- Canada

- /

- Trade Distributors

- /

- TSX:RCH

Shareholders Are Optimistic That Richelieu Hardware (TSE:RCH) Will Multiply In Value

What are the early trends we should look for to identify a stock that could multiply in value over the long term? Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. That's why when we briefly looked at Richelieu Hardware's (TSE:RCH) ROCE trend, we were very happy with what we saw.

Return On Capital Employed (ROCE): What Is It?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. The formula for this calculation on Richelieu Hardware is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.23 = CA$231m ÷ (CA$1.3b - CA$362m) (Based on the trailing twelve months to February 2023).

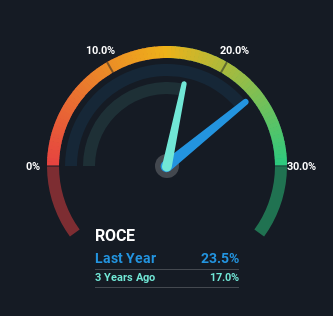

Therefore, Richelieu Hardware has an ROCE of 23%. That's a fantastic return and not only that, it outpaces the average of 19% earned by companies in a similar industry.

View our latest analysis for Richelieu Hardware

Above you can see how the current ROCE for Richelieu Hardware compares to its prior returns on capital, but there's only so much you can tell from the past. If you're interested, you can view the analysts predictions in our free report on analyst forecasts for the company.

SWOT Analysis for Richelieu Hardware

- Earnings growth over the past year exceeded the industry.

- Debt is well covered by earnings.

- Earnings growth over the past year is below its 5-year average.

- Dividend is low compared to the top 25% of dividend payers in the Trade Distributors market.

- Expensive based on P/E ratio and estimated fair value.

- RCH's financial characteristics indicate limited near-term opportunities for shareholders.

- Debt is not well covered by operating cash flow.

- Paying a dividend but company has no free cash flows.

What Does the ROCE Trend For Richelieu Hardware Tell Us?

We'd be pretty happy with returns on capital like Richelieu Hardware. The company has consistently earned 23% for the last five years, and the capital employed within the business has risen 120% in that time. Now considering ROCE is an attractive 23%, this combination is actually pretty appealing because it means the business can consistently put money to work and generate these high returns. You'll see this when looking at well operated businesses or favorable business models.

On another note, while the change in ROCE trend might not scream for attention, it's interesting that the current liabilities have actually gone up over the last five years. This is intriguing because if current liabilities hadn't increased to 27% of total assets, this reported ROCE would probably be less than23% because total capital employed would be higher.The 23% ROCE could be even lower if current liabilities weren't 27% of total assets, because the the formula would show a larger base of total capital employed. With that in mind, just be wary if this ratio increases in the future, because if it gets particularly high, this brings with it some new elements of risk.

The Key Takeaway

In the end, the company has proven it can reinvest it's capital at high rates of returns, which you'll remember is a trait of a multi-bagger. And since the stock has risen strongly over the last five years, it appears the market might expect this trend to continue. So even though the stock might be more "expensive" than it was before, we think the strong fundamentals warrant this stock for further research.

Like most companies, Richelieu Hardware does come with some risks, and we've found 2 warning signs that you should be aware of.

If you'd like to see other companies earning high returns, check out our free list of companies earning high returns with solid balance sheets here.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:RCH

Richelieu Hardware

Manufactures, imports, and distributes specialty hardware and complementary products in Canada and the United States.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success