Investors Still Aren't Entirely Convinced By NFI Group Inc.'s (TSE:NFI) Revenues Despite 35% Price Jump

Those holding NFI Group Inc. (TSE:NFI) shares would be relieved that the share price has rebounded 35% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Taking a wider view, although not as strong as the last month, the full year gain of 10% is also fairly reasonable.

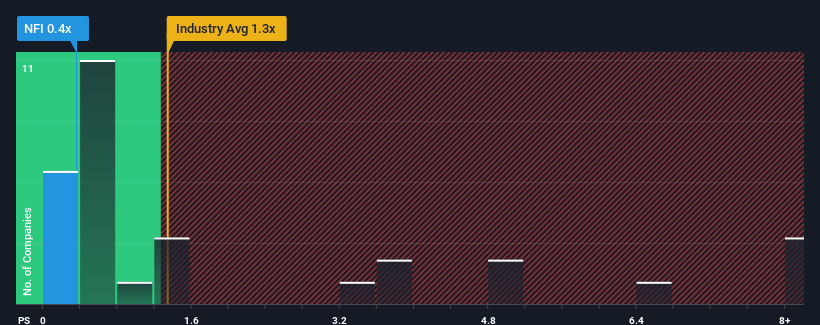

In spite of the firm bounce in price, it's still not a stretch to say that NFI Group's price-to-sales (or "P/S") ratio of 0.4x right now seems quite "middle-of-the-road" compared to the Machinery industry in Canada, where the median P/S ratio is around 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for NFI Group

What Does NFI Group's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, NFI Group has been doing relatively well. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on NFI Group.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, NFI Group would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 16% last year. The strong recent performance means it was also able to grow revenue by 33% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 25% during the coming year according to the five analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 8.3%, which is noticeably less attractive.

With this in consideration, we find it intriguing that NFI Group's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

NFI Group's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Looking at NFI Group's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

We don't want to rain on the parade too much, but we did also find 1 warning sign for NFI Group that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if NFI Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:NFI

NFI Group

Manufactures and sells buses in North America, the United Kingdom, rest of Europe, and the Asia Pacific.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives