- Canada

- /

- Trade Distributors

- /

- TSX:FTT

What Finning International Inc.'s (TSE:FTT) 28% Share Price Gain Is Not Telling You

Finning International Inc. (TSE:FTT) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. Taking a wider view, although not as strong as the last month, the full year gain of 13% is also fairly reasonable.

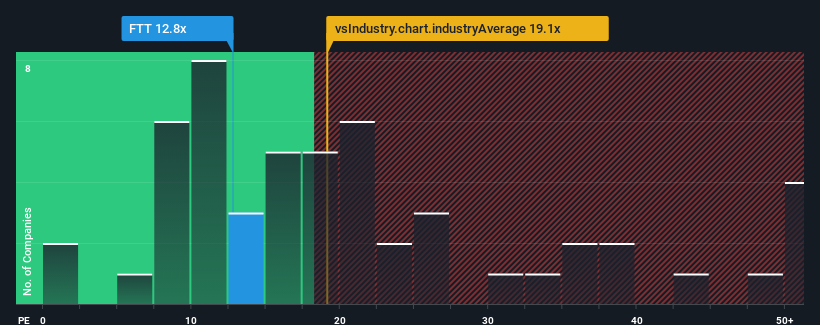

Although its price has surged higher, you could still be forgiven for feeling indifferent about Finning International's P/E ratio of 12.8x, since the median price-to-earnings (or "P/E") ratio in Canada is also close to 14x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Our free stock report includes 1 warning sign investors should be aware of before investing in Finning International. Read for free now.For example, consider that Finning International's financial performance has been pretty ordinary lately as earnings growth is non-existent. One possibility is that the P/E is moderate because investors think this benign earnings growth rate might not be enough to outperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Finning International

How Is Finning International's Growth Trending?

In order to justify its P/E ratio, Finning International would need to produce growth that's similar to the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period has seen an excellent 57% overall rise in EPS, in spite of its uninspiring short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 20% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

In light of this, it's curious that Finning International's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Key Takeaway

Finning International appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Finning International currently trades on a higher than expected P/E since its recent three-year growth is lower than the wider market forecast. Right now we are uncomfortable with the P/E as this earnings performance isn't likely to support a more positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Finning International that you should be aware of.

Of course, you might also be able to find a better stock than Finning International. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:FTT

Finning International

Sells, services, and rents heavy equipment, engines, and related products in Canada, Chile, the United Kingdom, Argentina, and internationally.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives