National Bank of Canada (TSE:NA) Is Increasing Its Dividend To CA$1.14

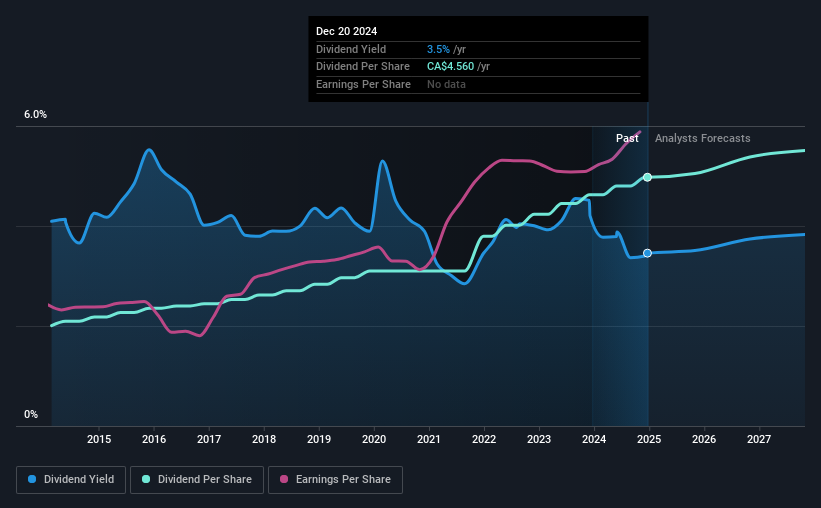

National Bank of Canada's (TSE:NA) dividend will be increasing from last year's payment of the same period to CA$1.14 on 1st of February. Although the dividend is now higher, the yield is only 3.5%, which is below the industry average.

View our latest analysis for National Bank of Canada

National Bank of Canada's Payment Expected To Have Solid Earnings Coverage

The dividend yield is a little bit low, but sustainability of the payments is also an important part of evaluating an income stock.

Having distributed dividends for at least 10 years, National Bank of Canada has a long history of paying out a part of its earnings to shareholders. Taking data from its last earnings report, calculating for the company's payout ratio shows 40%, which means that National Bank of Canada would be able to pay its last dividend without pressure on the balance sheet.

Looking forward, earnings per share is forecast to fall by 10.5% over the next 3 years. Fortunately, analysts forecast the future payout ratio to be 43% over the same time horizon, which is in the range that makes us comfortable with the sustainability of the dividend.

National Bank of Canada Has A Solid Track Record

The company has an extended history of paying stable dividends. The annual payment during the last 10 years was CA$1.84 in 2014, and the most recent fiscal year payment was CA$4.56. This implies that the company grew its distributions at a yearly rate of about 9.5% over that duration. The growth of the dividend has been pretty reliable, so we think this can offer investors some nice additional income in their portfolio.

The Dividend Looks Likely To Grow

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. It's encouraging to see that National Bank of Canada has been growing its earnings per share at 10% a year over the past five years. Earnings are on the uptrend, and it is only paying a small portion of those earnings to shareholders.

We Really Like National Bank of Canada's Dividend

Overall, we think this could be an attractive income stock, and it is only getting better by paying a higher dividend this year. The distributions are easily covered by earnings, and there is plenty of cash being generated as well. However, it is worth noting that the earnings are expected to fall over the next year, which may not change the long term outlook, but could affect the dividend payment in the next 12 months. All of these factors considered, we think this has solid potential as a dividend stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Just as an example, we've come across 2 warning signs for National Bank of Canada you should be aware of, and 1 of them doesn't sit too well with us. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if National Bank of Canada might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:NA

National Bank of Canada

Provides financial services to individuals, businesses, institutional clients, and governments in Canada and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success