What National Bank of Canada (TSX:NA)'s Leadership Reshuffle Means for Its Digital Transformation Strategy

Reviewed by Sasha Jovanovic

- National Bank of Canada recently announced several senior leadership changes that will take effect on January 1, 2026, including the retirement of Lucie Blanchet and the appointment of Julie Lévesque as Executive Vice-President, Personal Banking, alongside further realignment of key executive roles.

- This leadership transition emphasizes the bank’s intensified commitment to digital transformation and pan-Canadian growth through enhanced integration of technology and client-focused strategies.

- We'll explore how the emphasis on digital leadership and operational realignment could influence National Bank of Canada's future investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

National Bank of Canada Investment Narrative Recap

Investing in National Bank of Canada means having confidence in its ability to expand nationally, successfully integrate Canadian Western Bank, and protect margins while pursuing digital transformation. The recent executive leadership changes underscore the bank’s technology-led approach but do not materially shift the current top catalyst, integrating Canadian Western Bank for cost and funding synergies, or the most significant risk, which remains persistent margin pressure and regional concentration.

Among recent announcements, the appointment of Julie Lévesque as Executive Vice-President of Personal Banking directly connects to the bank’s push for enhanced digital capabilities and operational efficiency. Her continued oversight of technology and operations reinforces the focus on scaling digital initiatives, which is tightly linked to realizing operational synergies and cost savings during the CWB integration period.

By contrast, investors should also be alert to ongoing risks around margin pressure and the potential impact of...

Read the full narrative on National Bank of Canada (it's free!)

National Bank of Canada's narrative projects CA$16.2 billion revenue and CA$4.2 billion earnings by 2028. This requires 10.3% yearly revenue growth and a CA$0.5 billion earnings increase from the current earnings of CA$3.7 billion.

Uncover how National Bank of Canada's forecasts yield a CA$151.69 fair value, a 3% downside to its current price.

Exploring Other Perspectives

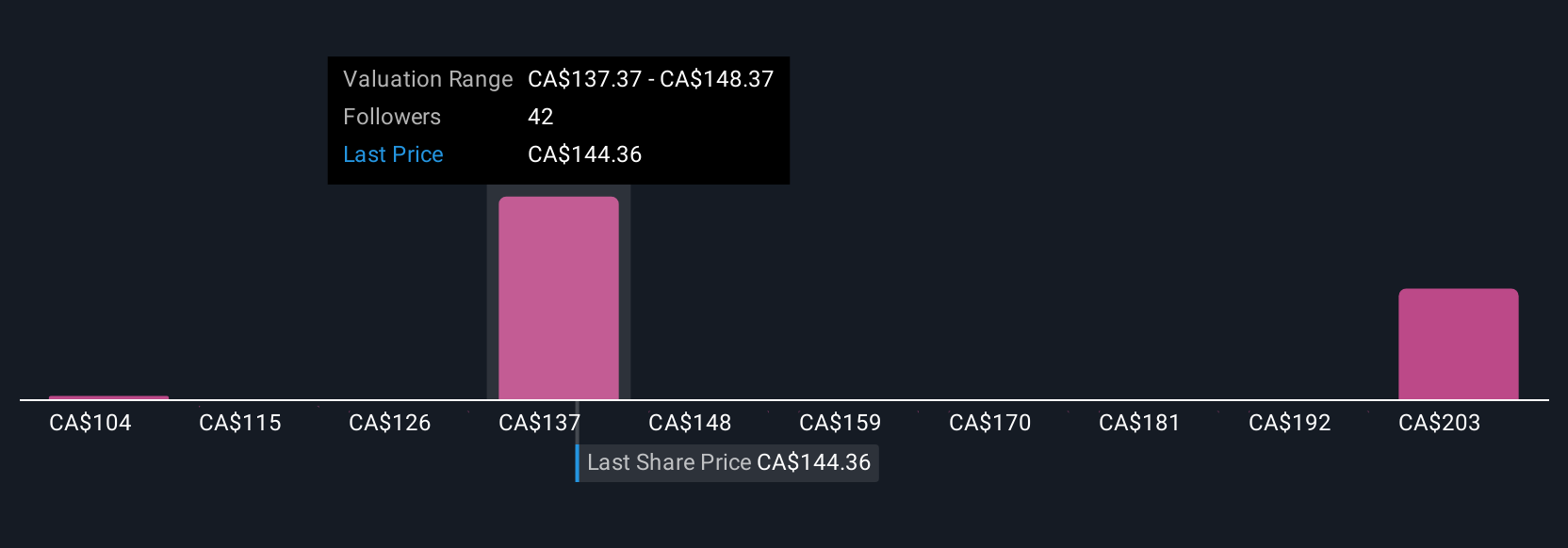

Seven members of the Simply Wall St Community provided fair value estimates for National Bank of Canada, ranging from CA$104.36 to CA$217.42. While opinions vary widely, expectations of digital transformation and successful integration with Canadian Western Bank remain pivotal factors influencing the company’s future potential, explore how these differing views could impact your own assessment.

Explore 7 other fair value estimates on National Bank of Canada - why the stock might be worth 33% less than the current price!

Build Your Own National Bank of Canada Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your National Bank of Canada research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free National Bank of Canada research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate National Bank of Canada's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Bank of Canada might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NA

National Bank of Canada

Provides financial services to individuals, businesses, institutional clients, and governments in Canada and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives