- Canada

- /

- Construction

- /

- TSX:ATRL

What AtkinsRéalis Group (TSX:ATRL)'s Hong Kong-Shenzhen Rail Link Win Means For Shareholders

Reviewed by Simply Wall St

- AtkinsRéalis Group, in partnership with AECOM, was awarded the consultancy contract by Hong Kong's Highways Department for the Hong Kong section of the Hong Kong-Shenzhen Western Rail Link, a major cross-border transport project aimed at improving regional accessibility and integration.

- The use of a unified digital data platform and advanced modeling tools highlights the project's emphasis on transparency, efficiency, and collaboration, potentially setting new standards for infrastructure delivery in the Greater Bay Area.

- We'll examine how this consultancy win could influence AtkinsRéalis Group's investment narrative, particularly in terms of future project opportunities in Asia.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

AtkinsRéalis Group Investment Narrative Recap

AtkinsRéalis Group’s investment story is built on securing large-scale infrastructure and engineering contracts worldwide, supported by a robust project backlog and a focused transition toward higher-margin services. The recent Hong Kong-Shenzhen Western Rail Link consultancy win with AECOM highlights progress in Asia but is not material enough by itself to alter near-term catalysts, which remain focused on operational execution and resolving challenges on major delayed projects. The largest immediate risk continues to be margin pressure from ongoing project delays and elevated commissioning costs, especially on the Trillium Line and Eglinton projects.

Among recent announcements, the Jacobs and AtkinsRéalis joint venture appointment by National Highways UK to deliver environmental and sustainability technical services is particularly relevant. This UK contract shows the continued strength of AtkinsRéalis in winning long-term consultancy mandates in priority markets, reinforcing the company’s core catalyst of expanding its engineering backlog amidst sector tailwinds but underlines the need for consistent execution to avoid delivery issues.

By contrast, investors should be aware of the persistent risk from unresolved issues on certain large infrastructure projects, which could continue to weigh on...

Read the full narrative on AtkinsRéalis Group (it's free!)

AtkinsRéalis Group's outlook anticipates CA$12.6 billion in revenue and CA$849.3 million in earnings by 2028. This reflects an 8.2% annual revenue growth rate and a CA$541.8 million increase in earnings from the current CA$307.5 million.

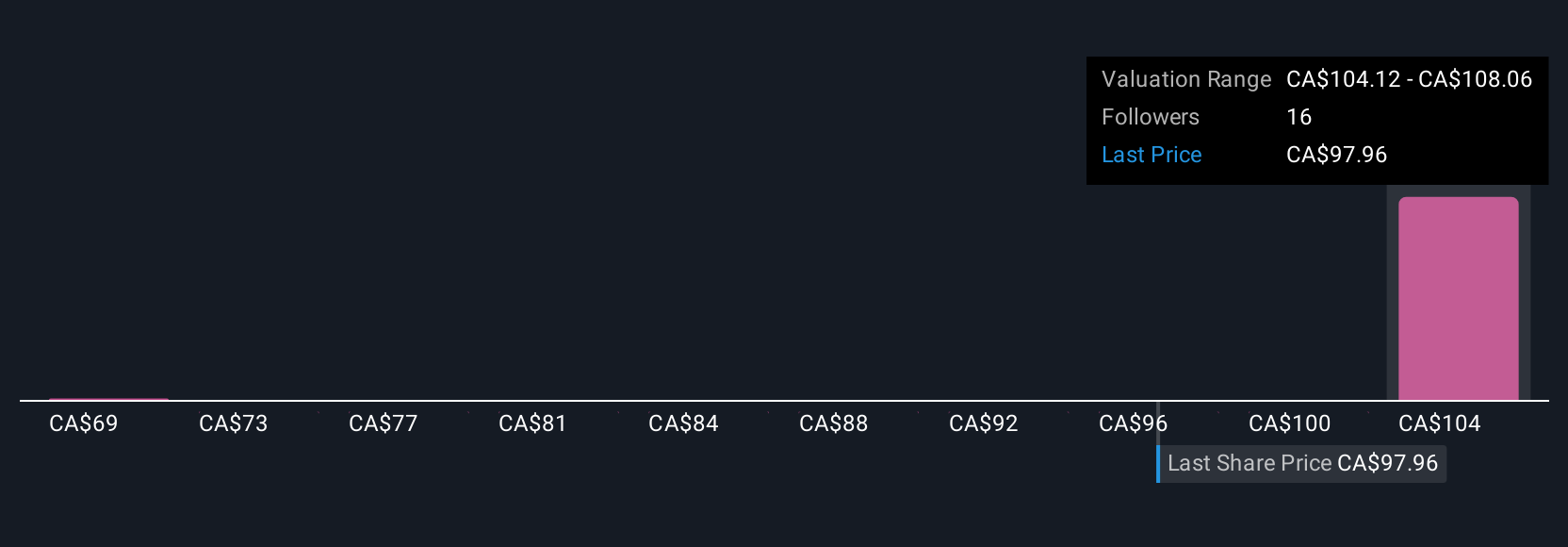

Uncover how AtkinsRéalis Group's forecasts yield a CA$106.43 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community span from CA$68.73 to CA$120.80, underlining a wide range of investor expectations. While many focus on future revenue growth, ongoing project risk and margin pressure could shift sentiment, explore the diversity of opinions before deciding.

Explore 3 other fair value estimates on AtkinsRéalis Group - why the stock might be worth 29% less than the current price!

Build Your Own AtkinsRéalis Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AtkinsRéalis Group research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free AtkinsRéalis Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AtkinsRéalis Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 21 early-stage AI stocks could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ATRL

AtkinsRéalis Group

Provides professional services and project management, and capital investment services in United Kingdom, Canada, the United States, Saudi Arabia, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives