- Canada

- /

- Construction

- /

- TSX:STN

Stantec (TSX:STN): Exploring Valuation After 40% Year-to-Date Share Price Surge

Reviewed by Simply Wall St

Stantec (TSX:STN) has quietly continued to turn heads among investors thanks to another steady month of gains, bringing its year-to-date return to just over 40%. The stock’s performance is drawing attention, especially given the broader volatility in the capital goods sector.

See our latest analysis for Stantec.

Stantec’s share price has climbed steadily this year, with recent gains pushing its year-to-date return to 40%. This reflects both strong operational momentum and growing investor optimism around its long-term prospects. The company’s one-year total shareholder return of 41% also signals that confidence has been rewarded for those who have stuck with the stock.

If you’re looking to spot more companies seeing similar positive momentum, now is an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

With the stock's impressive returns making headlines, the big question now is whether Stantec's growth potential remains undervalued, or if the market has already factored in all future upside and left little room for buyers to benefit.

Most Popular Narrative: 3.4% Undervalued

Stantec's widely-followed fair value is set just above the latest closing price, sparking debate over whether the recent run has more to go. With only a small gap separating consensus valuation from where shares currently trade, future expectations are in sharp focus as analysts weigh long-term prospects against short-term price moves.

Ongoing investment in digital transformation, including broad deployment of AI tools and advanced analytics, plus the expansion of global delivery centers (Pune), is expected to deliver continued SG&A leverage, efficiency gains, and long-term EBITDA margin enhancement.

Curious what’s powering analyst confidence? The key behind this price estimate is a forecast of boosted margins, digital innovation, and bold growth targets. Want to know the one financial projection that most shapes the valuation? Don’t miss the deep dive to see what really tips the scale in Stantec’s fair value calculation.

Result: Fair Value of $164.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, such as ongoing integration challenges from recent acquisitions and possible shifts in government infrastructure funding. These factors could pressure future growth.

Find out about the key risks to this Stantec narrative.

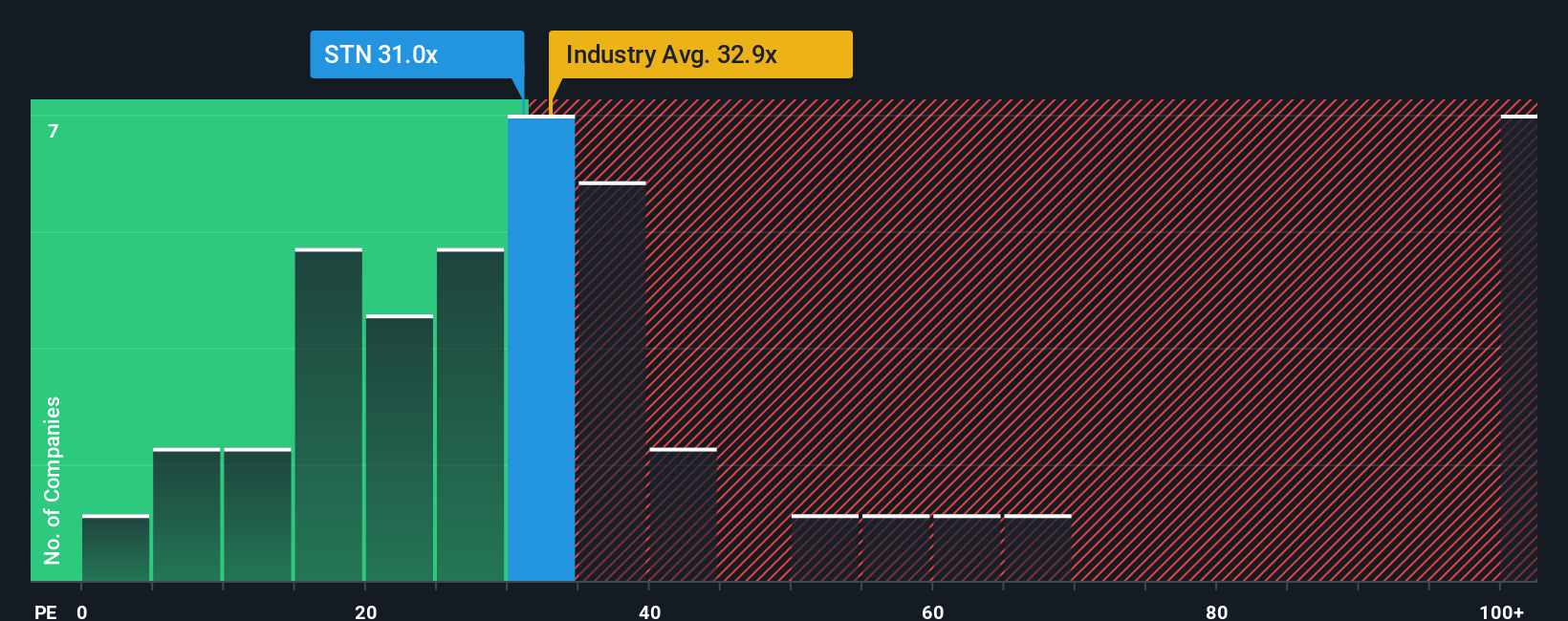

Another View: Multiples Tell a Different Story

Looking at Stantec’s price-to-earnings ratio, a different perspective emerges. At 41.5x earnings, the stock is much pricier than its peer average of 24.7x, the industry average of 35.3x, and its estimated fair ratio of 24.3x. This steep premium raises questions about valuation risk, even amid strong recent growth. Are investors paying too much for momentum?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Stantec Narrative

If you see the numbers differently or want to dig deeper yourself, you can explore the data and craft your own perspective in just minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Stantec.

Looking for more investment ideas?

Take charge of your portfolio’s potential by tapping into investment opportunities most investors overlook. Don’t let tomorrow’s best performers slip through your fingers.

- Target generous income streams when you check out these 17 dividend stocks with yields > 3%. This selection features companies with reliable yields above 3%.

- Spot undervalued potential early and capitalize on these 877 undervalued stocks based on cash flows to find stocks trading below their intrinsic value based on cash flows.

- Ride the AI wave by joining these 24 AI penny stocks for exposure to pioneers shaping the future with breakthrough artificial intelligence technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:STN

Stantec

Provides professional services in the areas of infrastructure and facilities to the public and private sectors in Canada, the United States, and internationally.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion