- Canada

- /

- Electrical

- /

- TSXV:EGT

Benign Growth For Eguana Technologies Inc. (CVE:EGT) Underpins Stock's 40% Plummet

The Eguana Technologies Inc. (CVE:EGT) share price has fared very poorly over the last month, falling by a substantial 40%. For any long-term shareholders, the last month ends a year to forget by locking in a 94% share price decline.

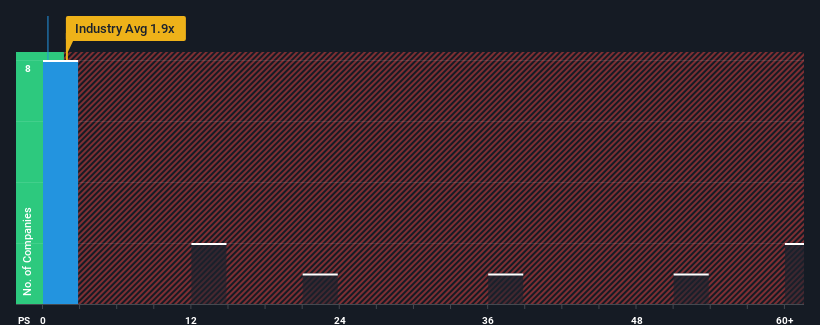

Since its price has dipped substantially, Eguana Technologies may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.4x, since almost half of all companies in the Electrical industry in Canada have P/S ratios greater than 2.9x and even P/S higher than 22x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Eguana Technologies

What Does Eguana Technologies' P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Eguana Technologies has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Eguana Technologies will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Eguana Technologies?

Eguana Technologies' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 190% last year. Pleasingly, revenue has also lifted 136% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 13% as estimated by the lone analyst watching the company. Meanwhile, the rest of the industry is forecast to expand by 125%, which is noticeably more attractive.

With this information, we can see why Eguana Technologies is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Eguana Technologies' P/S?

Eguana Technologies' P/S looks about as weak as its stock price lately. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As expected, our analysis of Eguana Technologies' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

Don't forget that there may be other risks. For instance, we've identified 5 warning signs for Eguana Technologies (4 shouldn't be ignored) you should be aware of.

If you're unsure about the strength of Eguana Technologies' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Eguana Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:EGT

Eguana Technologies

Designs, manufactures, and markets energy storage solutions for residential and commercial markets in Australia, Europe, and North America.

Moderate risk and fair value.

Market Insights

Community Narratives