The Canadian market has experienced significant volatility, with the TSX reaching all-time highs despite earlier declines driven by U.S. policy shifts and trade tensions. For investors interested in smaller or newer companies, penny stocks—though an older term—remain a relevant area for potential growth, especially when backed by solid financial foundations. In this article, we explore several Canadian penny stocks that stand out for their financial strength and potential to offer value and stability amidst ongoing market uncertainties.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.67 | CA$64.74M | ✅ 3 ⚠️ 3 View Analysis > |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$1.85 | CA$254.04M | ✅ 4 ⚠️ 1 View Analysis > |

| illumin Holdings (TSX:ILLM) | CA$2.02 | CA$105.29M | ✅ 4 ⚠️ 1 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.025 | CA$2.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.43 | CA$12.18M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.76 | CA$518.93M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.94 | CA$18.43M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.42 | CA$169.01M | ✅ 1 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.86 | CA$178.37M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.10 | CA$6.28M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 446 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Silver Mountain Resources (TSXV:AGMR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Silver Mountain Resources Inc. focuses on acquiring, exploring, and developing precious metal resource properties in Peru with a market cap of CA$19.51 million.

Operations: Silver Mountain Resources Inc. has not reported any revenue segments.

Market Cap: CA$19.51M

Silver Mountain Resources Inc., with a market cap of CA$19.51 million, remains pre-revenue and unprofitable, having reported a net loss of US$2.11 million for 2024. Despite no debt and experienced management and board teams, the company faces financial challenges with less than a year of cash runway and high weekly volatility compared to most Canadian stocks. Recent executive changes include appointing Oliver Foeste as CFO, bringing extensive finance expertise to potentially stabilize operations. However, an auditor's report expressed doubts about the company's ability to continue as a going concern, underscoring significant risks associated with this penny stock investment.

- Jump into the full analysis health report here for a deeper understanding of Silver Mountain Resources.

- Gain insights into Silver Mountain Resources' past trends and performance with our report on the company's historical track record.

BIGG Digital Assets (TSXV:BIGG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: BIGG Digital Assets Inc. is involved in owning, operating, and investing in digital assets businesses across Canada, the United States, Europe, and internationally with a market cap of CA$44.47 million.

Operations: The company's revenue is primarily generated from Netcoins (CA$10.83 million), with additional contributions from Terrazero (CA$0.09 million) and Blockchain services (CA$1.89 million).

Market Cap: CA$44.47M

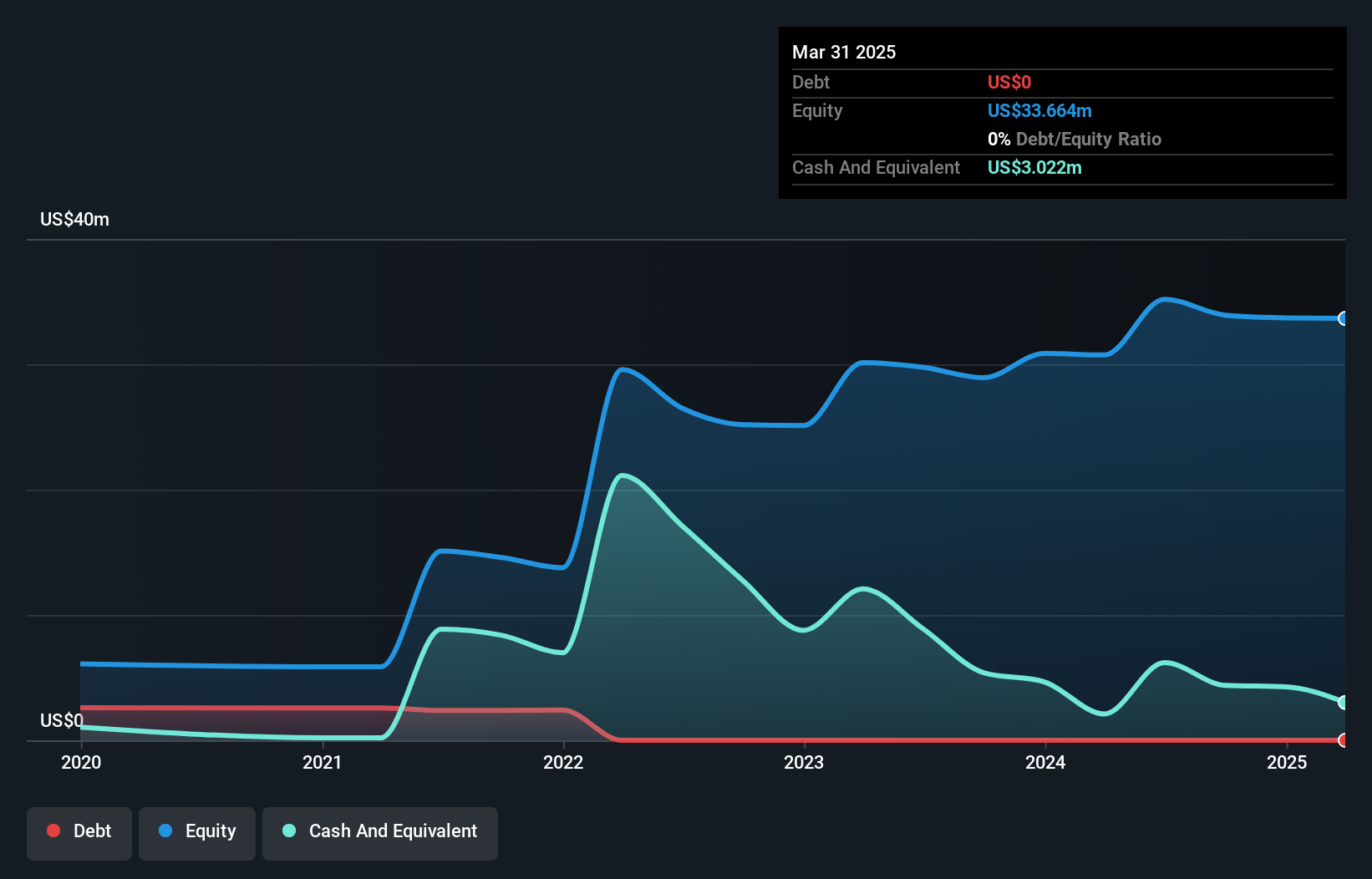

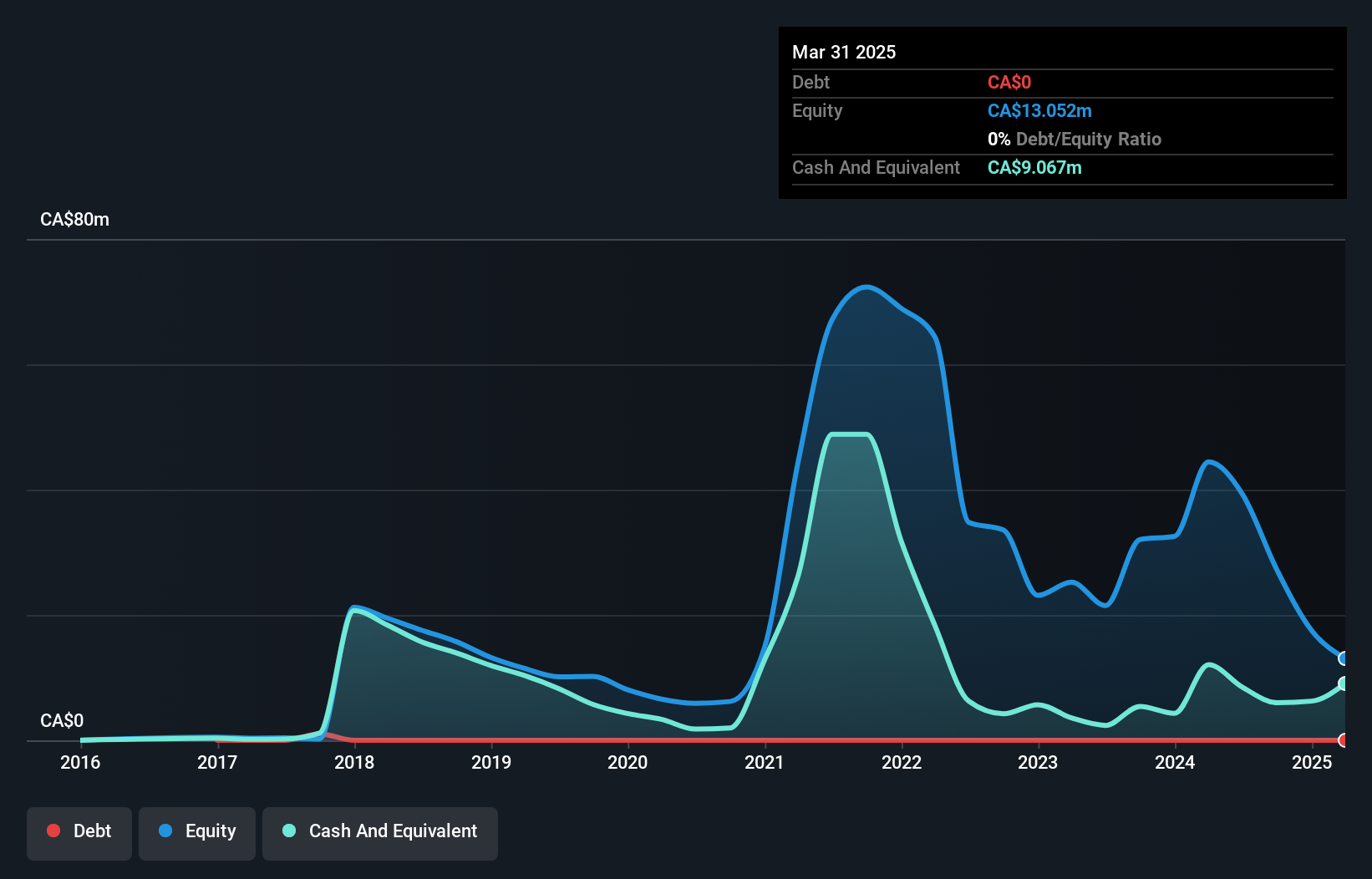

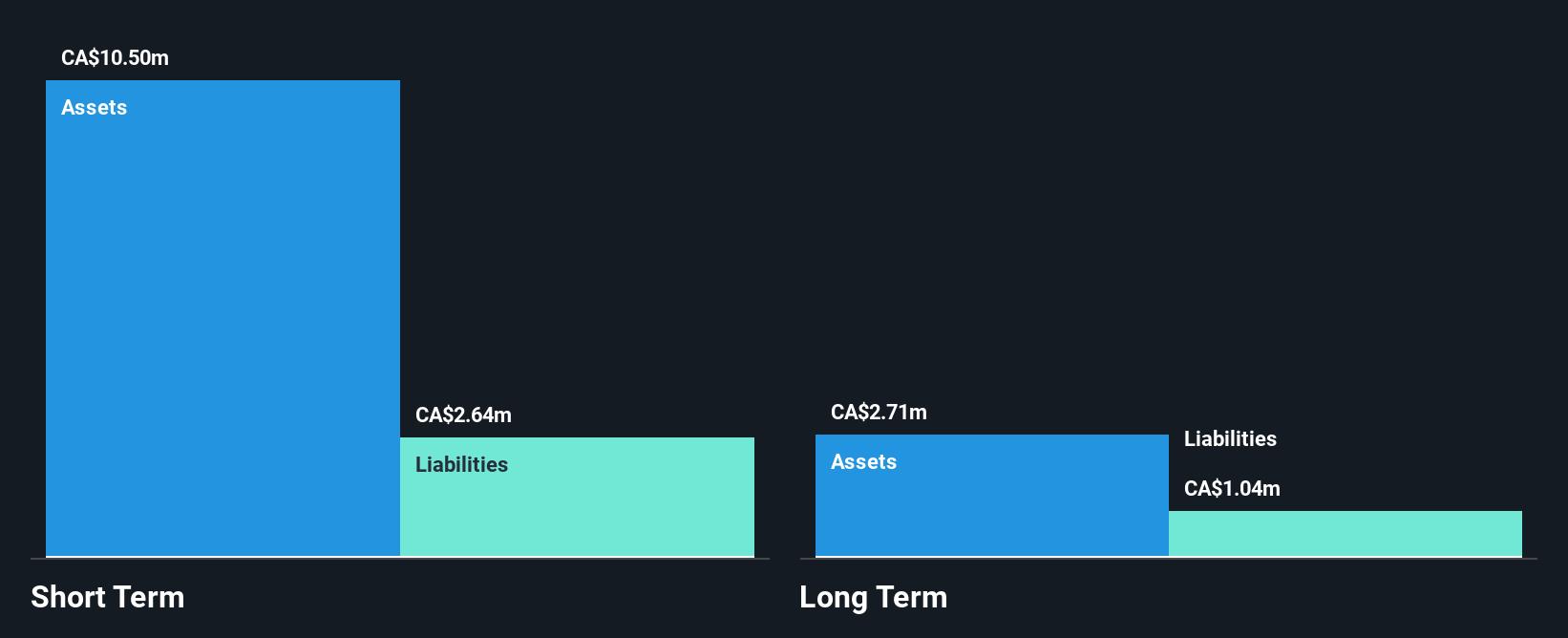

BIGG Digital Assets Inc., with a market cap of CA$44.47 million, is unprofitable and has experienced increasing losses over the past five years. Despite being debt-free, the company faces financial challenges with less than a year of cash runway and high volatility in its share price. Recent developments include TerraZero Technologies' launch of AI integration into its Intraverse platform and new virtual experiences that could drive user engagement. However, an auditor's report raised concerns about BIGG's ability to continue as a going concern, highlighting significant risks for investors considering this penny stock.

- Get an in-depth perspective on BIGG Digital Assets' performance by reading our balance sheet health report here.

- Understand BIGG Digital Assets' track record by examining our performance history report.

EnWave (TSXV:ENW)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: EnWave Corporation designs, constructs, markets, and sells vacuum-microwave dehydration machinery for the food, cannabis, and biomaterial industries across Canada, the United States, and internationally with a market cap of CA$44.48 million.

Operations: EnWave Corporation has not reported any specific revenue segments.

Market Cap: CA$44.48M

EnWave Corporation, with a market cap of CA$44.48 million, has shown significant revenue growth, reporting sales of CA$3.69 million for Q2 2025 compared to CA$0.663 million the previous year. Despite being unprofitable, it boasts a positive cash flow and sufficient cash runway for over three years. Recent agreements with partners like MicroDried® and Procescir S.A. de C.V., involving royalty-bearing licenses and equipment purchases, enhance its revenue potential in North America and Mexico's snack markets. The company trades below estimated fair value and has stable weekly volatility without meaningful shareholder dilution recently observed.

- Click here and access our complete financial health analysis report to understand the dynamics of EnWave.

- Assess EnWave's previous results with our detailed historical performance reports.

Taking Advantage

- Reveal the 446 hidden gems among our TSX Penny Stocks screener with a single click here.

- Interested In Other Possibilities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BIGG Digital Assets might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:BIGG

BIGG Digital Assets

Owns, operates, and invests in businesses in the digital assets space industry in Canada, the United States of America, Europe, and internationally.

Adequate balance sheet with low risk.

Market Insights

Community Narratives