- Canada

- /

- Construction

- /

- TSX:ATRL

Major Nuclear Infrastructure Win Could Be a Game Changer for AtkinsRéalis Group (TSX:ATRL)

Reviewed by Sasha Jovanovic

- AtkinsRéalis Group Inc. recently reported its third quarter and nine-month 2025 earnings, with revenue reaching CA$2.81 billion for the quarter and net income rising to CA$146.68 million, alongside the confirmation of a CA$0.02 per share dividend. The company also secured a multi-year Owner’s Engineer mandate from Hydro One for the Bowmanville Switching Station expansion, a key project supporting Ontario’s growing nuclear and renewable energy infrastructure.

- An interesting insight is that AtkinsRéalis Group’s recent role in major power and green hydrogen projects, including supporting small modular reactor integration and clean power transmission, highlights its expanding influence in the low-carbon energy transition across Canada and North America.

- Following the company’s robust third quarter results, we’ll examine how AtkinsRéalis’ involvement in advancing nuclear infrastructure could enhance its investment narrative.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

AtkinsRéalis Group Investment Narrative Recap

To be a shareholder in AtkinsRéalis Group, you need to believe in the company’s ability to secure and deliver large-scale infrastructure and nuclear projects amid accelerating demand for low-carbon energy. The latest third quarter earnings, with increased revenue and net income, reinforce short-term confidence, but do not meaningfully alter the primary catalyst of new nuclear contract wins or reduce the ongoing risk of project delays and regional contract reprioritizations.

The recent announcement of AtkinsRéalis’ multi-year mandate with Hydro One for the Bowmanville Switching Station directly connects to the nuclear build catalyst, giving added visibility to the firm’s pivotal involvement in Ontario’s grid expansion and SMR integration. This project win supports future contracted backlog, yet emphasizes the importance of execution and timely project delivery to sustain growth momentum.

However, investors should be aware that, despite solid financials, regional project delays in USLA and EMEA could still ...

Read the full narrative on AtkinsRéalis Group (it's free!)

AtkinsRéalis Group is projected to reach CA$12.8 billion in revenue and CA$896.4 million in earnings by 2028. This outlook assumes annual revenue growth of 7.4% and a decrease in earnings of approximately CA$1.6 billion from current earnings of CA$2.5 billion.

Uncover how AtkinsRéalis Group's forecasts yield a CA$113.96 fair value, a 25% upside to its current price.

Exploring Other Perspectives

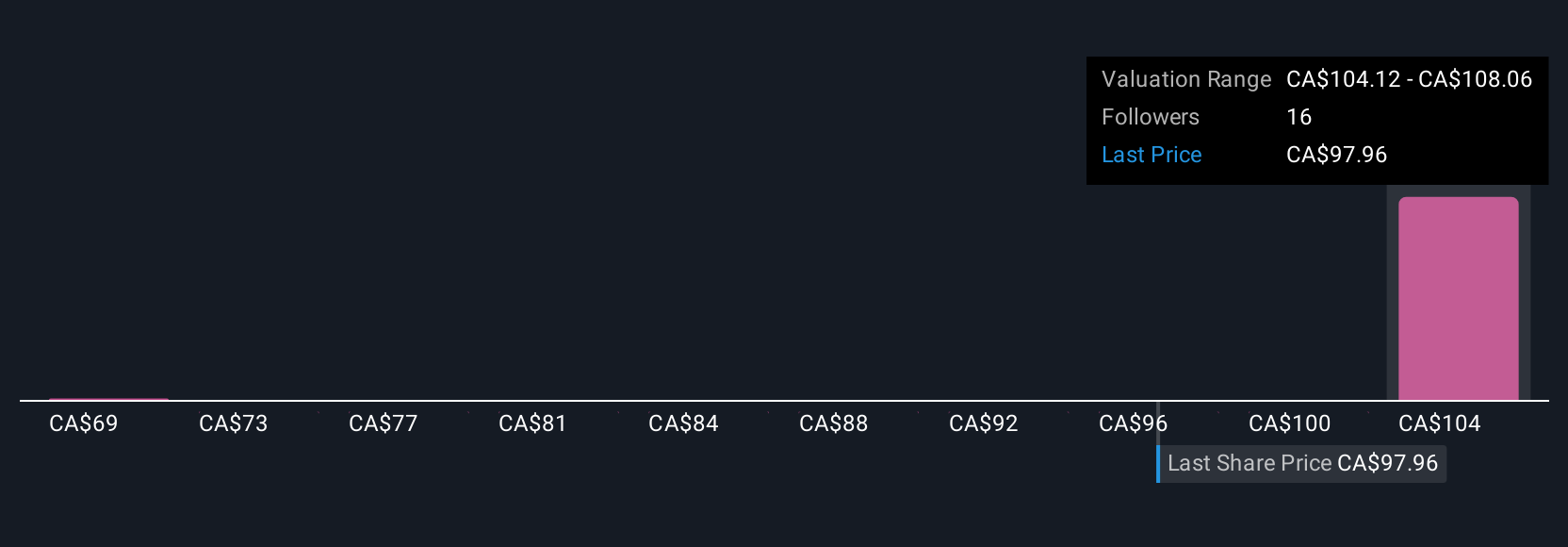

Simply Wall St Community members provided three fair value estimates for AtkinsRéalis stock, ranging from CA$68.73 to CA$114.68. While contract momentum is strong, project execution risks in core geographies could give investors reason to seek out alternative views on the company’s outlook.

Explore 3 other fair value estimates on AtkinsRéalis Group - why the stock might be worth as much as 26% more than the current price!

Build Your Own AtkinsRéalis Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AtkinsRéalis Group research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free AtkinsRéalis Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AtkinsRéalis Group's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ATRL

AtkinsRéalis Group

Provides professional services and project management, and capital investment services in United Kingdom, Canada, the United States, Saudi Arabia, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives