Aecon Group Inc.'s (TSE:ARE) investors are due to receive a payment of CA$0.19 per share on 3rd of January. This means the annual payment is 2.8% of the current stock price, which is above the average for the industry.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that Aecon Group's stock price has increased by 37% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

Check out our latest analysis for Aecon Group

Estimates Indicate Aecon Group's Dividend Coverage Likely To Improve

A big dividend yield for a few years doesn't mean much if it can't be sustained. While Aecon Group is not profitable, it is paying out less than 75% of its free cash flow, which means that there is plenty left over for reinvestment into the business. This gives us some comfort about the level of the dividend payments.

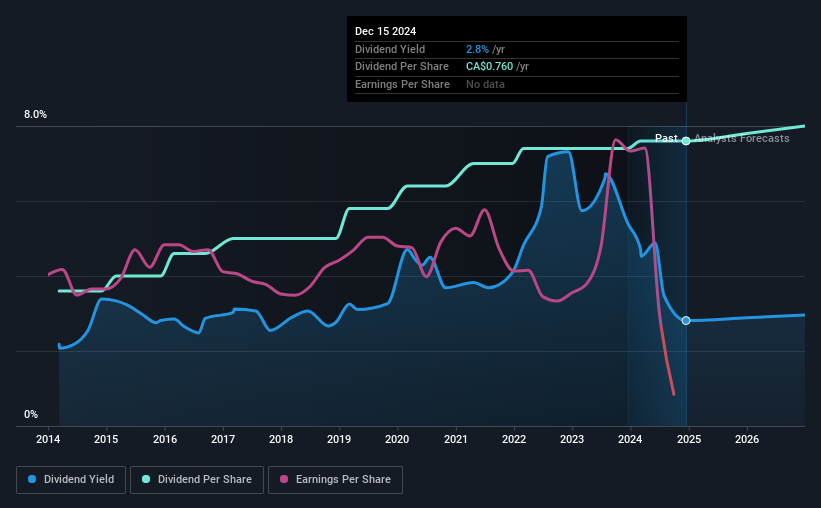

Looking forward, earnings per share is forecast to rise exponentially over the next year. Assuming the dividend continues along recent trends, we think the payout ratio will be 9.3%, which makes us pretty comfortable with the sustainability of the dividend.

Aecon Group Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. The annual payment during the last 10 years was CA$0.36 in 2014, and the most recent fiscal year payment was CA$0.76. This works out to be a compound annual growth rate (CAGR) of approximately 7.8% a year over that time. The growth of the dividend has been pretty reliable, so we think this can offer investors some nice additional income in their portfolio.

Aecon Group May Find It Hard To Grow The Dividend

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Unfortunately things aren't as good as they seem. Aecon Group has seen earnings per share falling at 3.5% per year over the last five years. If earnings continue declining, the company may have to make the difficult choice of reducing the dividend or even stopping it completely - the opposite of dividend growth. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

Our Thoughts On Aecon Group's Dividend

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. The company has been bring in plenty of cash to cover the dividend, but we don't necessarily think that makes it a great dividend stock. We would probably look elsewhere for an income investment.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. Taking the debate a bit further, we've identified 2 warning signs for Aecon Group that investors need to be conscious of moving forward. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:ARE

Aecon Group

Aecon Group Inc., together with its subsidiaries, provide construction and infrastructure development services to private and public sector clients in Canada, the United States, and internationally.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success