- Canada

- /

- Metals and Mining

- /

- TSXV:WRLG

TSX Growth Companies With High Insider Ownership In December 2025

Reviewed by Simply Wall St

As the Canadian market navigates policy shifts and global uncertainties, the TSX stands out with its strongest calendar-year return since 2009, providing investors reasons to be thankful amidst a landscape often clouded by skepticism. In this context of robust equity gains, growth companies with high insider ownership present intriguing opportunities, as they often indicate strong alignment between management and shareholder interests—an important consideration for investors seeking resilience in volatile markets.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Zedcor (TSXV:ZDC) | 19.2% | 122.6% |

| West Red Lake Gold Mines (TSXV:WRLG) | 11.1% | 78% |

| Stingray Group (TSX:RAY.A) | 22.8% | 33.9% |

| Robex Resources (TSXV:RBX) | 20.6% | 97.7% |

| Propel Holdings (TSX:PRL) | 30.6% | 32.1% |

| PowerBank (NEOE:SUNN) | 16.1% | 59% |

| goeasy (TSX:GSY) | 21.7% | 27.3% |

| Enterprise Group (TSX:E) | 35.7% | 33.8% |

| CEMATRIX (TSX:CEMX) | 10.5% | 58.3% |

| Almonty Industries (TSX:AII) | 12.1% | 63.4% |

We'll examine a selection from our screener results.

Savaria (TSX:SIS)

Simply Wall St Growth Rating: ★★★★☆☆

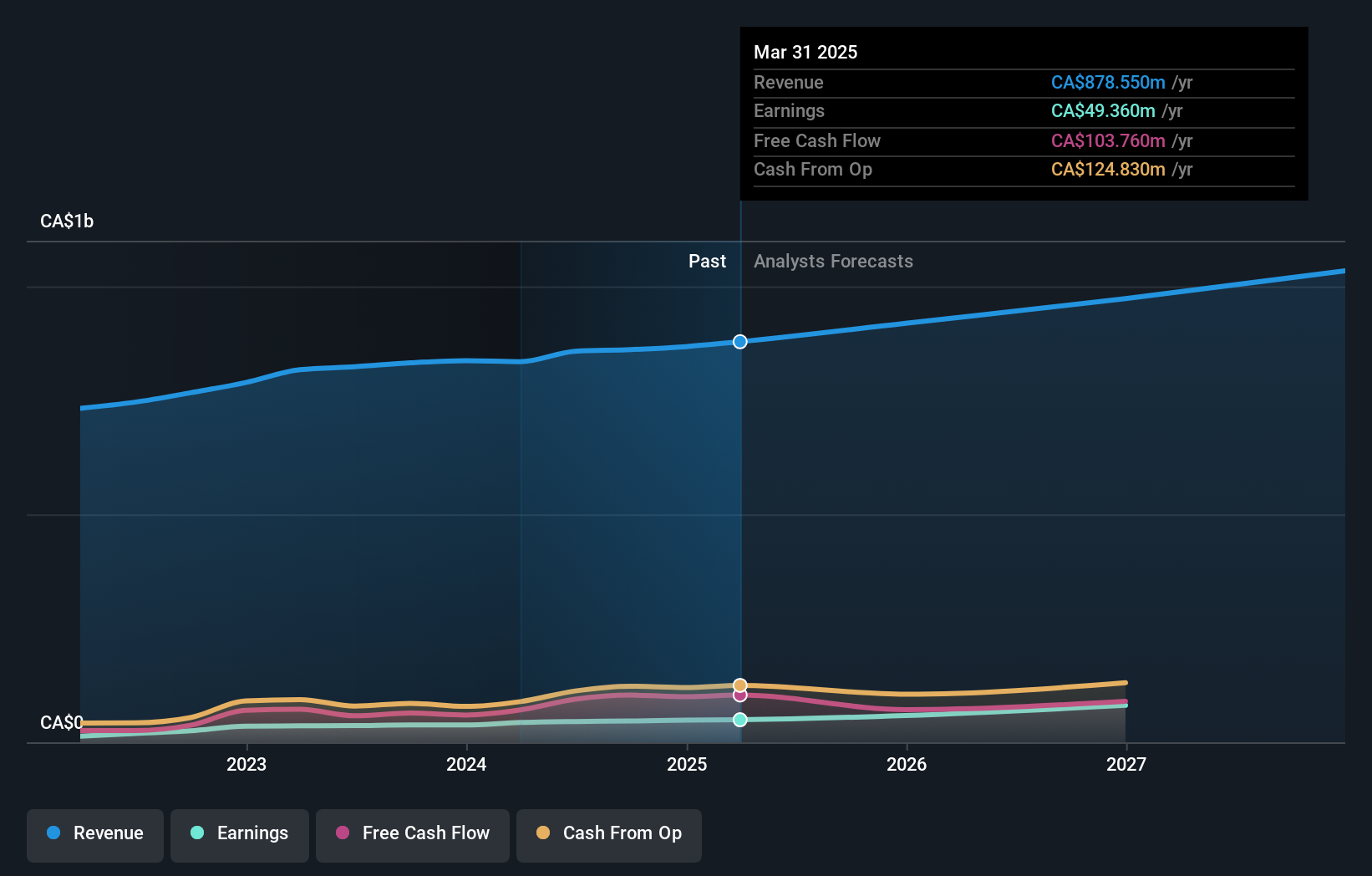

Overview: Savaria Corporation offers accessibility solutions for the elderly and physically challenged across Canada, the United States, Europe, and internationally with a market cap of CA$1.53 billion.

Operations: The company generates revenue from two main segments: Patient Care, which accounts for CA$197.90 million, and Accessibility (including Adapted Vehicles), contributing CA$697.19 million.

Insider Ownership: 17.3%

Savaria Corporation is experiencing significant earnings growth, forecasted at 29.5% annually, surpassing the Canadian market's average. Despite slower revenue growth at 5.8%, it remains above market expectations. The company maintains a reliable dividend yield of 2.63%. Recent financial results show improved net income and sales, while insider activity indicates substantial buying over selling in recent months. With $290 million available for acquisitions, Savaria aims to expand both organically and through strategic acquisitions.

- Unlock comprehensive insights into our analysis of Savaria stock in this growth report.

- Our valuation report unveils the possibility Savaria's shares may be trading at a discount.

Volatus Aerospace (TSXV:FLT)

Simply Wall St Growth Rating: ★★★★★☆

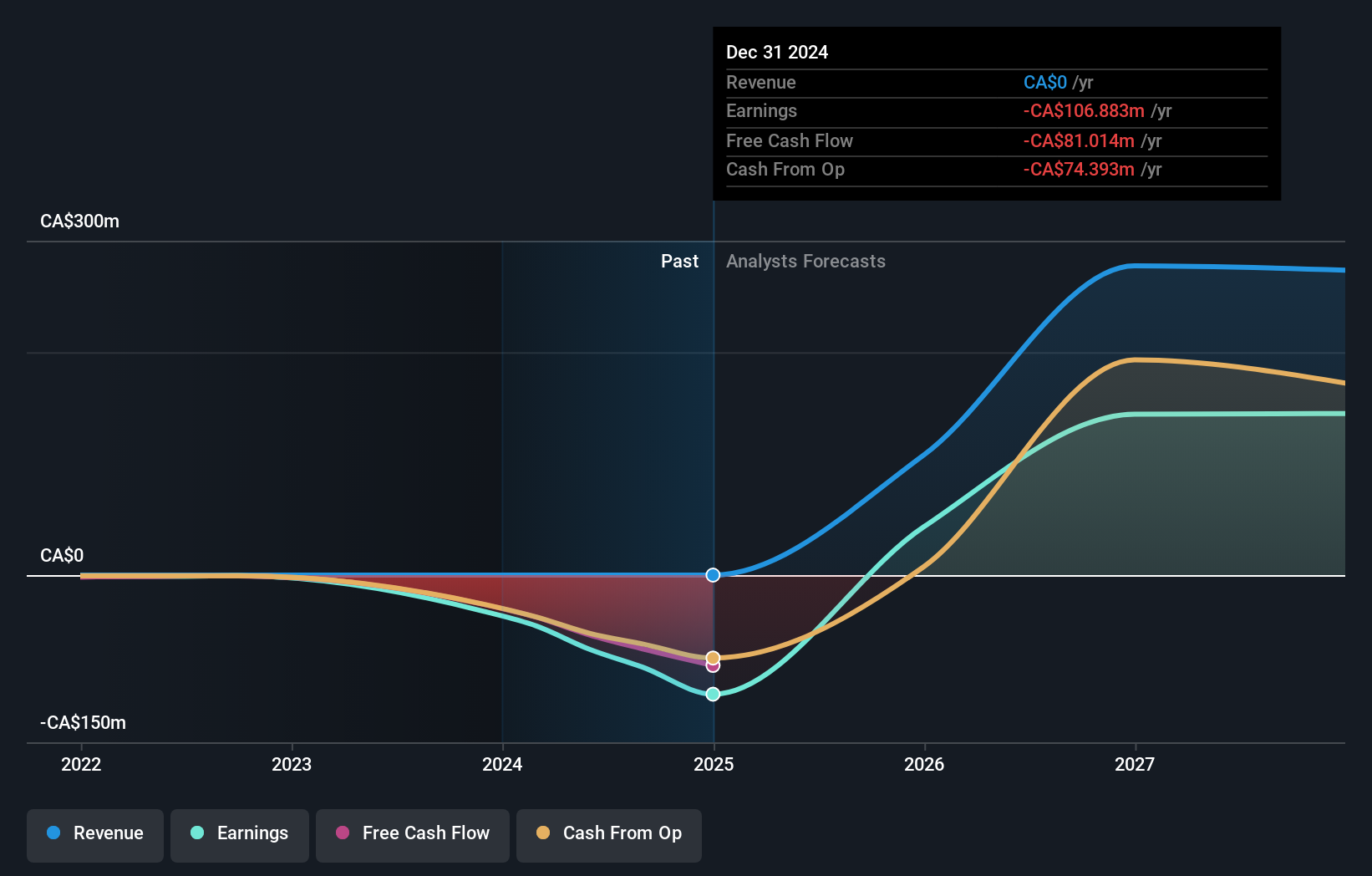

Overview: Volatus Aerospace Inc. offers integrated drone solutions across Canada, the United States, the United Kingdom, and Norway with a market cap of CA$413.04 million.

Operations: The company's revenue is primarily derived from its Aerospace & Defense segment, totaling CA$29.70 million.

Insider Ownership: 21.1%

Volatus Aerospace is trading significantly below its estimated fair value, with revenue expected to grow 34.8% annually, surpassing the Canadian market. Although recent equity offerings have diluted shareholders, these funds support strategic expansions like the Mirabel Innovation Centre for drone production. The company is poised to capitalize on defense and utility sectors through contracts and partnerships, such as a CAD 15 million utility inspection agreement and collaboration with VoltaXplore for domestic battery supply, enhancing its growth trajectory in Canada’s aerospace industry.

- Click here and access our complete growth analysis report to understand the dynamics of Volatus Aerospace.

- Upon reviewing our latest valuation report, Volatus Aerospace's share price might be too optimistic.

West Red Lake Gold Mines (TSXV:WRLG)

Simply Wall St Growth Rating: ★★★★★★

Overview: West Red Lake Gold Mines Ltd. is engaged in the acquisition, exploration, evaluation, and development of gold properties in Canada with a market cap of CA$356.69 million.

Operations: West Red Lake Gold Mines Ltd. does not report any revenue segments in its financial disclosures.

Insider Ownership: 11.1%

West Red Lake Gold Mines is positioned for significant growth, with revenue expected to grow 65.3% annually, outpacing the Canadian market. Despite past shareholder dilution, insider ownership remains strong as the company advances its Madsen Mine and Fork Deposit projects in Ontario's Red Lake District. Recent developments include a fully funded infill drilling program and increased ore production at Madsen, which enhance its operational capabilities. The company's strategic focus on high-grade gold opportunities supports its robust growth outlook.

- Click here to discover the nuances of West Red Lake Gold Mines with our detailed analytical future growth report.

- The valuation report we've compiled suggests that West Red Lake Gold Mines' current price could be inflated.

Key Takeaways

- Take a closer look at our Fast Growing TSX Companies With High Insider Ownership list of 45 companies by clicking here.

- Interested In Other Possibilities? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if West Red Lake Gold Mines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:WRLG

West Red Lake Gold Mines

Acquires, explores, evaluates, and develops gold properties in Canada.

Exceptional growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026