- Canada

- /

- Construction

- /

- TSX:WSP

The Bull Case For WSP Global (TSX:WSP) Could Change Following Upbeat 2025 Guidance and Dividend Affirmation – Learn Why

Reviewed by Sasha Jovanovic

- Earlier this month, WSP Global Inc. reported third-quarter and nine-month 2025 results, showing significant year-over-year increases in sales and net income, and raised its full-year 2025 revenue guidance to a range of $13.8 billion to $14.0 billion, up from its prior outlook of $13.5 billion to $14.0 billion.

- Alongside these strong results, WSP Global’s Board affirmed its quarterly dividend, providing an additional signal of confidence in the company’s financial position and cash flow generation.

- We'll examine how WSP Global's upward revision to its 2025 earnings guidance may impact the company's investment narrative and outlook.

The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

WSP Global Investment Narrative Recap

To be a WSP Global shareholder, you need to believe that rising demand for sustainable and digital infrastructure translates into persistent revenue and earnings growth, despite integration risks associated with ongoing acquisitions. The company’s upward revision to 2025 revenue guidance and strong recent earnings suggest continued business momentum but do not fundamentally alter the most immediate catalyst: the pace of new project wins tied to public sector investment. Integration challenges from recent M&A activity remain the key risk in the short term, and recent results do not materially mitigate this concern.

The most relevant recent announcement is WSP Global’s decision to raise its revenue guidance for 2025. This move, coming on the heels of robust third-quarter sales and income growth, adds weight to the view that major infrastructure spending and project backlogs are still powering the business’s short-term outlook. However, much of this optimism continues to hinge on sustainable execution and smooth onboarding of newly acquired firms.

By contrast, investors should be aware that even with this upbeat guidance, lingering integration risks from recent acquisitions could still...

Read the full narrative on WSP Global (it's free!)

WSP Global's outlook anticipates CA$16.3 billion in revenue and CA$1.6 billion in earnings by 2028. This is based on a forecast annual revenue decline of 2.4% and an earnings increase of CA$806 million from the current CA$794 million.

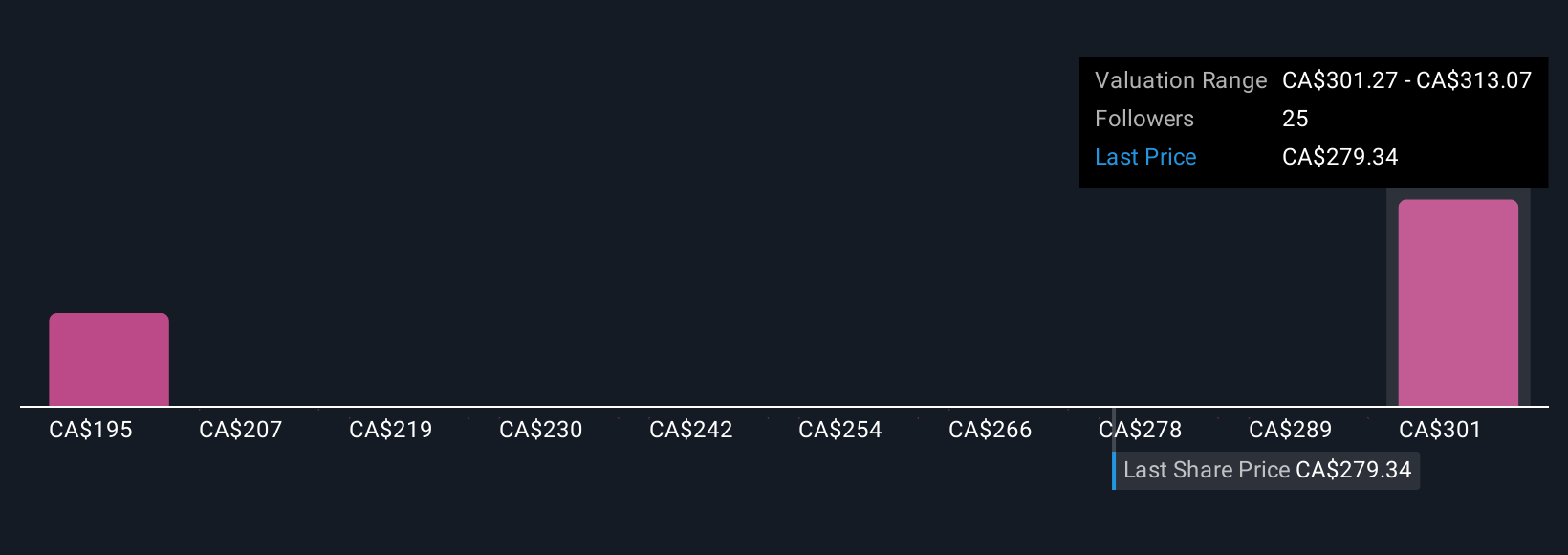

Uncover how WSP Global's forecasts yield a CA$320.14 fair value, a 26% upside to its current price.

Exploring Other Perspectives

Four individual WSP Global fair value estimates from the Simply Wall St Community span from CA$168.76 to CA$320.14, a difference of over CA$150, capturing widely divergent views. As you consider these perspectives, keep in mind that the company’s growth remains strongly linked to government infrastructure budgets, which could affect revenue streams and overall business resilience.

Explore 4 other fair value estimates on WSP Global - why the stock might be worth as much as 26% more than the current price!

Build Your Own WSP Global Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WSP Global research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free WSP Global research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WSP Global's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WSP Global might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WSP

WSP Global

Operates as a professional services consulting firm in the United States, Canada, the United Kingdom, Sweden, Australia, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives