Stock Analysis

The Canadian market has shown promising growth, with a 1.3% increase in the last week and an impressive 9.1% rise over the past year, complemented by a forecast of 13% annual earnings growth. In such an environment, stocks with high insider ownership can be particularly appealing as they often indicate confidence from those who know the company best.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| goeasy (TSX:GSY) | 21.7% | 15.9% |

| Vox Royalty (TSX:VOXR) | 12.4% | 72.8% |

| Aritzia (TSX:ATZ) | 19% | 51.6% |

| Payfare (TSX:PAY) | 15% | 63.8% |

| Allied Gold (TSX:AAUC) | 22.4% | 73.5% |

| Rivalry (TSXV:RVLY) | 11.7% | 61.8% |

| ROK Resources (TSXV:ROK) | 16.6% | 135.9% |

| Artemis Gold (TSXV:ARTG) | 31.8% | 58.9% |

| Ivanhoe Mines (TSX:IVN) | 13.1% | 36.4% |

| UGE International (TSXV:UGE) | 35.4% | 57.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

Allied Gold (TSX:AAUC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Allied Gold Corporation, along with its subsidiaries, is engaged in the exploration and production of mineral deposits in Africa, with a market capitalization of approximately CA$832.40 million.

Operations: The company is primarily involved in the exploration and production of minerals across Africa.

Insider Ownership: 22.4%

Earnings Growth Forecast: 73.5% p.a.

Allied Gold, with substantial insider buying in the past three months, is poised for significant growth. The company is trading at 90.5% below its estimated fair value and analysts expect a sharp price rise of 139.9%. Forecasts predict Allied Gold will become profitable within three years, with earnings growth projected at 73.55% per year. Recent positive exploration results could further enhance resource estimates, supporting long-term growth despite current challenges like a net loss in Q1 2024 and operational risks in emerging markets.

- Get an in-depth perspective on Allied Gold's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Allied Gold shares in the market.

Orla Mining (TSX:OLA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Orla Mining Ltd. is a company engaged in the acquisition, exploration, development, and exploitation of mineral properties, with a market capitalization of approximately CA$1.67 billion.

Operations: The company generates revenue primarily from the evaluation and exploration of mineral exploration properties, totaling CA$233.64 million.

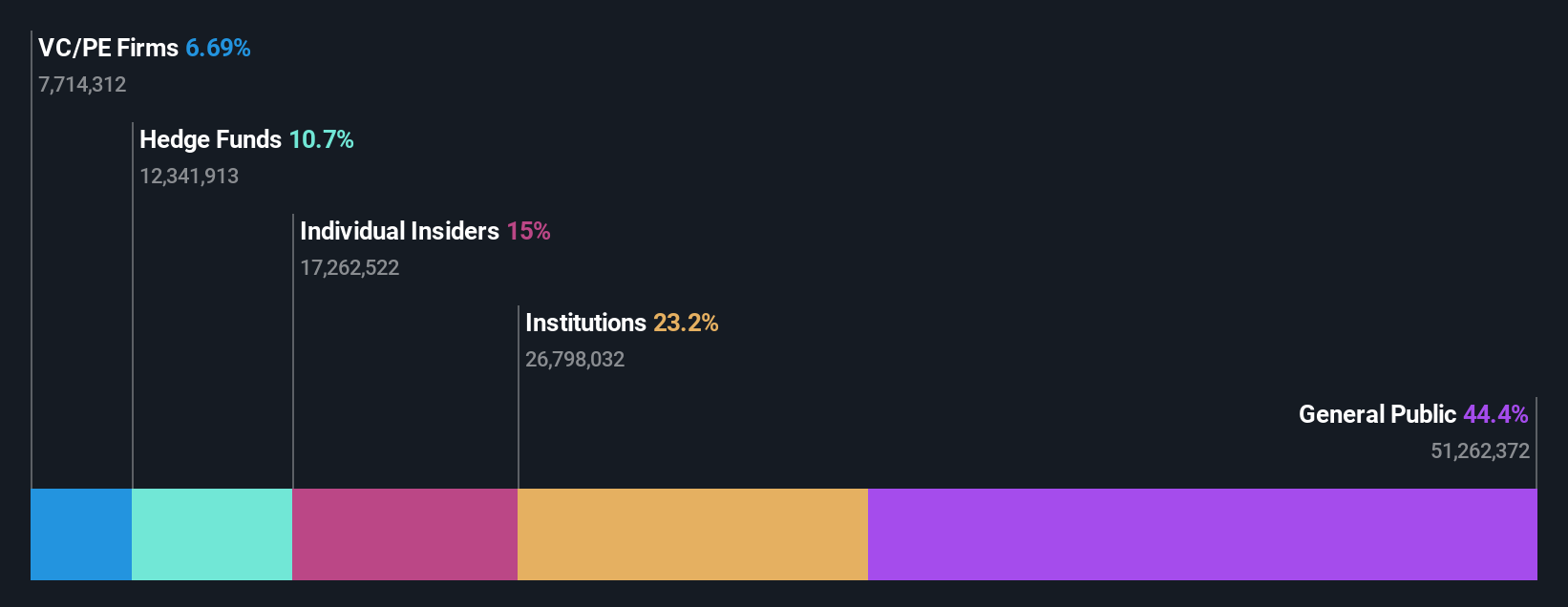

Insider Ownership: 11.4%

Earnings Growth Forecast: 71.9% p.a.

Orla Mining, despite mixed insider activity with more shares bought than sold recently, is not showing substantial insider buying overall. Analysts predict a 26.4% potential increase in stock price, and Orla's revenue growth at 13.6% annually outpaces the Canadian market's 6.6%. The company is expected to turn profitable within three years with earnings potentially growing by 71.92% annually, although its return on equity might remain low at 13.8%. Recent operational updates include significant gold production and promising exploration advancements at the South Railroad Project, enhancing future growth prospects.

- Unlock comprehensive insights into our analysis of Orla Mining stock in this growth report.

- According our valuation report, there's an indication that Orla Mining's share price might be on the expensive side.

VersaBank (TSX:VBNK)

Simply Wall St Growth Rating: ★★★★☆☆

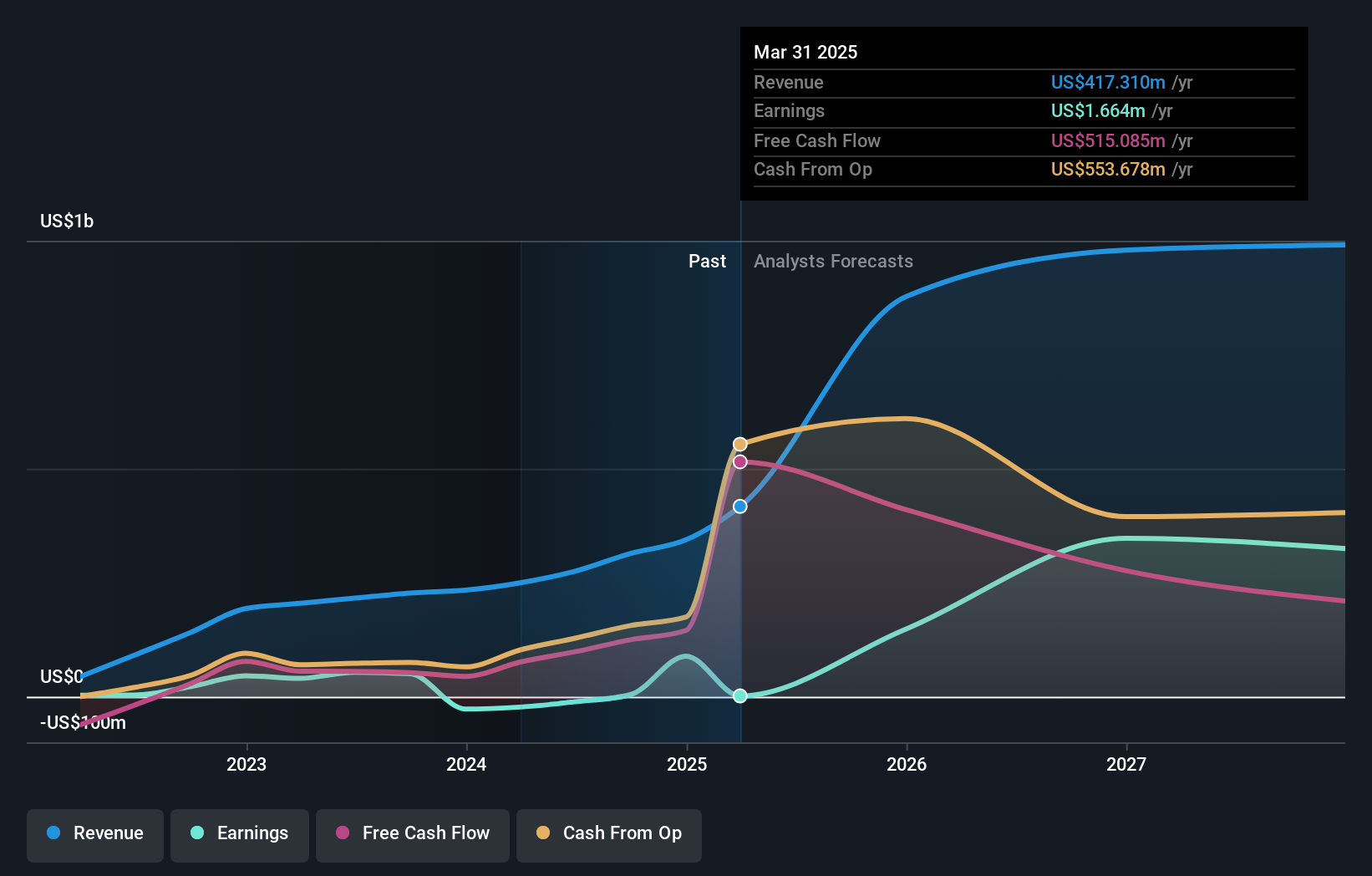

Overview: VersaBank offers a range of banking products and services across Canada and the United States, with a market capitalization of approximately CA$343.51 million.

Operations: The bank's revenue is primarily derived from two segments: Digital Banking, which generated CA$102.91 million, and DRTC, focused on cybersecurity services and banking technology, contributing CA$10.37 million.

Insider Ownership: 13.3%

Earnings Growth Forecast: 24% p.a.

VersaBank, with a low allowance for bad loans at 16%, demonstrates prudent financial management. Recent earnings show robust growth, with net income rising to CA$12.7 million from CA$9.42 million year-over-year, reflecting a solid increase in profitability. Insider activities reveal more buying than selling over the past three months, indicating confidence among those closest to the company's operations. VersaBank's revenue and earnings are projected to outpace the Canadian market significantly, suggesting promising growth potential.

- Delve into the full analysis future growth report here for a deeper understanding of VersaBank.

- The valuation report we've compiled suggests that VersaBank's current price could be quite moderate.

Next Steps

- Get an in-depth perspective on all 33 Fast Growing TSX Companies With High Insider Ownership by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether VersaBank is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:VBNK

VersaBank

Provides various banking products and services in Canada and the United States.

Solid track record with excellent balance sheet.