- Canada

- /

- Trade Distributors

- /

- TSX:E

Enterprise Group And 2 Other TSX Penny Stocks To Consider

Reviewed by Simply Wall St

As the Canadian market navigates a noisy end to 2025 with a constructive outlook for 2026, investors are keenly observing the potential shifts in market leadership and portfolio positioning. In this context, penny stocks—often representing smaller or newer companies—offer an intriguing mix of affordability and growth potential when backed by strong financials. Despite being seen as a relic of past trading days, these stocks continue to provide opportunities for investors looking to uncover hidden value in quality companies.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.10 | CA$53.09M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$21.61M | ✅ 2 ⚠️ 2 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.26 | CA$246.67M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.16 | CA$116.92M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.465 | CA$3.88M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.345 | CA$51.82M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.30 | CA$864.89M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.18 | CA$23.39M | ✅ 2 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.03 | CA$153.69M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.96 | CA$185.47M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 394 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Enterprise Group (TSX:E)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Enterprise Group, Inc. operates as an equipment rental and construction services company in Canada with a market cap of CA$117.66 million.

Operations: The company generates revenue of CA$33.84 million from its operations in Canada.

Market Cap: CA$117.66M

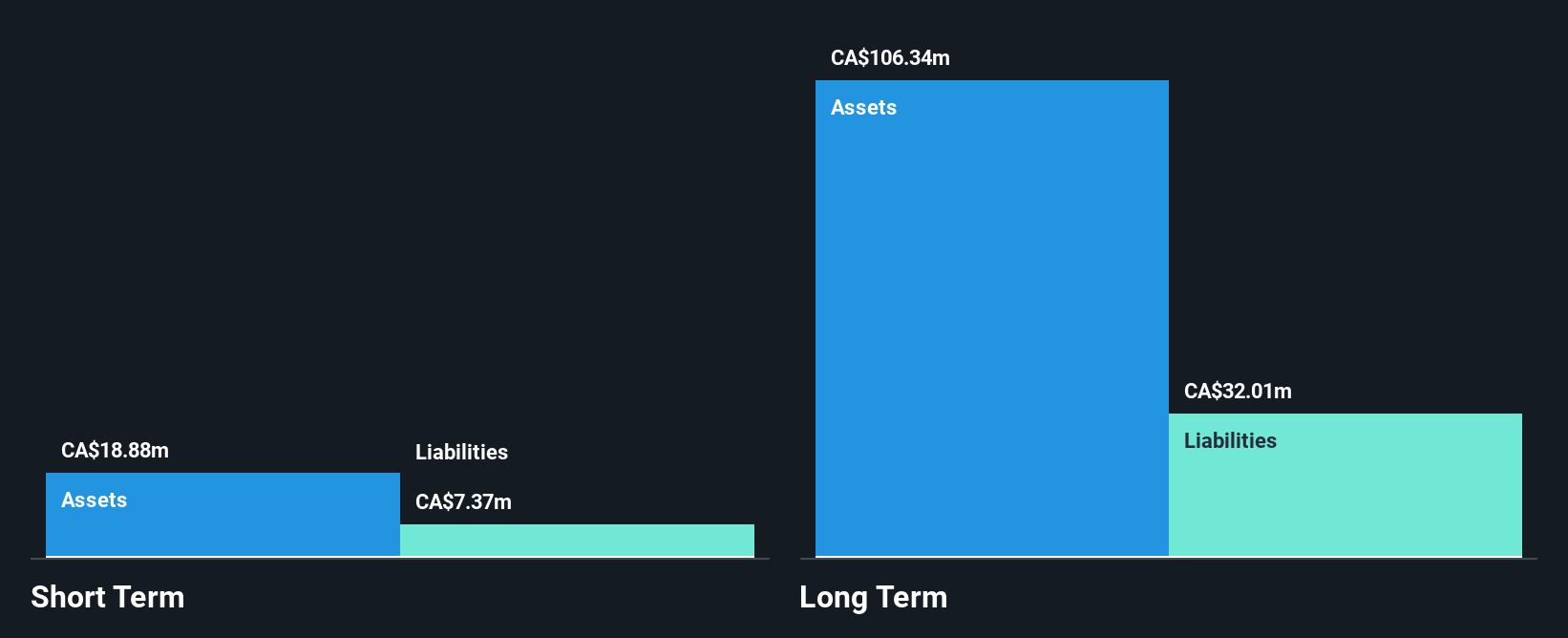

Enterprise Group has shown profitability over the past five years, with a notable earnings growth rate of 58.6% annually. However, recent performance has been less favorable, with negative earnings growth of 42.2% in the past year and declining net profit margins from 16.8% to 10.5%. The company's short-term assets cover its short-term liabilities but fall short for long-term obligations. Despite these challenges, Enterprise's debt is well-covered by operating cash flow and analysts forecast a significant annual earnings growth of 33.84%. Recent quarterly results indicate improved sales and a return to profitability compared to last year’s losses.

- Click to explore a detailed breakdown of our findings in Enterprise Group's financial health report.

- Gain insights into Enterprise Group's outlook and expected performance with our report on the company's earnings estimates.

illumin Holdings (TSX:ILLM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: illumin Holdings Inc. is a technology company that offers digital media solutions across various regions including the United States, Canada, Europe, and Latin America, with a market cap of CA$57.84 million.

Operations: The company generates CA$150.37 million in revenue from its Internet Information Providers segment.

Market Cap: CA$57.84M

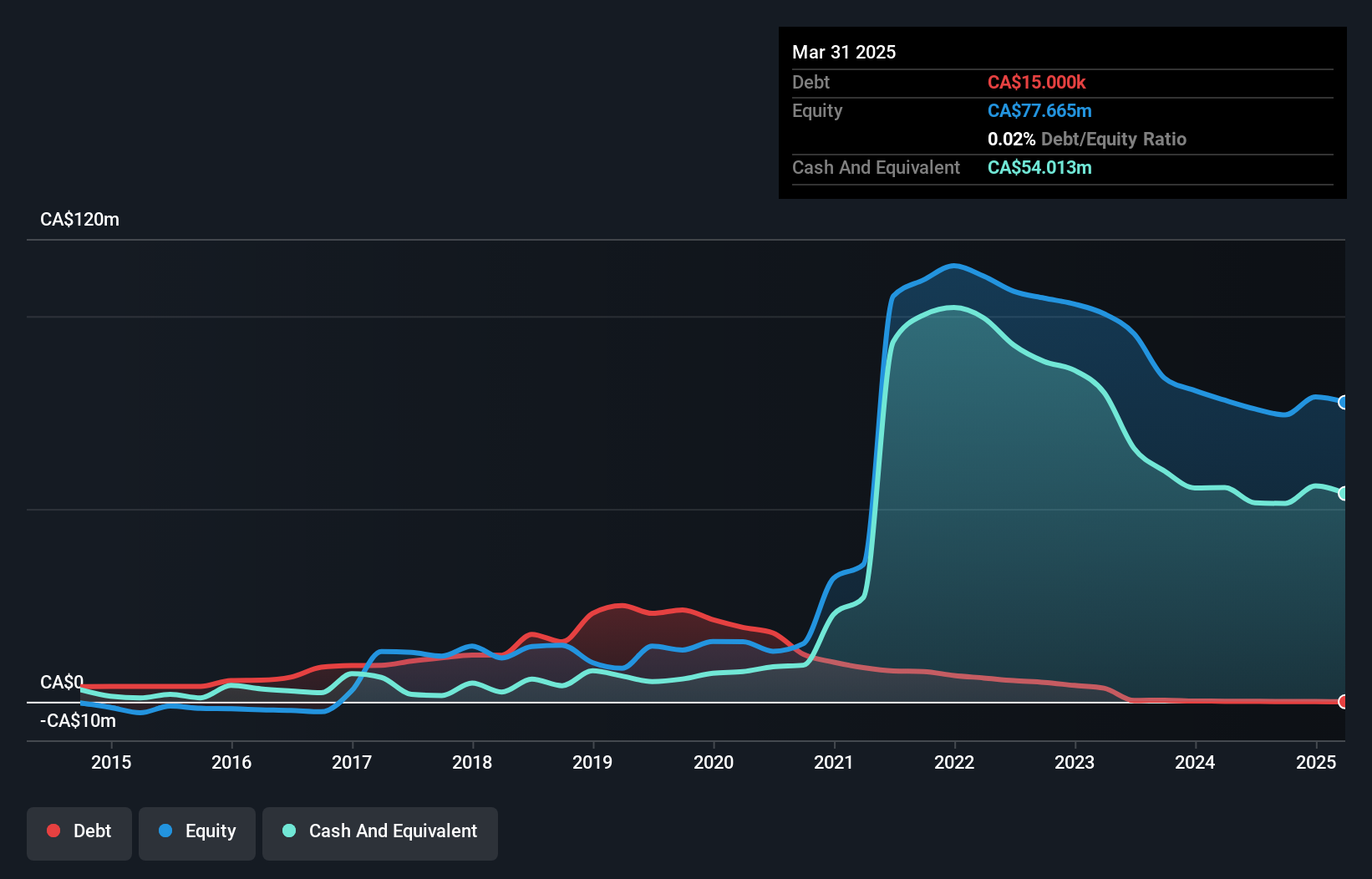

illumin Holdings Inc. has demonstrated a strong market presence with CA$150.37 million in revenue, primarily from its Internet Information Providers segment, despite being unprofitable with increasing losses over the past five years. The company recently reported third-quarter sales of CA$38.24 million but faced a net loss of CA$2.15 million, highlighting ongoing financial challenges. However, illumin's robust cash runway exceeding three years and debt-free status provide stability amidst volatility. Recent strategic moves include share buybacks and leadership changes aimed at enhancing global sales efforts and expanding partnerships across key markets like North America and Europe.

- Take a closer look at illumin Holdings' potential here in our financial health report.

- Examine illumin Holdings' earnings growth report to understand how analysts expect it to perform.

Progressive Planet Solutions (TSXV:PLAN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Progressive Planet Solutions Inc., along with its subsidiaries, focuses on acquiring and exploring mineral properties in Canada and the United States, with a market cap of CA$36.77 million.

Operations: There are no reported revenue segments for Progressive Planet Solutions Inc.

Market Cap: CA$36.77M

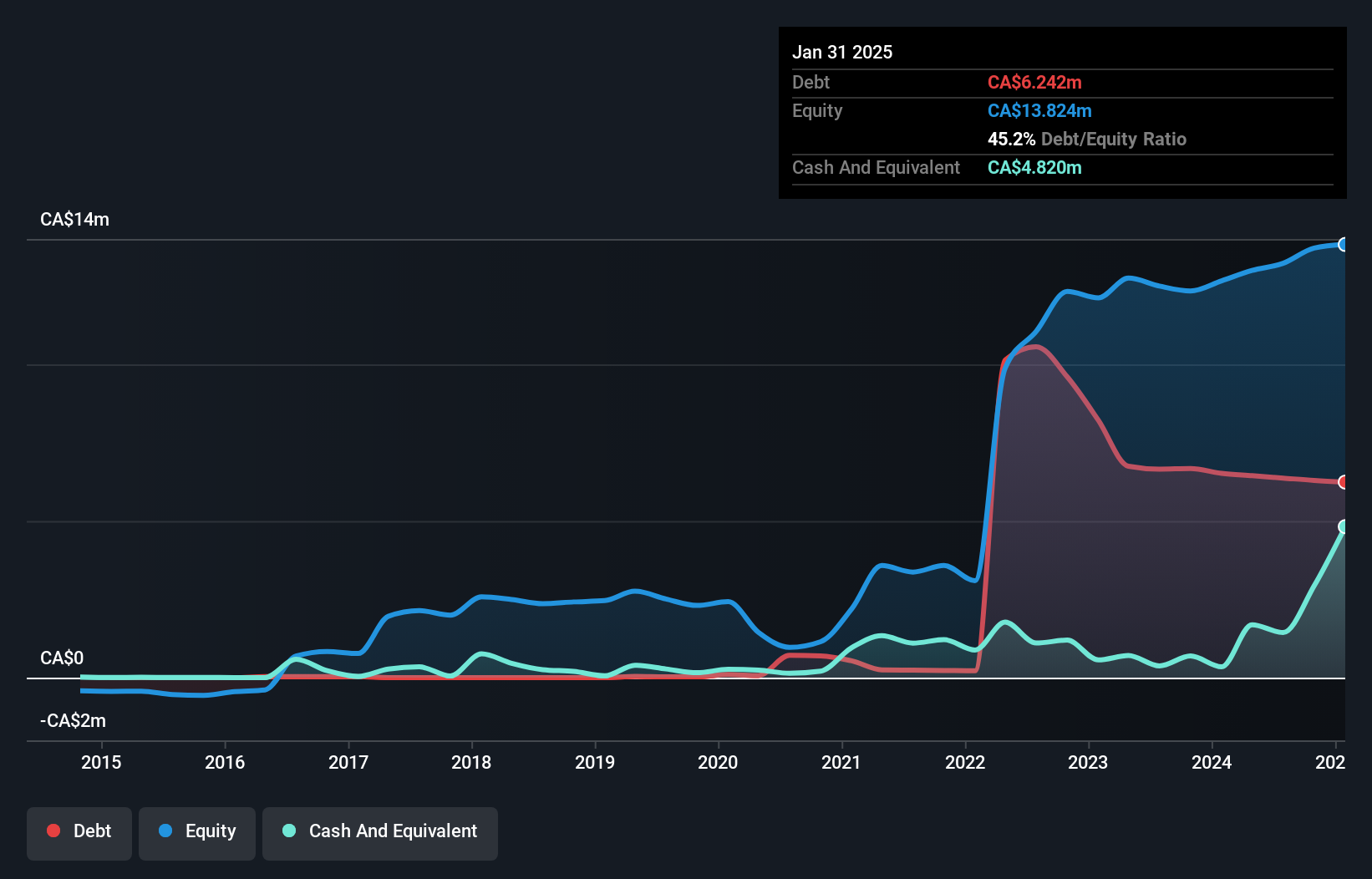

Progressive Planet Solutions Inc. has shown significant earnings growth, with net income rising to CA$2.28 million for the first half of 2025, compared to CA$0.996 million a year prior. The company is actively expanding its product line with innovations like Gladiator SCM and PozGlass SCM powder, supported by notable collaborations such as those with the National Research Council of Canada and BC Innovative Clean Energy Fund. Despite short-term assets not covering long-term liabilities, Progressive Planet's debt management has improved over time, and its operating cash flow adequately covers its debt obligations, reflecting financial stability amidst ongoing development efforts.

- Jump into the full analysis health report here for a deeper understanding of Progressive Planet Solutions.

- Learn about Progressive Planet Solutions' historical performance here.

Seize The Opportunity

- Jump into our full catalog of 394 TSX Penny Stocks here.

- Seeking Other Investments? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Enterprise Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:E

Enterprise Group

Through its subsidiaries, operates as an equipment rental and construction services company in Canada.

High growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion