- Canada

- /

- Construction

- /

- TSX:ARE

Aecon Group (TSX:ARE) Valuation in Focus After Breakthrough U.S. Nuclear Project Deal

Reviewed by Simply Wall St

Aecon Group (TSX:ARE), together with partners Kiewit and Black & Veatch, is moving forward on a joint venture to design, plan, and build four Xe-100 small modular reactors in Washington state. This signals a strategic entry for Aecon into the U.S. nuclear energy market.

See our latest analysis for Aecon Group.

This breakthrough on the U.S. nuclear front is clearly igniting momentum in Aecon’s shares. The stock jumped 12.3% in a day and is now up over 50% in the last 90 days. Looking longer term, Aecon boasts a 31.2% total shareholder return over the past year and an exceptional 239% in three years, reflecting building investor confidence around its prospects.

If this kind of growth story has you interested in finding more high-potential stocks, consider broadening your search and discover fast growing stocks with high insider ownership

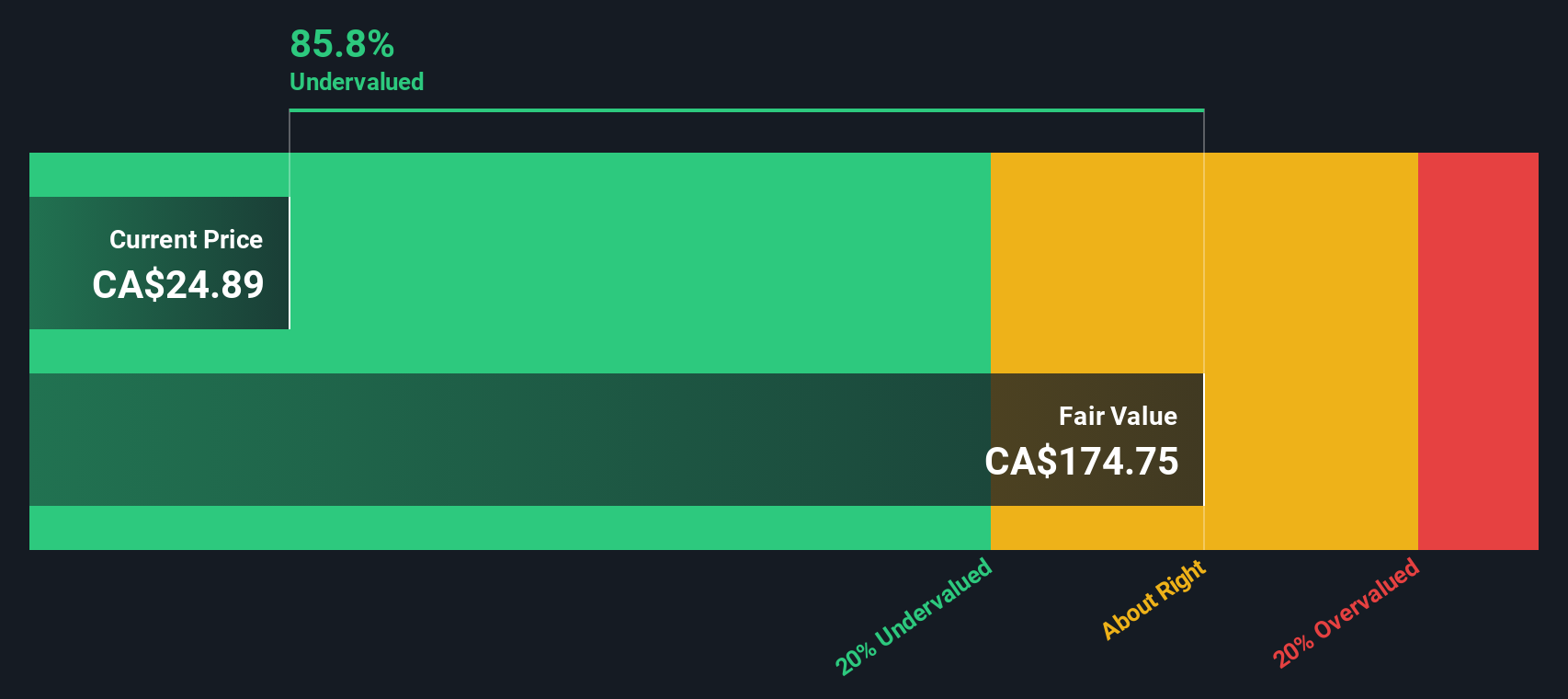

With shares surging after recent nuclear project wins, the big question remains: is Aecon still undervalued at this level, or has the market already priced in years of future growth for the company?

Most Popular Narrative: 11.5% Overvalued

At CA$28.49, Aecon Group’s share price is trading above the narrative’s fair value estimate. The valuation suggests expectations for substantial future growth are built in, but key business catalysts must still deliver.

Significant progress in deleveraging, balance sheet strengthening, and disciplined capital allocation, including successful integration of targeted acquisitions, has created financial headroom for larger project bids and further M&A. This provides optionality for earnings and margin expansion.

Curious how analysts built their confidence? This fair value is powered by bold assumptions on future profit margins and aggressive multi-year earnings growth. Want to know which projections could flip the investment math on its head? Dive in to uncover the full narrative playbook.

Result: Fair Value of $25.55 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as margin compression and potential changes in government spending could challenge Aecon’s ambitious growth narrative in the future.

Find out about the key risks to this Aecon Group narrative.

Another View: SWS DCF Model Shows Deep Value Gap

A contrasting take comes from the SWS DCF model, which estimates Aecon’s fair value at a striking CA$178.29, much higher than both the current price and analyst consensus. This suggests the market is pricing in significant skepticism toward Aecon’s future cash flows. Could the DCF outlook signal untapped potential, or is the optimism baked into the model too ambitious?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Aecon Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Aecon Group Narrative

If you want to dig into the data yourself or take a different approach to Aecon’s story, you can craft a personalized narrative in just minutes, so you can Do it your way.

A great starting point for your Aecon Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Take your portfolio to the next level. Don’t sit on the sidelines while other investors find tomorrow’s winners. Put these unique stock ideas to work right now:

- Unlock new opportunities for cash flow by evaluating these 17 dividend stocks with yields > 3% with yields above the market average and a track record of paying investors.

- Jump into the heart of artificial intelligence innovation by researching these 27 AI penny stocks where leading-edge tech is reshaping entire industries.

- Pounce on stocks the market may have overlooked with these 876 undervalued stocks based on cash flows that could deliver growth before the mainstream catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ARE

Aecon Group

Aecon Group Inc., together with its subsidiaries, provide construction and infrastructure development services to private and public sector clients in Canada, the United States, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives