Despite the rising tariff rates, Canadian markets have shown resilience, with inflation and economic data remaining stable. For investors willing to explore beyond the well-known names, penny stocks—often representing smaller or newer companies—can still present intriguing opportunities. These stocks may offer a blend of value and growth potential that larger firms might overlook, making them appealing for those seeking under-the-radar investments with strong financial foundations.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.70 | CA$69.79M | ✅ 3 ⚠️ 3 View Analysis > |

| illumin Holdings (TSX:ILLM) | CA$2.09 | CA$108.9M | ✅ 4 ⚠️ 1 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.025 | CA$2.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.425 | CA$12.18M | ✅ 2 ⚠️ 4 View Analysis > |

| Mandalay Resources (TSX:MND) | CA$4.64 | CA$427.48M | ✅ 4 ⚠️ 0 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.76 | CA$492.32M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.38 | CA$176.12M | ✅ 1 ⚠️ 1 View Analysis > |

| ACT Energy Technologies (TSX:ACX) | CA$4.53 | CA$153.38M | ✅ 4 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.94 | CA$186.11M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.84 | CA$8.91M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 450 stocks from our TSX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

DIRTT Environmental Solutions (TSX:DRT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: DIRTT Environmental Solutions Ltd. is a Canadian interior construction company with a market cap of CA$177.10 million.

Operations: The company's revenue primarily comes from its building products segment, which generated $174.76 million.

Market Cap: CA$177.1M

DIRTT Environmental Solutions, with a market cap of CA$177.10 million, has recently become profitable and is trading slightly below its estimated fair value. The company's short-term assets exceed both its short- and long-term liabilities, indicating strong liquidity. However, the debt to equity ratio has increased over five years to 56.1%, though it remains manageable with cash exceeding total debt. Recent financials show stable revenue but a net loss in the latest quarter due to non-recurring items affecting earnings quality. The company also filed for a $3.3 million shelf registration and completed a minor share buyback program recently.

- Take a closer look at DIRTT Environmental Solutions' potential here in our financial health report.

- Explore DIRTT Environmental Solutions' analyst forecasts in our growth report.

Nano One Materials (TSX:NANO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nano One Materials Corp. focuses on producing and selling cathode active materials for lithium-ion batteries used in electric vehicles, energy storage systems, and consumer electronics, with a market cap of CA$109.27 million.

Operations: There are no specific revenue segments reported for Nano One Materials Corp.

Market Cap: CA$109.27M

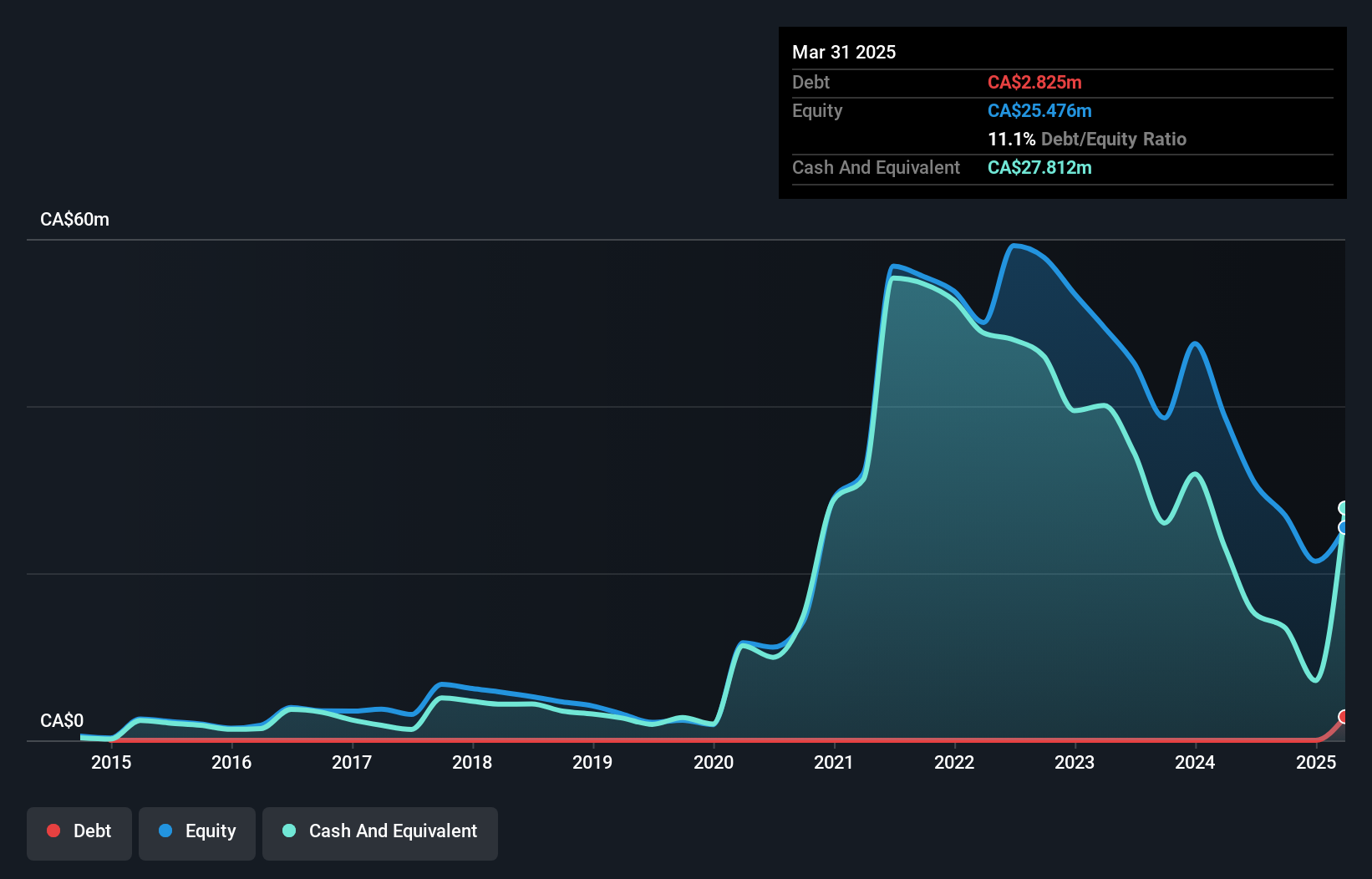

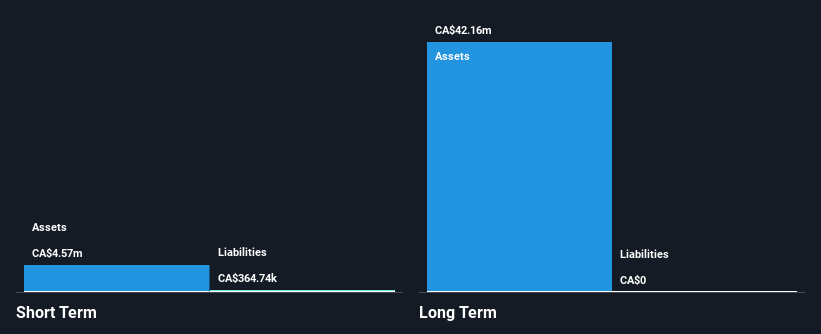

Nano One Materials Corp., with a market cap of CA$109.27 million, is pre-revenue but has gained strategic momentum by joining the Arkansas Lithium Technology Accelerator, enhancing its visibility in the U.S. and reinforcing its role in domestic battery material supply chains. The company reported a net income of CA$2.67 million for Q1 2025, showing improvement from a previous loss, although it remains unprofitable overall with earnings declining over five years. Despite increased debt levels, Nano One's short-term assets comfortably cover liabilities, and it benefits from recent U.S. Department of Defense funding worth US$12.9 million to support growth initiatives.

- Click to explore a detailed breakdown of our findings in Nano One Materials' financial health report.

- Examine Nano One Materials' past performance report to understand how it has performed in prior years.

Wealth Minerals (TSXV:WML)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Wealth Minerals Ltd. focuses on acquiring, exploring, and developing mineral properties in Canada, Chile, Peru, and Mexico with a market cap of CA$18.80 million.

Operations: Wealth Minerals Ltd. does not report any revenue segments.

Market Cap: CA$18.8M

Wealth Minerals Ltd., with a market cap of CA$18.80 million, is pre-revenue and focuses on lithium projects in Chile. Recent developments include forming Kuska Minerals SpA with the Quechua Indigenous Community to advance the Kuska lithium project, and entering a strategic alliance with Voith Hydro for the Pabellon Lithium Project. The company has no debt, but its cash runway is less than a year. Despite an experienced management team and board, Wealth faces high share price volatility and challenges in securing special lithium operation contracts due to regulatory hurdles in Chile.

- Jump into the full analysis health report here for a deeper understanding of Wealth Minerals.

- Explore historical data to track Wealth Minerals' performance over time in our past results report.

Summing It All Up

- Navigate through the entire inventory of 450 TSX Penny Stocks here.

- Contemplating Other Strategies? Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nano One Materials might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NANO

Nano One Materials

Engages in the production and sale of cathode active materials for lithium-ion battery applications in electric vehicles, energy storage systems, and consumer electronics.

Adequate balance sheet with low risk.

Market Insights

Community Narratives