- Canada

- /

- Renewable Energy

- /

- TSX:MXG

3 Canadian Undiscovered Gems With Promising Potential

Reviewed by Simply Wall St

As the Canadian market navigates the uncertainties surrounding new U.S. policies on tariffs and energy, the TSX index has shown resilience, buoyed by a solid economic backdrop and potential interest rate adjustments from the Bank of Canada. In this environment, identifying stocks with strong fundamentals and growth potential becomes crucial for investors seeking opportunities amidst broader market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TWC Enterprises | 6.24% | 12.63% | 23.89% | ★★★★★★ |

| Reconnaissance Energy Africa | NA | 9.16% | 15.11% | ★★★★★★ |

| Minsud Resources | NA | nan | -29.01% | ★★★★★★ |

| Lithium Chile | NA | nan | 42.01% | ★★★★★★ |

| Maxim Power | 25.01% | 12.79% | 17.14% | ★★★★★☆ |

| Mako Mining | 10.21% | 38.44% | 58.78% | ★★★★★☆ |

| Grown Rogue International | 24.92% | 19.37% | 188.55% | ★★★★★☆ |

| Corby Spirit and Wine | 65.79% | 7.46% | -5.76% | ★★★★☆☆ |

| Petrus Resources | 19.44% | 17.20% | 46.03% | ★★★★☆☆ |

| Dundee | 3.76% | -37.57% | 44.64% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Héroux-Devtek (TSX:HRX)

Simply Wall St Value Rating: ★★★★★★

Overview: Héroux-Devtek Inc. specializes in the design, development, manufacture, and repair of aircraft landing gears and related components, with a market cap of approximately CA$1.09 billion.

Operations: Héroux-Devtek generates revenue primarily from its aerospace segment, amounting to CA$694.73 million. The company's market cap is approximately CA$1.09 billion.

Héroux-Devtek, a notable player in the Aerospace & Defense sector, has demonstrated impressive financial resilience. Recent earnings showed net income at C$9.96 million for Q2 2024, up from C$4.63 million the previous year, with sales climbing to C$173.16 million from C$141.5 million. The company's debt management is commendable with a net debt to equity ratio of 26.5%, down from 58.9% over five years, and interest payments well covered by EBIT at 5.4x coverage. Trading significantly below its estimated fair value suggests potential upside for investors eyeing growth opportunities in this space.

- Take a closer look at Héroux-Devtek's potential here in our health report.

Assess Héroux-Devtek's past performance with our detailed historical performance reports.

Maxim Power (TSX:MXG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Maxim Power Corp. is an independent power producer that focuses on acquiring, developing, owning, and operating power and power-related projects in Alberta, Canada with a market cap of CA$388.53 million.

Operations: Maxim Power generates revenue primarily from its power generation facilities, amounting to CA$116.42 million. The company's financial performance is highlighted by a focus on optimizing its operations within the Alberta region.

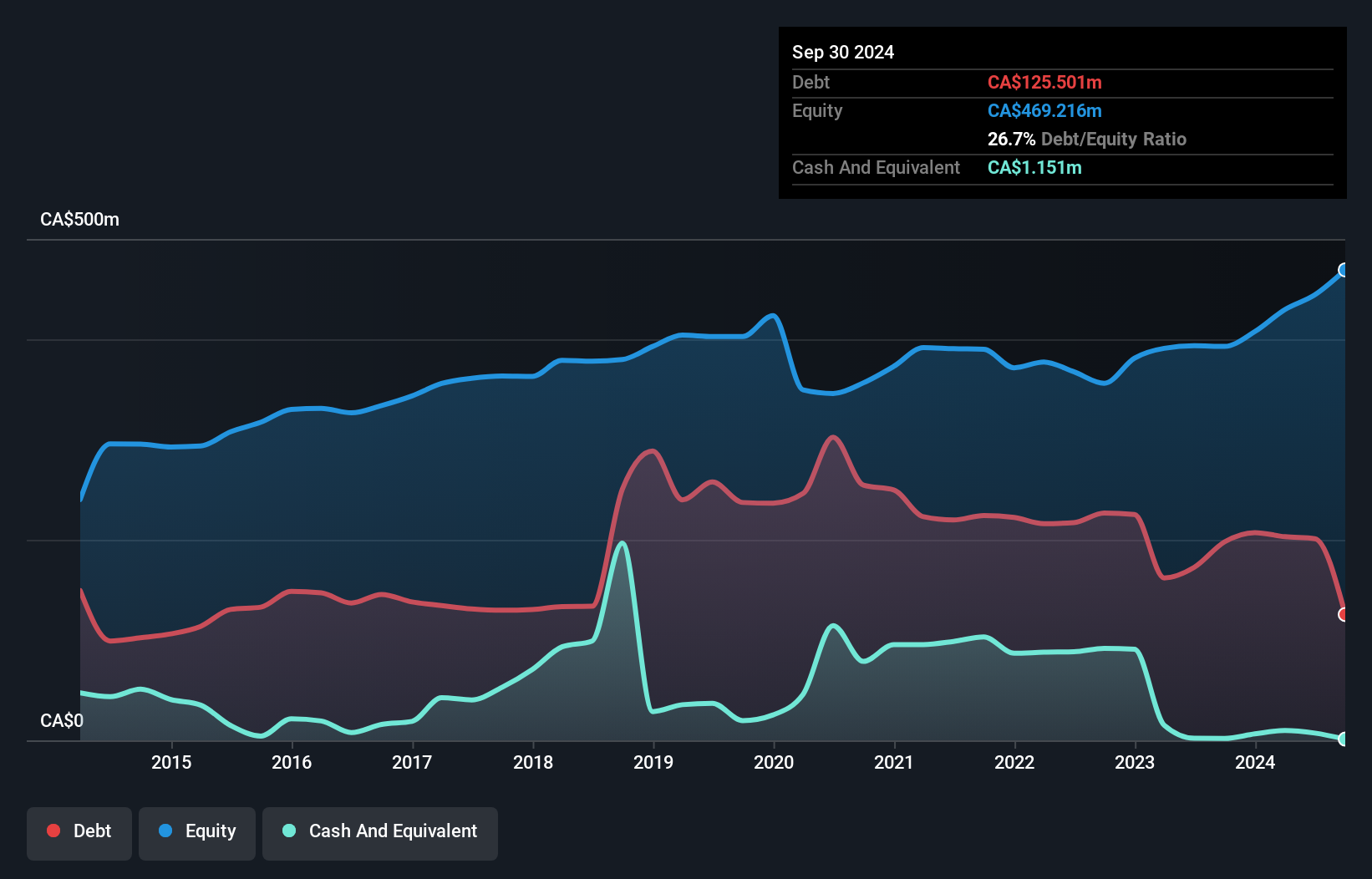

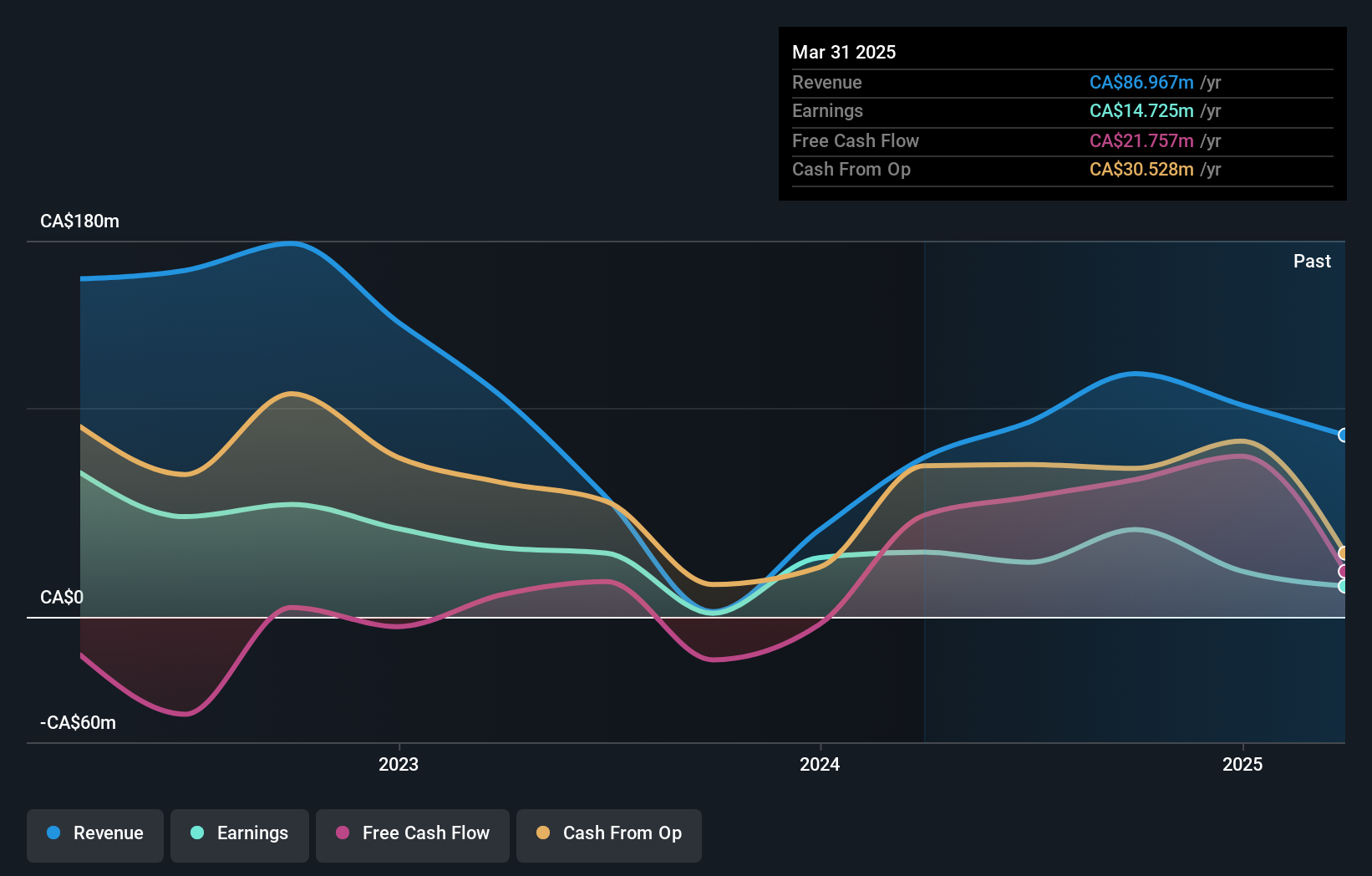

Maxim Power has shown impressive growth, with earnings surging by 2412.9% over the past year, far outpacing the Renewable Energy industry's 0.6%. The company's net profit margin sits at 35.9%, down from last year's 67.3%, indicating some volatility despite strong performance. Its price-to-earnings ratio of 9.5x presents a good value against the Canadian market average of 15x, while interest payments are well covered with EBIT at seven times the debt repayments. Recent activities include a special dividend of CA$0.50 per share and repurchasing shares worth CA$0.04 million, reflecting strategic financial management decisions amidst significant insider selling in recent months.

- Dive into the specifics of Maxim Power here with our thorough health report.

Gain insights into Maxim Power's historical performance by reviewing our past performance report.

North West (TSX:NWC)

Simply Wall St Value Rating: ★★★★★★

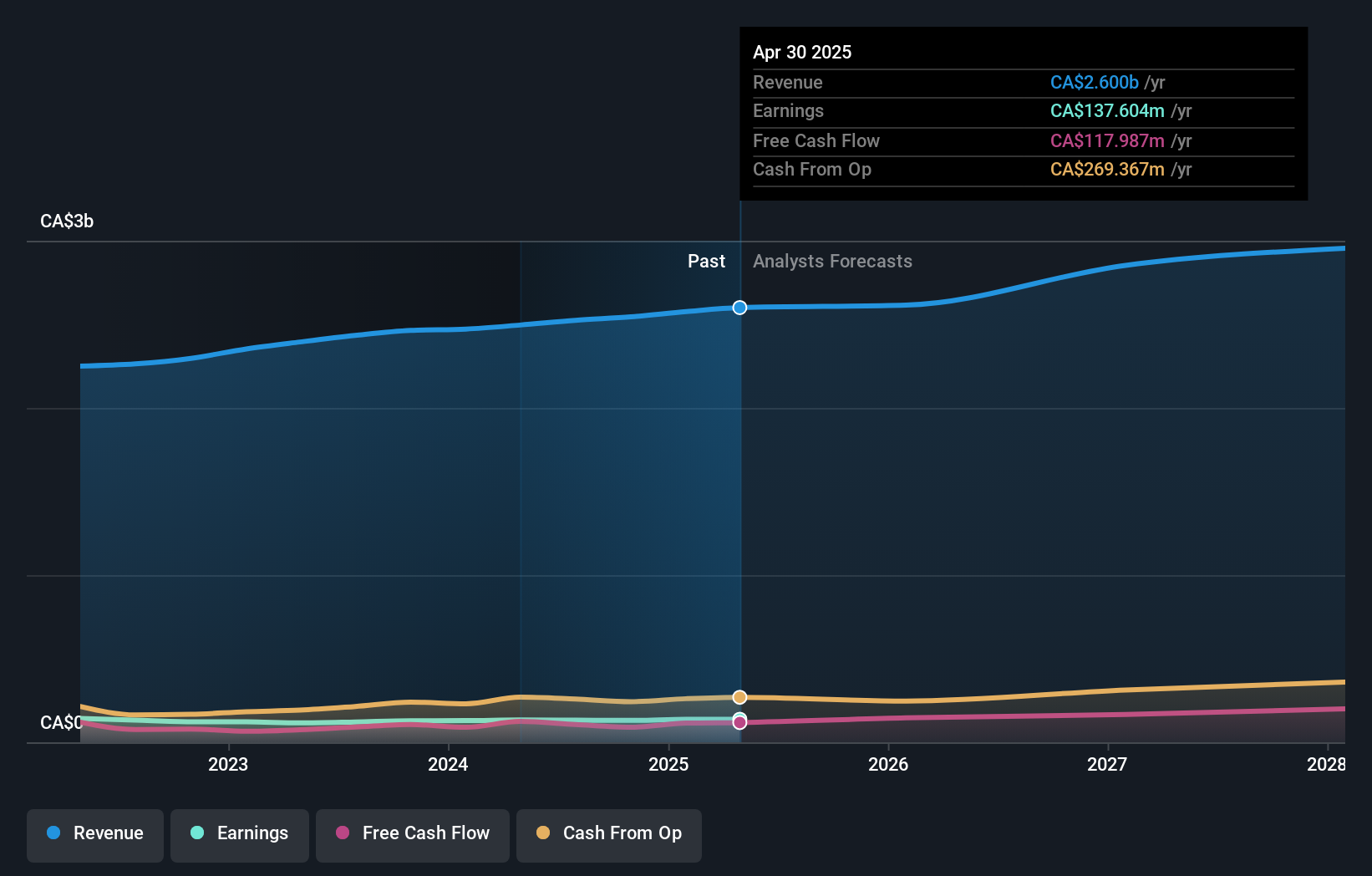

Overview: The North West Company Inc. operates as a retailer of food and everyday products and services, serving rural communities and urban neighborhood markets in northern Canada, rural Alaska, the South Pacific, and the Caribbean with a market cap of CA$2.27 billion.

Operations: North West generates revenue of CA$2.54 billion from retailing food and everyday products and services.

North West, a notable player in the retail sector, is showcasing solid performance metrics. Its net debt to equity ratio stands at a satisfactory 33.5%, reflecting prudent financial management over the years as it decreased from 100.8% to 42.3%. The company's earnings grew by 1.4% last year, outperforming the industry average of -11.5%. Recent figures reveal third-quarter sales of C$637 million, with net income slightly dipping to C$35 million compared to last year's C$37 million. Despite this dip, North West trades at an attractive value, estimated at 56.6% below its fair value estimate and maintains high-quality earnings with interest payments well covered by EBIT at a multiple of 10.8x.

- Click to explore a detailed breakdown of our findings in North West's health report.

Understand North West's track record by examining our Past report.

Key Takeaways

- Gain an insight into the universe of 47 TSX Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MXG

Maxim Power

An independent power producer, develops, owns, and operates power and power related projects in Canada.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)