- Canada

- /

- Trade Distributors

- /

- TSX:BRY

A Piece Of The Puzzle Missing From Bri-Chem Corp.'s (TSE:BRY) 48% Share Price Climb

Bri-Chem Corp. (TSE:BRY) shareholders would be excited to see that the share price has had a great month, posting a 48% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 28%.

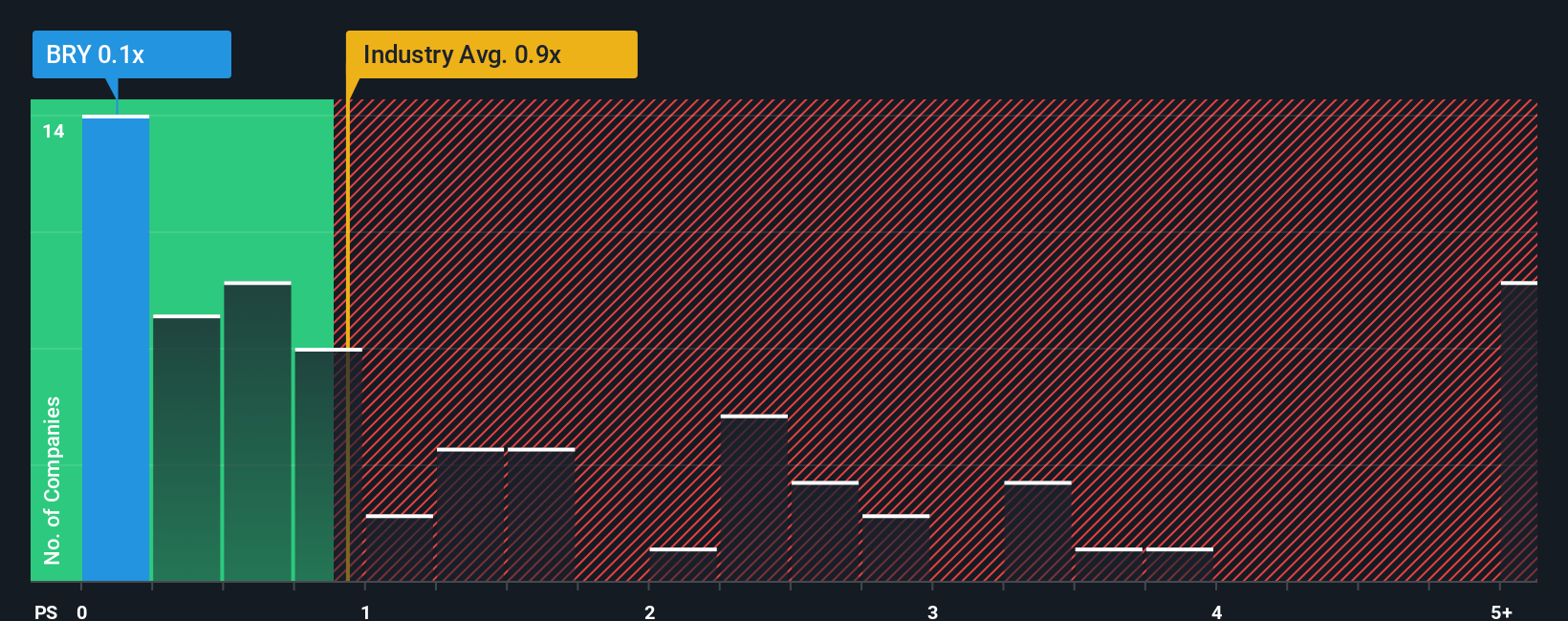

Although its price has surged higher, you could still be forgiven for feeling indifferent about Bri-Chem's P/S ratio of 0.1x, since the median price-to-sales (or "P/S") ratio for the Trade Distributors industry in Canada is also close to 0.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Bri-Chem

What Does Bri-Chem's Recent Performance Look Like?

For example, consider that Bri-Chem's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Bri-Chem will help you shine a light on its historical performance.How Is Bri-Chem's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Bri-Chem's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 19% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 13% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

When compared to the industry's one-year growth forecast of 1.8%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we find it interesting that Bri-Chem is trading at a fairly similar P/S compared to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What We Can Learn From Bri-Chem's P/S?

Bri-Chem appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Bri-Chem currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

Having said that, be aware Bri-Chem is showing 2 warning signs in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Bri-Chem might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:BRY

Bri-Chem

Engages in the wholesale distribution of oilfield chemicals for the oil and gas industry in North America.

Good value with adequate balance sheet.

Market Insights

Community Narratives