- Canada

- /

- Aerospace & Defense

- /

- CNSX:DPRO

Shareholders May Not Be So Generous With Draganfly Inc.'s (CSE:DPRO) CEO Compensation And Here's Why

Key Insights

- Draganfly will host its Annual General Meeting on 18th of July

- Total pay for CEO Cameron Chell includes CA$408.3k salary

- Total compensation is similar to the industry average

- Draganfly's three-year loss to shareholders was 96% while its EPS grew by 45% over the past three years

In the past three years, the share price of Draganfly Inc. (CSE:DPRO) has struggled to grow and now shareholders are sitting on a loss. What is concerning is that despite positive EPS growth, the share price has not tracked the trend in fundamentals. Shareholders may want to question the board on the future direction of the company at the upcoming AGM on 18th of July. Voting on resolutions such as executive remuneration and other matters could also be a way to influence management. We discuss below why we think shareholders should be cautious of approving a raise for the CEO at the moment.

Check out our latest analysis for Draganfly

How Does Total Compensation For Cameron Chell Compare With Other Companies In The Industry?

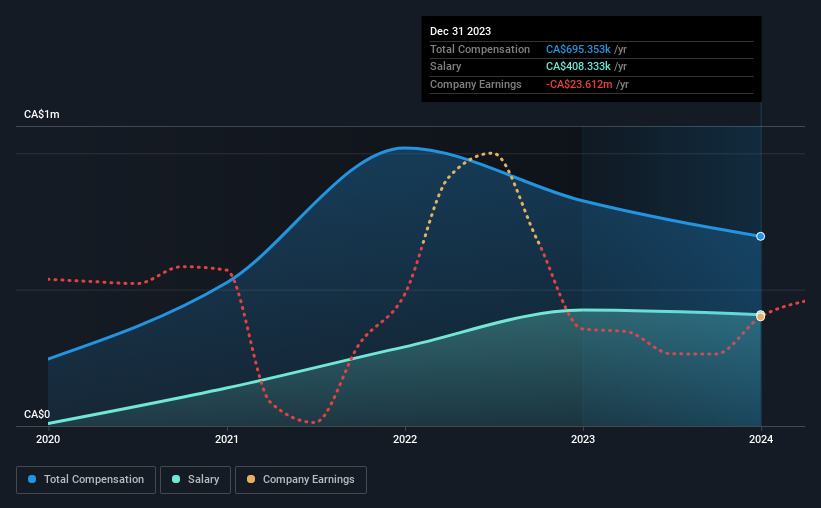

At the time of writing, our data shows that Draganfly Inc. has a market capitalization of CA$22m, and reported total annual CEO compensation of CA$695k for the year to December 2023. That's a notable decrease of 16% on last year. Notably, the salary which is CA$408.3k, represents a considerable chunk of the total compensation being paid.

On comparing similar-sized companies in the Canadian Aerospace & Defense industry with market capitalizations below CA$272m, we found that the median total CEO compensation was CA$673k. This suggests that Draganfly remunerates its CEO largely in line with the industry average.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CA$408k | CA$425k | 59% |

| Other | CA$287k | CA$401k | 41% |

| Total Compensation | CA$695k | CA$826k | 100% |

On an industry level, around 23% of total compensation represents salary and 77% is other remuneration. It's interesting to note that Draganfly pays out a greater portion of remuneration through salary, compared to the industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Draganfly Inc.'s Growth Numbers

Over the past three years, Draganfly Inc. has seen its earnings per share (EPS) grow by 45% per year. In the last year, its revenue is down 12%.

Shareholders would be glad to know that the company has improved itself over the last few years. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Draganfly Inc. Been A Good Investment?

Few Draganfly Inc. shareholders would feel satisfied with the return of -96% over three years. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

Despite the growth in its earnings, the share price decline in the past three years is certainly concerning. A huge lag in share price growth when earnings have grown may indicate there could be other issues that are affecting the company at the moment that the market is focused on. Shareholders would be keen to know what's holding the stock back when earnings have grown. These concerns should be addressed at the upcoming AGM, where shareholders can question the board and evaluate if their judgement and decision making is still in line with their expectations.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. That's why we did our research, and identified 6 warning signs for Draganfly (of which 2 can't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:DPRO

Draganfly

Develops, manufactures, and sells cutting-edge unmanned and remote data collection and analysis platforms and systems in the United States and Canada.

Flawless balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success