- Canada

- /

- Aerospace & Defense

- /

- TSX:MDA

MDA Space (TSX:MDA): Assessing Valuation After Maritime Launch Deal and New Spaceport Partnership

Reviewed by Simply Wall St

MDA Space (TSX:MDA) has invested $10 million in Maritime Launch Services, securing an equity stake and operational partnership in the Canadian company. This move sets the stage for building and operating Canada’s first commercial orbital launch site.

See our latest analysis for MDA Space.

This major investment comes after a turbulent stretch for MDA Space, with the share price dropping sharply, down 29% over the past month and 42.5% over the past three months. This decline has been primarily driven by sector uncertainty and news of major contract risks. Yet, despite short-term volatility, the stock’s one-year total shareholder return remains just in positive territory, and its three-year total shareholder return stands out at more than 312%, hinting at serious long-term growth potential.

If recent headlines about space infrastructure spark your curiosity, it’s a perfect moment to see what else is taking off in aerospace and defense. Take a look at See the full list for free.

With MDA Space’s new partnership and recent share price turbulence, investors are left wondering if the stock is trading at a bargain ahead of future growth or if the market has already accounted for what is next.

Most Popular Narrative: 42% Undervalued

According to IndusyHoldings, the latest narrative sets MDA Space's fair value far above the recent closing price. This suggests the market might not fully capture the company’s long-term earnings potential, fueling debate over whether investors are missing out.

*The space industry is currently experiencing strong growth and is expected to grow by an average of 9% per year until 2035. MDA Space can benefit greatly from the tailwind of the industry as they offer a wide product range that includes LEO and MEO satellites, space robots and space rovers.*

Want to know the engine behind this bold valuation? The narrative hints at sky-high growth rates, ambitious industry trends, and a diverse revenue stream. What surprise forecasts push that fair value so high? Find out what is propelling MDA Space’s potential in the full narrative.

Result: Fair Value of $44.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, around a third of MDA Space’s revenue depends on government contracts. Delays to major programs like Artemis could quickly affect earnings.

Find out about the key risks to this MDA Space narrative.

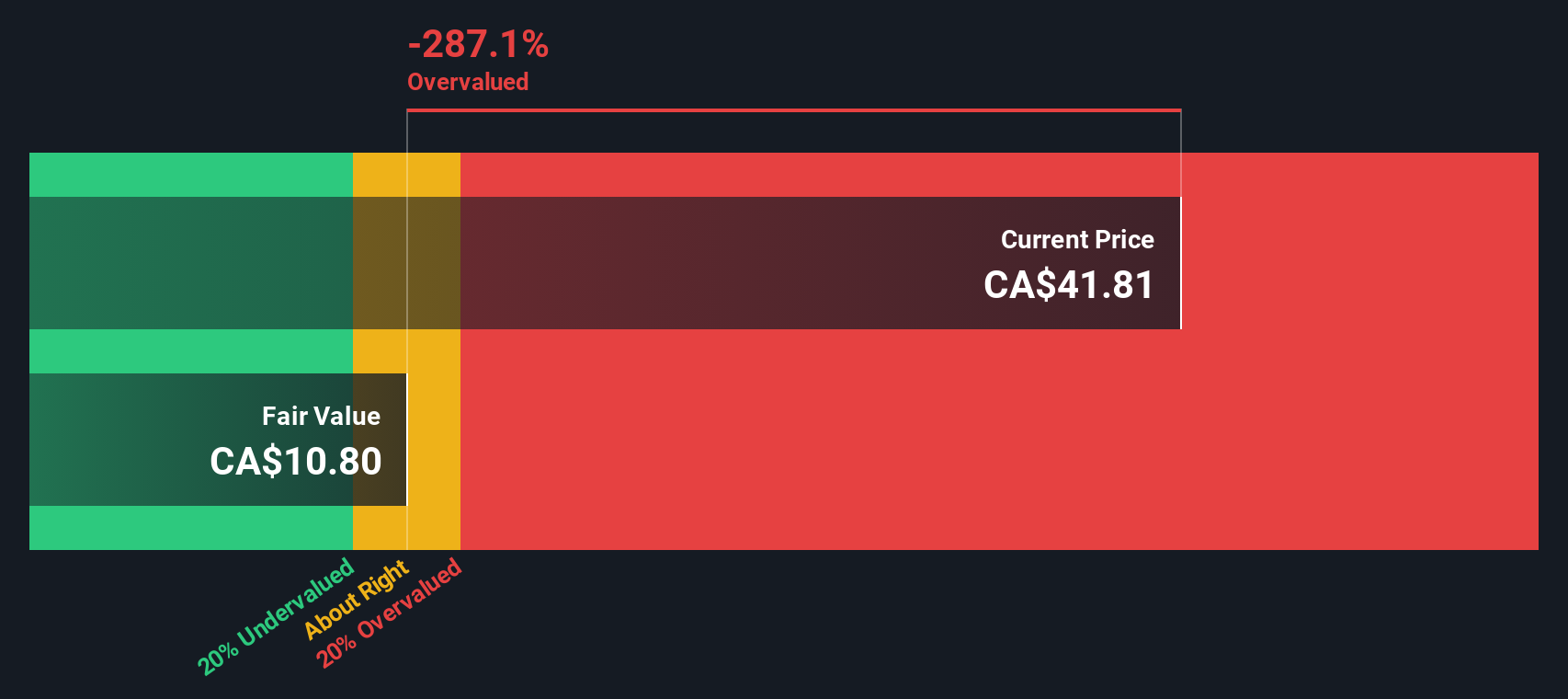

Another View: Discounted Cash Flow Perspective

To challenge the fair value narrative, our SWS DCF model looks at future cash flows and arrives at a far lower estimate for MDA Space, at just CA$4.34 per share. That suggests the current market price could be well above what fundamentals justify. Which story should investors believe?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out MDA Space for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 849 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own MDA Space Narrative

If you have your own take on MDA Space or want to dig into the details, you can craft a custom narrative in just a few minutes. Do it your way

A great starting point for your MDA Space research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your search to one sector. There are untapped opportunities waiting for investors who are ready to act before the crowd catches on. Use these smart screeners to spot stocks with a competitive edge, robust cash flows, or standout innovation:

- Maximize your returns by checking out these 849 undervalued stocks based on cash flows, which is packed with companies trading below their true worth.

- Tap into unstoppable trends with these 26 AI penny stocks, featuring firms driving breakthroughs in artificial intelligence.

- Boost your income stream by exploring these 20 dividend stocks with yields > 3%, with yields above 3% for reliable passive gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MDA

MDA Space

Provides space technology solutions and in Canada, the United States, Europe, Asia, the Middle East, and internationally.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives