Here's Why It's Unlikely That EnWave Corporation's (CVE:ENW) CEO Will See A Pay Rise This Year

Key Insights

- EnWave will host its Annual General Meeting on 27th of March

- Total pay for CEO Brent Charleton includes CA$300.0k salary

- Total compensation is 40% above industry average

- EnWave's three-year loss to shareholders was 73% while its EPS was down 2.8% over the past three years

The results at EnWave Corporation (CVE:ENW) have been quite disappointing recently and CEO Brent Charleton bears some responsibility for this. Shareholders can take the chance to hold the board and management accountable for the unsatisfactory performance at the next AGM on 27th of March. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. We present the case why we think CEO compensation is out of sync with company performance.

Check out our latest analysis for EnWave

Comparing EnWave Corporation's CEO Compensation With The Industry

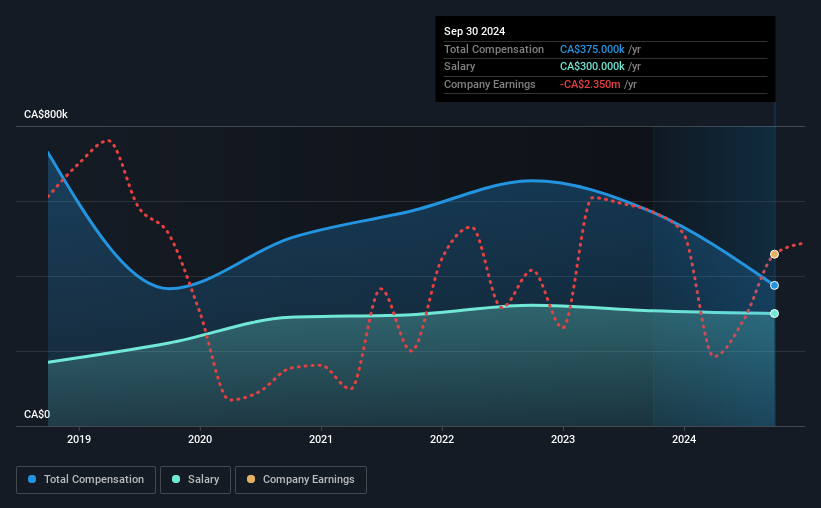

Our data indicates that EnWave Corporation has a market capitalization of CA$28m, and total annual CEO compensation was reported as CA$375k for the year to September 2024. That's a notable decrease of 34% on last year. In particular, the salary of CA$300.0k, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the Canadian Machinery industry with market capitalizations under CA$286m, the reported median total CEO compensation was CA$268k. Accordingly, our analysis reveals that EnWave Corporation pays Brent Charleton north of the industry median.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | CA$300k | CA$308k | 80% |

| Other | CA$75k | CA$262k | 20% |

| Total Compensation | CA$375k | CA$569k | 100% |

On an industry level, roughly 84% of total compensation represents salary and 16% is other remuneration. Our data reveals that EnWave allocates salary more or less in line with the wider market. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

EnWave Corporation's Growth

Over the last three years, EnWave Corporation has shrunk its earnings per share by 2.8% per year. Its revenue is down 18% over the previous year.

A lack of EPS improvement is not good to see. And the fact that revenue is down year on year arguably paints an ugly picture. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has EnWave Corporation Been A Good Investment?

Few EnWave Corporation shareholders would feel satisfied with the return of -73% over three years. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 2 warning signs for EnWave that you should be aware of before investing.

Switching gears from EnWave, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if EnWave might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:ENW

EnWave

Designs, constructs, markets, and sells vacuum-microwave dehydration machinery for the food, cannabis, and biomaterial industries in Canada, the United States, and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion