Will Laurentian Bank’s (TSX:LB) Rate Cut Strategy Drive Lending Growth or Pressure Margins?

Reviewed by Sasha Jovanovic

- Laurentian Bank of Canada recently reduced its base and prime lending rates by 25 basis points for both CAD and USD products, effective October 30, 2025, aiming to adjust its monetary policy in response to current market conditions.

- This shift is designed to make borrowing more accessible and could boost the bank’s competitive appeal for retail and commercial customers across Canada and the United States.

- We'll assess how Laurentian Bank's interest rate reductions might influence its investment narrative, especially in terms of lending activity and profitability.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Laurentian Bank of Canada Investment Narrative Recap

To see Laurentian Bank of Canada as an attractive investment, you need to believe in its transition toward more efficient, tech-driven operations and its potential for higher-margin commercial lending. The recent 25 basis point rate cut may support near-term loan growth, but it does not materially change the main short-term catalyst of operational efficiency gains, nor does it offset the biggest current risk, sustained high expense levels that continue to pressure profitability and margins.

Among recent developments, the Q3 2025 earnings report stands out, showing growth in net interest income and net income year-over-year. This supports the catalyst that an increase in lending activity, possibly spurred by lower rates, could contribute to improved financial results if cost control measures begin to take hold. However, investors should be aware that…

Read the full narrative on Laurentian Bank of Canada (it's free!)

Laurentian Bank of Canada’s outlook anticipates revenues reaching CA$1.1 billion and earnings of CA$157.8 million by 2028. This is based on an assumed annual revenue growth rate of 4.9% and an earnings increase of approximately CA$23.1 million from current earnings of CA$134.7 million.

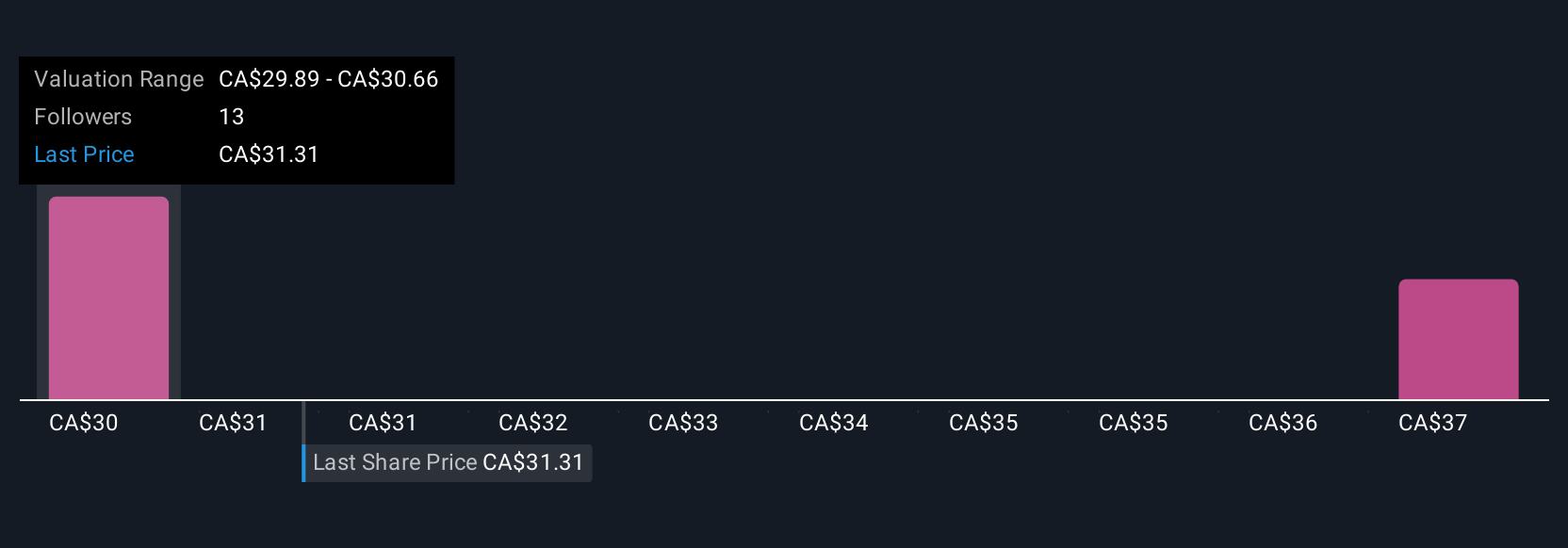

Uncover how Laurentian Bank of Canada's forecasts yield a CA$29.89 fair value, a 11% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided four fair value estimates ranging from CA$29.89 to CA$56.90 per share, reflecting wide differences in outlooks. While opinions vary, many see the continued high efficiency ratio as a key factor influencing Laurentian Bank’s profit potential over the medium term, consider reviewing these alternative viewpoints for a fuller picture.

Explore 4 other fair value estimates on Laurentian Bank of Canada - why the stock might be worth as much as 69% more than the current price!

Build Your Own Laurentian Bank of Canada Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Laurentian Bank of Canada research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Laurentian Bank of Canada research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Laurentian Bank of Canada's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:LB

Laurentian Bank of Canada

Provides various financial services to personal, business, and institutional customers in Canada and the United States.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives