- Canada

- /

- Electrical

- /

- TSX:ELVA

If You Had Bought Electrovaya (TSE:EFL) Shares A Year Ago You'd Have Earned 629% Returns

For many, the main point of investing in the stock market is to achieve spectacular returns. When you buy and hold the right company, the returns can make a huge difference to both you and your family. For example, Electrovaya Inc. (TSE:EFL) has generated a beautiful 629% return in just a single year. On top of that, the share price is up 51% in about a quarter. And shareholders have also done well over the long term, with an increase of 159% in the last three years.

It really delights us to see such great share price performance for investors.

See our latest analysis for Electrovaya

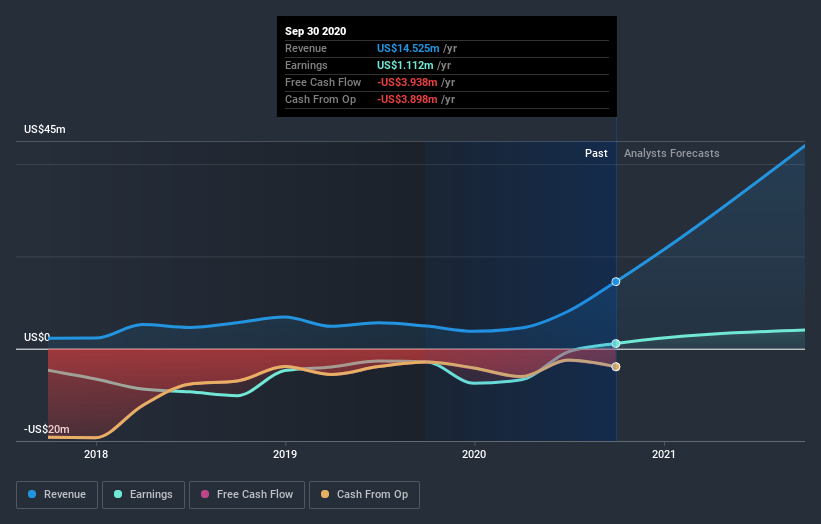

We don't think that Electrovaya's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Over the last twelve months, Electrovaya's revenue grew by 198%. That's a head and shoulders above most loss-making companies. But the share price seems headed to the moon, up 629% as previously highlighted. Despite the strong growth, it's certainly possible the market has gotten a little over-excited. But if the share price does moderate a bit, there might be an opportunity for high growth investors.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So it makes a lot of sense to check out what analysts think Electrovaya will earn in the future (free profit forecasts).

A Different Perspective

It's good to see that Electrovaya has rewarded shareholders with a total shareholder return of 629% in the last twelve months. That's better than the annualised return of 16% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Electrovaya is showing 4 warning signs in our investment analysis , and 1 of those is a bit unpleasant...

Electrovaya is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you’re looking to trade Electrovaya, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Electrovaya might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:ELVA

Electrovaya

Engages in the design, development, manufacture, and sale of lithium-ion batteries, battery management systems, and battery-related products for energy storage, clean electric transportation, and other specialized applications in North America.

High growth potential with acceptable track record.