Toronto-Dominion Bank (TSX:TD): Weighing Fair Value After a Strong Run

Reviewed by Simply Wall St

See our latest analysis for Toronto-Dominion Bank.

It has been a strong year for Toronto-Dominion Bank, with its share price up nearly 48% year-to-date and a total shareholder return of over 50% for the past 12 months. This kind of momentum, despite a quiet stretch in recent weeks, suggests renewed investor optimism about growth prospects and improving sentiment around Canadian banks overall.

If you’re looking to broaden your search beyond the banks, this might be the perfect moment to discover fast growing stocks with high insider ownership.

But with TD trading near analysts’ price targets, investors are left wondering if the stock is truly undervalued or if all the good news is already reflected in the share price. Investors may ask whether there is still a buying opportunity, or if the market has fully priced in future growth.

Most Popular Narrative: Fairly Valued

The most widely followed valuation narrative puts Toronto-Dominion Bank’s fair value at $112.86, just ahead of its recent close around $113.58. Here is what is driving the narrative and why market watchers are closely tracking these numbers.

Persistent investment in compliance, notably elevated AML remediation, cyber, and fraud prevention costs, is expected to drive higher structural expenses. This could weigh on net margins and overall earnings growth well into 2026 and 2027, as regulatory scrutiny and associated operational costs remain elevated.

What is the real math behind such a precise valuation call? The core reasoning: analysts are betting on shrinking margins in a cost-heavy regulatory climate and forecasting future earnings far lower than today. The catch is that the price tag only makes sense if you accept these sharply downgraded growth assumptions. Think you know what is priced in or what is left on the table? Unpack the numbers behind the narrative and see what could change everything next.

Result: Fair Value of $112.86 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, consistent growth in TD’s U.S. and digital businesses, or successful cost reduction efforts, could quickly shift expectations and challenge current assumptions.

Find out about the key risks to this Toronto-Dominion Bank narrative.

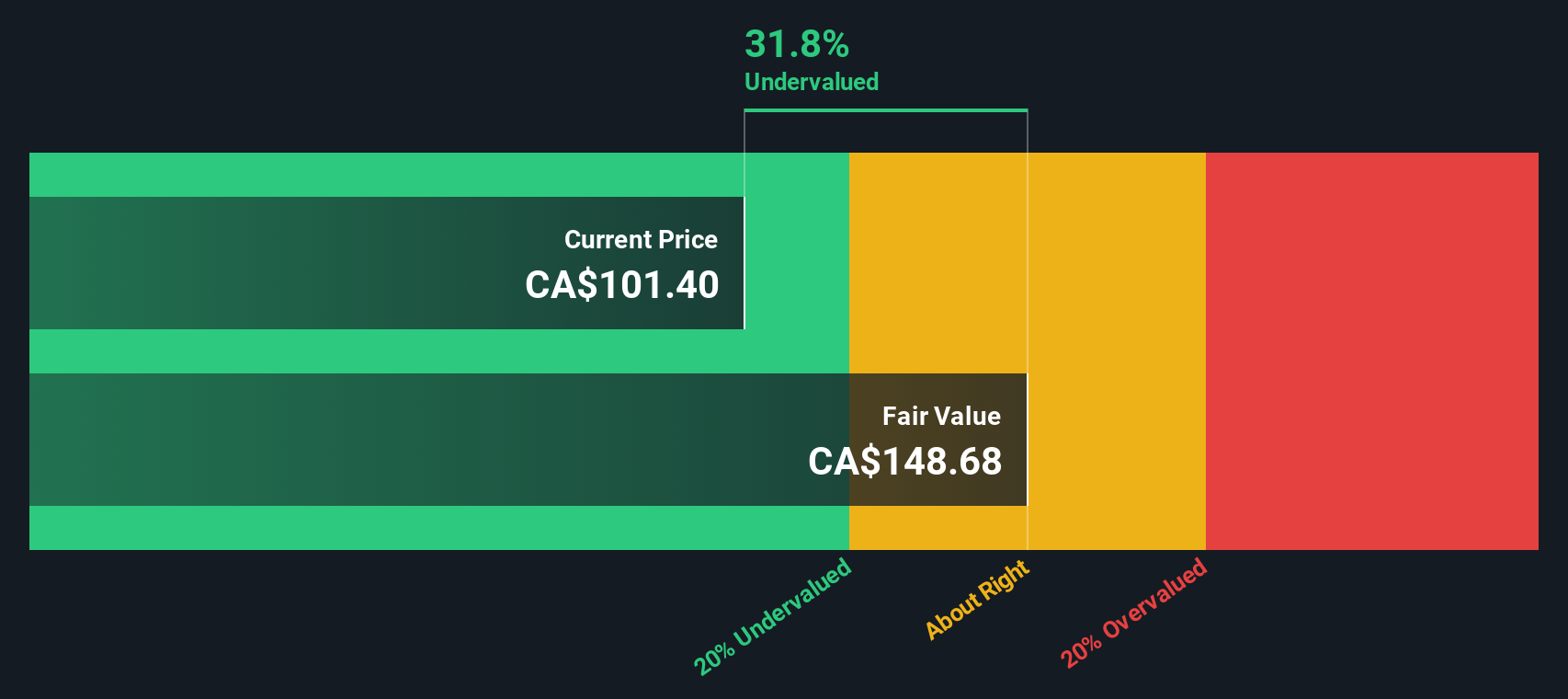

Another View: Discounted Cash Flow Model

To challenge the current narrative, we can look at Toronto-Dominion Bank through the lens of our DCF model. This approach estimates that shares are trading significantly below their fair value, suggesting the stock could be meaningfully undervalued if future cash flows hold up as projected. But does the DCF model know something the market does not, or is it too optimistic about what lies ahead?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Toronto-Dominion Bank Narrative

If you’re ready to draw your own conclusions or want to test a different set of beliefs, it’s easy to investigate the numbers and build a fresh case for yourself. You can start in just a few minutes. Do it your way

A great starting point for your Toronto-Dominion Bank research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't sit on the sidelines while new opportunities are taking off. Expand your horizon and invest smarter by checking these hand-picked lists made for forward-thinking investors.

- Unlock the potential of tomorrow’s innovators and check out these 24 AI penny stocks, making headlines for their cutting-edge advances in artificial intelligence.

- Get ahead of the curve with stable returns by browsing these 16 dividend stocks with yields > 3%, featuring established companies rewarding shareholders with consistent income streams.

- Tap into unique gains in a rapidly evolving sector by exploring these 27 quantum computing stocks, where breakthroughs in computing could reshape entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toronto-Dominion Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TD

Toronto-Dominion Bank

Provides various financial products and services in Canada, the United States, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives