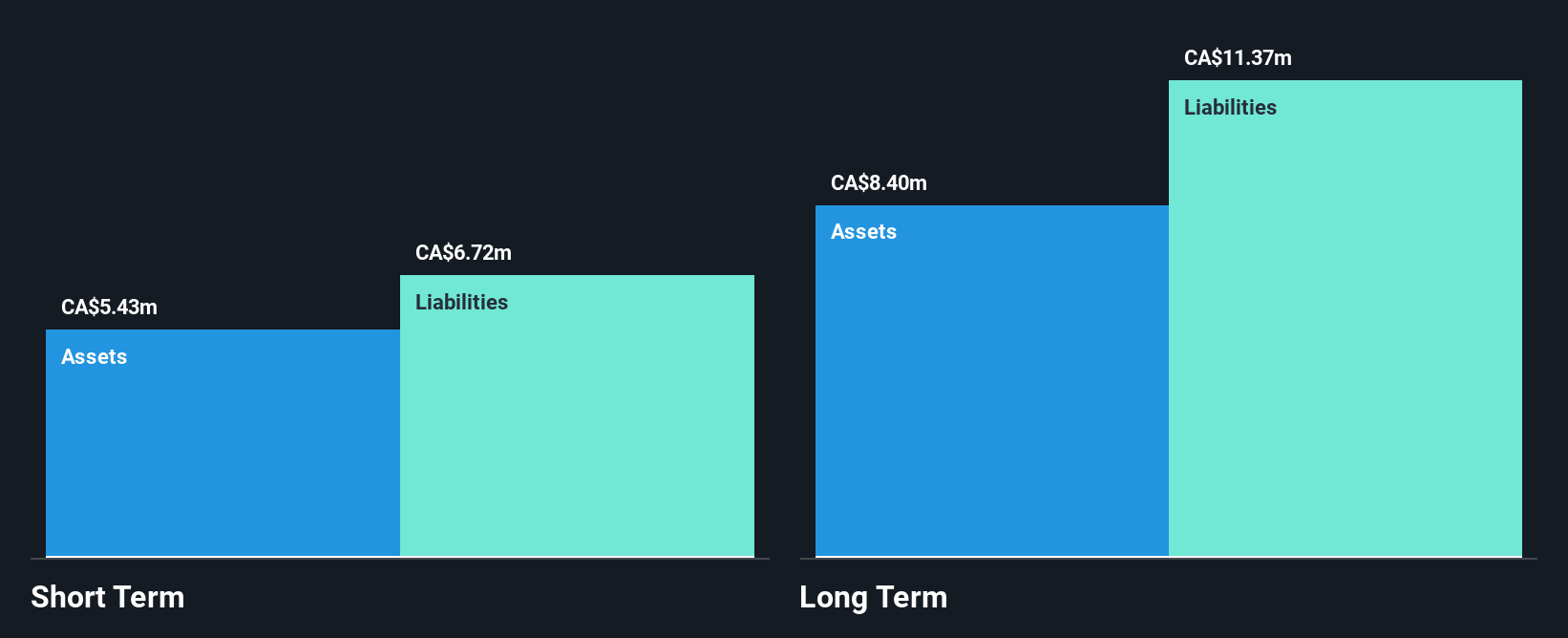

Next Hydrogen Solutions Inc., with a market cap of CA$11.45 million, is focused on water electrolyzers for renewable energy integration but remains pre-revenue with sales of CA$2.06 million. The company recently closed a private placement raising CA$2.73 million, which may extend its cash runway beyond the current 3-4 months based on free cash flow estimates. Despite having more cash than debt and covering short-term liabilities with assets, it faces challenges like high volatility and unprofitability, evidenced by a net loss increase to CA$11.24 million over nine months in 2024. Management's average tenure suggests limited experience in navigating these financial hurdles.

- Click to explore a detailed breakdown of our findings in Next Hydrogen Solutions' financial health report.

- Evaluate Next Hydrogen Solutions' historical performance by accessing our past performance report.

Key Takeaways

- Click this link to deep-dive into the 935 companies within our TSX Penny Stocks screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Next Hydrogen Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:NXH

Next Hydrogen Solutions

Specializes in the development and production of water electrolyzers designed to integrate with intermittent renewable energy sources.

Moderate and overvalued.

Similar Companies

Market Insights

Community Narratives