When FLYHT Aerospace Solutions Ltd. (CVE:FLY) reported its results to December 2020 its auditors, KPMG LLP - Klynveld Peat Marwick Goerdeler could not be sure that it would be able to continue as a going concern in the next year. This means that, based on the financial results to that date, the company arguably should raise capital, or otherwise strengthen the balance sheet, as soon as possible.

Given its situation, it may not be in a good position to raise capital on favorable terms. So it is suddenly extremely important to consider whether the company is taking too much risk on its balance sheet. Debt is always a risk factor in these cases, as creditors could be in a position to wind up the company, in the worst case scenario.

View our latest analysis for FLYHT Aerospace Solutions

How Much Debt Does FLYHT Aerospace Solutions Carry?

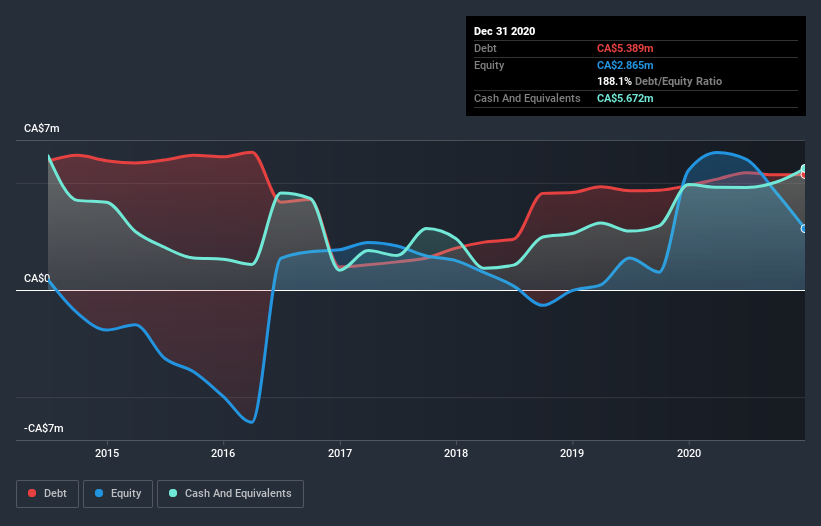

You can click the graphic below for the historical numbers, but it shows that as of December 2020 FLYHT Aerospace Solutions had CA$5.39m of debt, an increase on CA$4.88m, over one year. But it also has CA$5.67m in cash to offset that, meaning it has CA$283.3k net cash.

A Look At FLYHT Aerospace Solutions' Liabilities

We can see from the most recent balance sheet that FLYHT Aerospace Solutions had liabilities of CA$5.68m falling due within a year, and liabilities of CA$5.19m due beyond that. On the other hand, it had cash of CA$5.67m and CA$1.78m worth of receivables due within a year. So its liabilities total CA$3.42m more than the combination of its cash and short-term receivables.

Since publicly traded FLYHT Aerospace Solutions shares are worth a total of CA$20.2m, it seems unlikely that this level of liabilities would be a major threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. While it does have liabilities worth noting, FLYHT Aerospace Solutions also has more cash than debt, so we're pretty confident it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine FLYHT Aerospace Solutions's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, FLYHT Aerospace Solutions made a loss at the EBIT level, and saw its revenue drop to CA$14m, which is a fall of 36%. To be frank that doesn't bode well.

So How Risky Is FLYHT Aerospace Solutions?

Although FLYHT Aerospace Solutions had an earnings before interest and tax (EBIT) loss over the last twelve months, it generated positive free cash flow of CA$542k. So although it is loss-making, it doesn't seem to have too much near-term balance sheet risk, keeping in mind the net cash. Until we see some positive EBIT, we're a bit cautious of the stock, not least because of the rather modest revenue growth. We prefer to avoid a company after its auditor has expressed any uncertainty about its ability to continue as a going concern. That's because companies should always make sure the auditor has confidence that the company will continue as a going concern, in our view. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 1 warning sign for FLYHT Aerospace Solutions that you should be aware of before investing here.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

When trading FLYHT Aerospace Solutions or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:FLY

FLYHT Aerospace Solutions

Provides real-time communications with aircrafts for the aerospace industry.

Slight and slightly overvalued.

Market Insights

Community Narratives