The board of Equitable Group Inc. (TSE:EQB) has announced that it will pay a dividend of CA$0.37 per share on the 30th of September. Including this payment, the dividend yield on the stock will be 1.0%, which is a modest boost for shareholders' returns.

See our latest analysis for Equitable Group

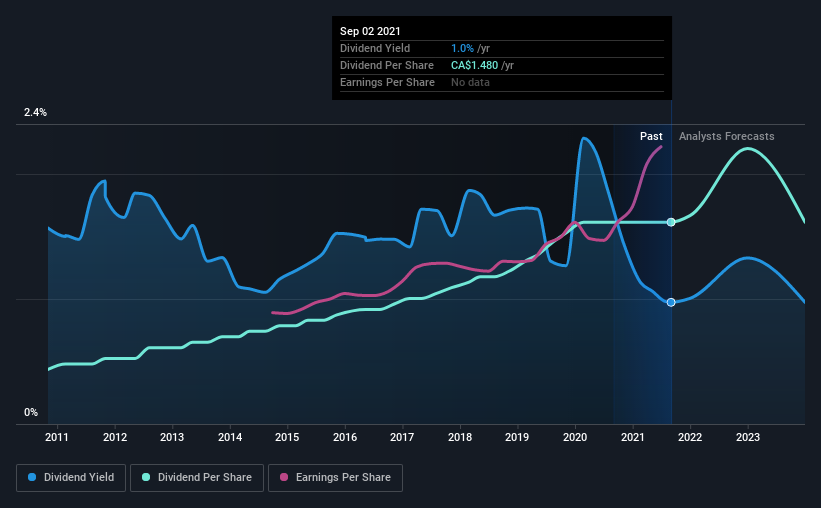

Equitable Group's Earnings Easily Cover the Distributions

If it is predictable over a long period, even low dividend yields can be attractive. Based on the last payment, Equitable Group was earning enough to cover the dividend, but free cash flows weren't positive. In general, we consider cash flow to be more important than earnings, so we would be cautious about relying on the sustainability of this dividend.

Over the next year, EPS is forecast to fall by 0.1%. If the dividend continues along recent trends, we estimate the payout ratio could be 10%, which we consider to be quite comfortable, with most of the company's earnings left over to grow the business in the future.

Equitable Group Has A Solid Track Record

The company has an extended history of paying stable dividends. The dividend has gone from CA$0.40 in 2011 to the most recent annual payment of CA$1.48. This means that it has been growing its distributions at 14% per annum over that time. We can see that payments have shown some very nice upward momentum without faltering, which provides some reassurance that future payments will also be reliable.

The Dividend Looks Likely To Grow

The company's investors will be pleased to have been receiving dividend income for some time. It's encouraging to see Equitable Group has been growing its earnings per share at 17% a year over the past five years. Growth in EPS bodes well for the dividend, as does the low payout ratio that the company is currently reporting.

In Summary

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. While Equitable Group is earning enough to cover the payments, the cash flows are lacking. We don't think Equitable Group is a great stock to add to your portfolio if income is your focus.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've identified 2 warning signs for Equitable Group (1 is a bit concerning!) that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if EQB might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:EQB

EQB

Through its subsidiary, Equitable Bank, provides personal and commercial banking services to retail and commercial customers in Canada.

High growth potential established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion