National Bank of Canada (TSX:NA) Valuation in Focus After Senior Leadership Revamp and Strategic Digital Push

Reviewed by Simply Wall St

National Bank of Canada (TSX:NA) revealed sweeping changes to its senior leadership, naming Julie Lévesque as Executive Vice-President, Personal Banking. The shift comes as the bank sharpens its digital strategy and targets growth across Canada.

See our latest analysis for National Bank of Canada.

National Bank of Canada’s recent leadership shakeup comes after a robust run for shareholders, with the stock’s 1-year total return of nearly 23% and a five-year total return approaching 178%. Momentum has stayed strong all year, reflecting growing confidence in the bank’s digital transformation and its nationwide ambitions. Recent events, like calling notes for early redemption, have only reinforced a sense of forward motion.

If these strategic shifts have you thinking about fresh opportunities, it’s a great time to broaden your outlook and discover fast growing stocks with high insider ownership

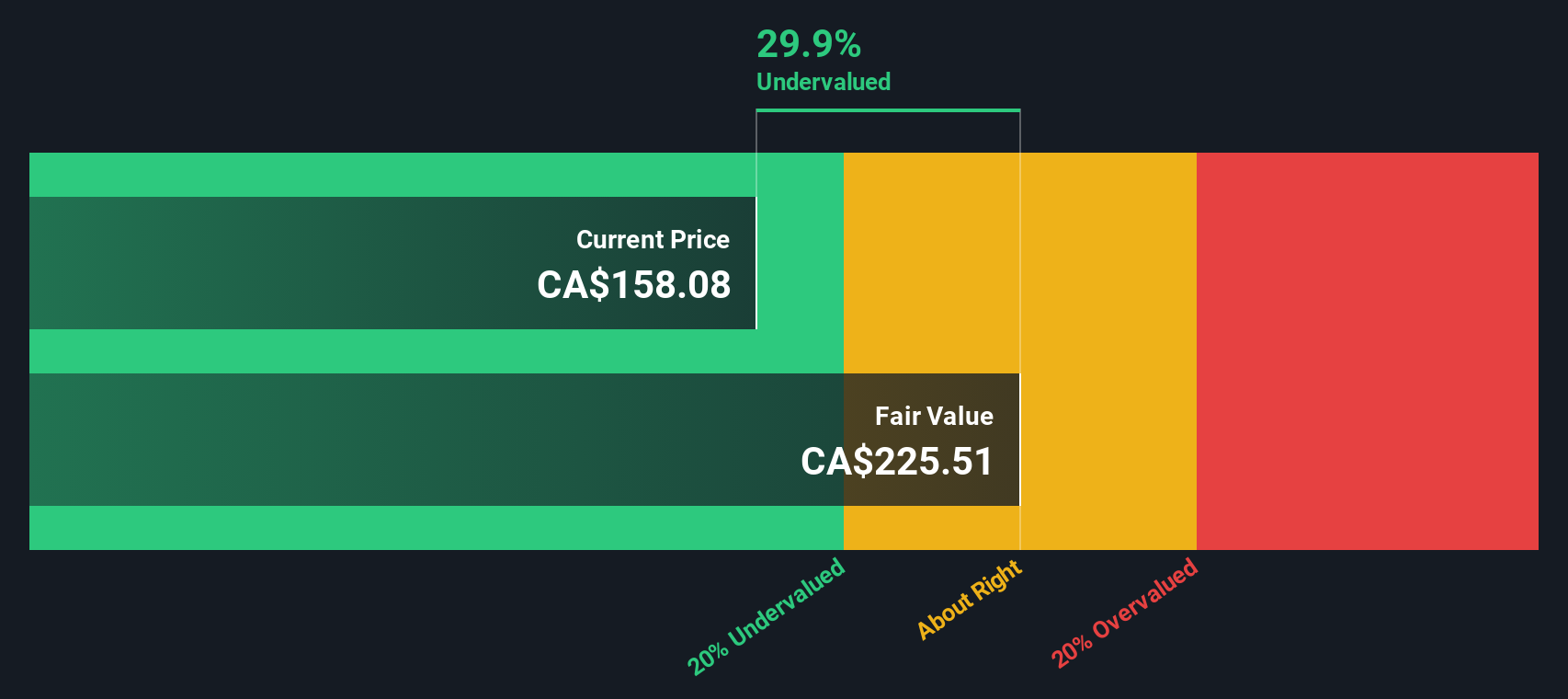

With such impressive returns and evolving leadership, the question for investors is clear: is National Bank of Canada’s stock still undervalued, or has the market already priced in the next wave of growth?

Most Popular Narrative: 3.9% Overvalued

National Bank of Canada’s latest fair value estimate stands at CA$151.69, while shares last closed at CA$157.57, suggesting modest overvaluation. Let’s see what’s driving this assessment.

Successful integration of Canadian Western Bank (CWB) and rapid realization of cost and funding synergies are progressing ahead of expectations. With revenue synergies yet to come, this positions the bank for accelerated revenue growth and improved net margins as integration milestones are completed over the next 18 months.

Curious how analysts are connecting double-digit growth ambitions and a higher-than-usual future profit multiple? There is a bold story playing out in the forecasted jump from current margins to a new profitability threshold. Want to know which business segments and projections are driving this valuation target? Dig deeper—you’ll be surprised which numbers might actually justify the current price premium.

Result: Fair Value of $151.69 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued pressure on net interest margins and rising technology costs could quickly tilt the outlook. This may challenge National Bank of Canada's current growth narrative.

Find out about the key risks to this National Bank of Canada narrative.

Another View: Discounted Cash Flow Valuation

Looking through the lens of our DCF model, National Bank of Canada appears significantly undervalued, with its share price trading well below an estimated fair value of CA$217.37. This raises a powerful question: can the true worth of the bank be captured in current market pricing, or is something being overlooked?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out National Bank of Canada for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 841 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own National Bank of Canada Narrative

If you have a different perspective or want to build your own view from the data, you can create your own narrative in just a few minutes. Do it your way

A great starting point for your National Bank of Canada research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep an eye out for tomorrow’s breakout opportunities. Use these handpicked stock lists to spot your next potential winner before the crowd catches on.

- Boost your income and stay ahead of inflation by reviewing these 18 dividend stocks with yields > 3% with yields above 3% and strong payout records.

- Capitalize on revolutionary healthcare advancements by scanning these 33 healthcare AI stocks where artificial intelligence is transforming the industry.

- Position yourself at the forefront of financial innovation with these 82 cryptocurrency and blockchain stocks as you tap into blockchain and digital asset trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Bank of Canada might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NA

National Bank of Canada

Provides financial services to individuals, businesses, institutional clients, and governments in Canada and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives