- Canada

- /

- Auto Components

- /

- TSX:XTC

Introducing Exco Technologies (TSE:XTC), The Stock That Dropped 35% In The Last Three Years

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. Unfortunately, that's been the case for longer term Exco Technologies Limited (TSE:XTC) shareholders, since the share price is down 35% in the last three years, falling well short of the market return of around 30%. The silver lining is that the stock is up 5.5% in about a week.

View our latest analysis for Exco Technologies

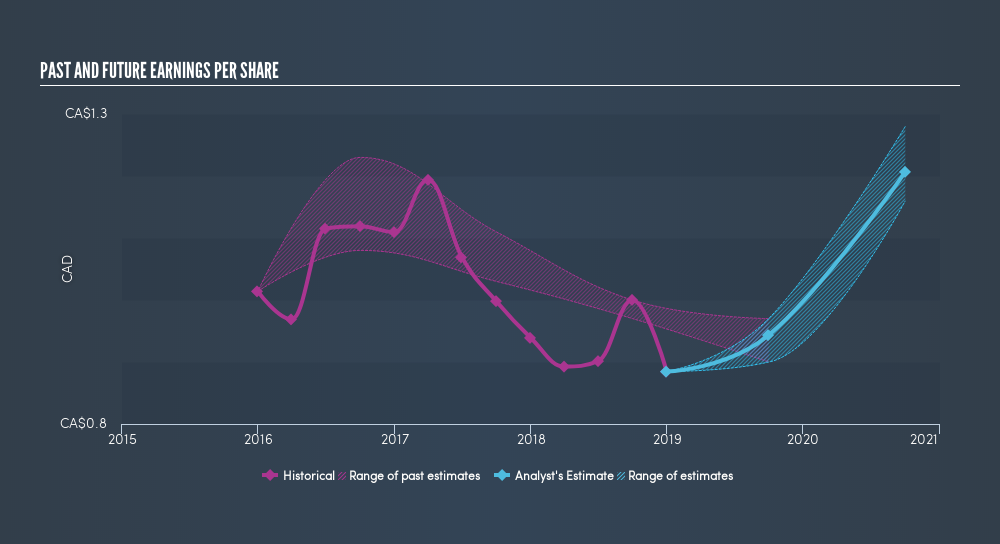

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Exco Technologies saw its EPS decline at a compound rate of 4.5% per year, over the last three years. This reduction in EPS is slower than the 13% annual reduction in the share price. So it seems the market was too confident about the business, in the past. This increased caution is also evident in the rather low P/E ratio, which is sitting at 11.09.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free interactive report on Exco Technologies's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Exco Technologies's TSR for the last 3 years was -28%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's nice to see that Exco Technologies shareholders have received a total shareholder return of 11% over the last year. That's including the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 4.7% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. If you would like to research Exco Technologies in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this freelist of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:XTC

Exco Technologies

Designs, develops, manufactures, and sells dies, molds, components and assemblies, and consumable equipment for the die-cast, extrusion, and automotive industries.

6 star dividend payer with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives