Does GR Seating Joint Venture Signal a Supply Chain Edge for NFI Group (TSX:NFI)?

Reviewed by Sasha Jovanovic

- On October 22, 2025, NFI Group Inc. and GILLIG LLC announced they had formed a 50/50 joint venture called GR Seating, LLC, which acquired the key assets of American Seating Inc., a major supplier of transit seating, and committed to maintaining existing operations, workforce partnerships, and customer support in Grand Rapids, Michigan.

- This collaborative move secures a critical supply chain component for both companies, aiming to stabilize American Seating’s operations and boost overall reliability for transit industry customers.

- We'll examine how the strengthened control over supply chain components could influence NFI Group's investment narrative and growth outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

NFI Group Investment Narrative Recap

To believe in NFI Group as a shareholder, investors typically need to have confidence in the company’s ability to capitalize on secular tailwinds such as massive fleet electrification and a record multiyear backlog, while managing the ongoing risks tied to supply chain, debt, and competitive dynamics. The GR Seating joint venture may help secure a critical supply-chain link, which could support near-term operational stability and reliability, but its impact on the biggest catalyst, order conversion and delivery execution, will likely depend on seamless integration in the coming quarters. Short-term, continued leverage and margin risks remain at the forefront given persistent unprofitability and high debt load, while longer-term prospects depend on successfully capturing growth in zero-emission vehicles despite some orders favoring internal combustion engines. Among recent company announcements, NFI’s reaffirmed 2025 revenue guidance between US$3.8 billion and US$4.2 billion stands out as most relevant. This guidance is a direct indicator of management’s expectations for stable order flow, improved supply chain reliability, and execution on backlog, all of which are themes echoed in the recent joint venture event and could influence future margin recovery and earnings stabilization. In contrast, investors should be aware of the company’s high debt load, which may limit financial flexibility if...

Read the full narrative on NFI Group (it's free!)

NFI Group's narrative projects $5.8 billion in revenue and $118.8 million in earnings by 2028. This requires 21.5% yearly revenue growth and a $282.5 million increase in earnings from the current level of -$163.7 million.

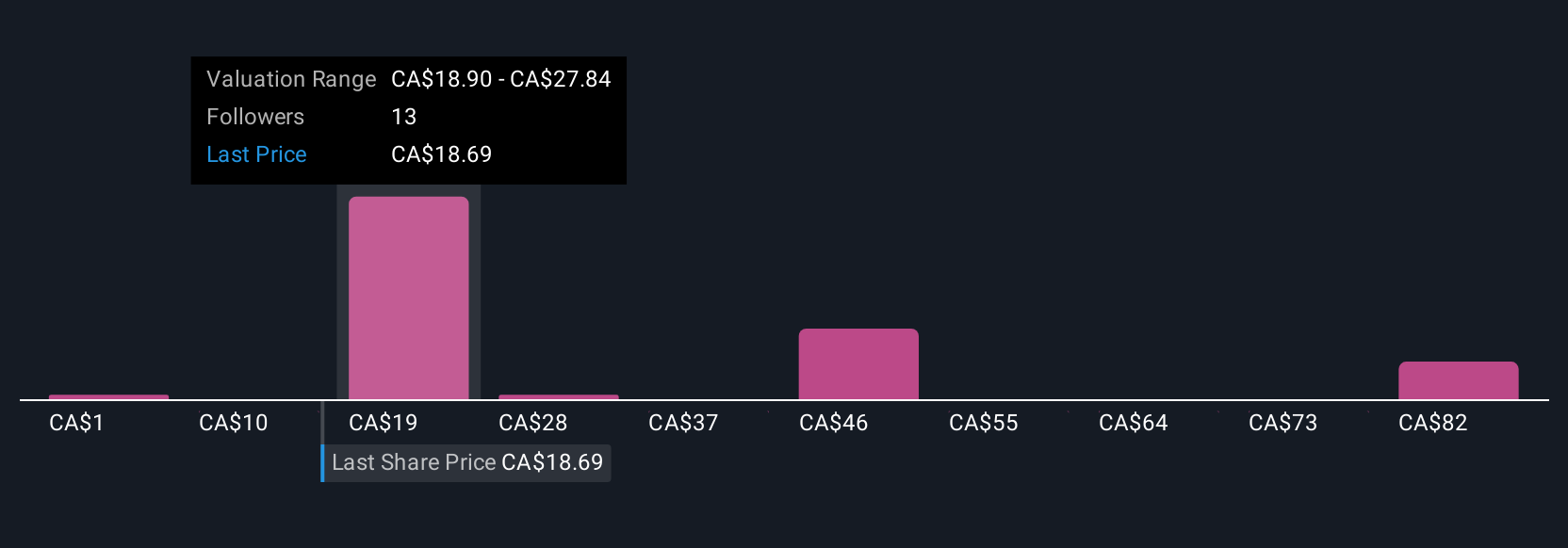

Uncover how NFI Group's forecasts yield a CA$22.35 fair value, a 60% upside to its current price.

Exploring Other Perspectives

Seven members of the Simply Wall St Community estimate NFI’s fair value from as low as CA$1 to as high as CA$108.56. With a supply chain recovery effort underway, readers should consider how execution risk may affect future outcomes, explore more viewpoints and decide where you fit in.

Explore 7 other fair value estimates on NFI Group - why the stock might be worth over 7x more than the current price!

Build Your Own NFI Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NFI Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NFI Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NFI Group's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NFI Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NFI

NFI Group

Manufactures and sells buses in North America, the United Kingdom, rest of Europe, and the Asia Pacific.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives