Decisive Dividend Corporation (CVE:DE) will pay a dividend of CA$0.045 on the 15th of July. The dividend yield will be 7.4% based on this payment which is still above the industry average.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Decisive Dividend's stock price has reduced by 34% in the last 3 months, which is not ideal for investors and can explain a sharp increase in the dividend yield.

See our latest analysis for Decisive Dividend

Decisive Dividend Is Paying Out More Than It Is Earning

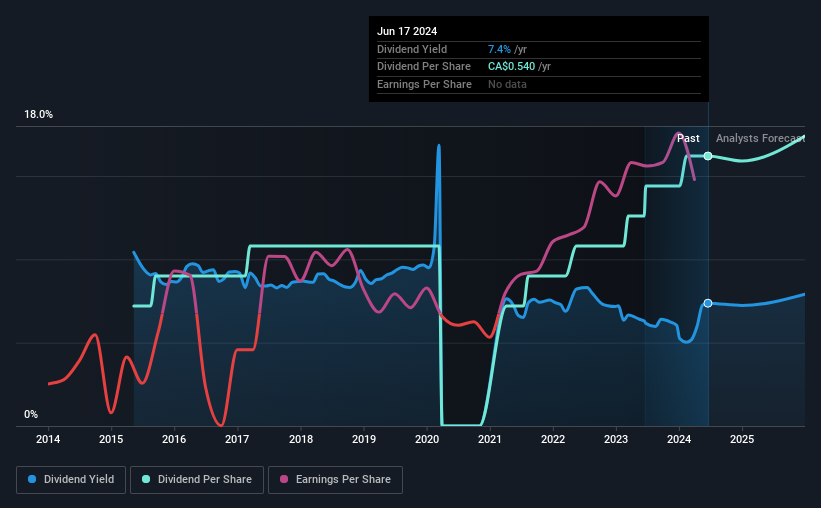

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Prior to this announcement, the company was paying out 132% of what it was earning and 90% of cash flows. The company could be more focused on returning cash to shareholders, but this could indicate that growth opportunities are few and far between.

Earnings per share is forecast to rise by 32.4% over the next year. However, if the dividend continues along recent trends, it could start putting pressure on the balance sheet with the payout ratio reaching 118% over the next year.

Decisive Dividend's Dividend Has Lacked Consistency

It's comforting to see that Decisive Dividend has been paying a dividend for a number of years now, however it has been cut at least once in that time. This makes us cautious about the consistency of the dividend over a full economic cycle. Since 2015, the annual payment back then was CA$0.24, compared to the most recent full-year payment of CA$0.54. This works out to be a compound annual growth rate (CAGR) of approximately 9.4% a year over that time. A reasonable rate of dividend growth is good to see, but we're wary that the dividend history is not as solid as we'd like, having been cut at least once.

Decisive Dividend's Dividend Might Lack Growth

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. It's encouraging to see that Decisive Dividend has been growing its earnings per share at 148% a year over the past five years. Strong earnings is nice to see, but unless this can be sustained on minimal reinvestment of profits, we would question whether dividends will follow suit.

An additional note is that the company has been raising capital by issuing stock equal to 12% of shares outstanding in the last 12 months. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

The Dividend Could Prove To Be Unreliable

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. Strong earnings growth means Decisive Dividend has the potential to be a good dividend stock in the future, despite the current payments being at elevated levels. We don't think Decisive Dividend is a great stock to add to your portfolio if income is your focus.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. To that end, Decisive Dividend has 3 warning signs (and 1 which is concerning) we think you should know about. Is Decisive Dividend not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:DE

Decisive Dividend

Through its subsidiaries, manufactures and sells wood burning stoves, fireplace inserts, and fireplaces in Canada, the United States, and internationally.

Reasonable growth potential with proven track record and pays a dividend.

Market Insights

Community Narratives