Could CIBC’s Retirement Portfolio Launch Signal an Evolving Wealth Strategy for (TSX:CM) Investors?

Reviewed by Sasha Jovanovic

- In recent days, CIBC Asset Management Inc. introduced the CIBC Target Retirement Date Portfolios, a suite of institutional investment portfolios customized for Canadian retirement plan members, while CIBC Innovation Banking and Information Venture Partners jointly provided a CA$20 million financing facility to DealMaker to support its growth and US expansion.

- This series of announcements highlights CIBC's ongoing efforts to broaden its retirement solutions and leverage partnerships to foster innovation in both wealth management and technology financing.

- We'll explore how the launch of new retirement investment portfolios may influence CIBC’s overall investment narrative and future direction.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Canadian Imperial Bank of Commerce Investment Narrative Recap

To be a CIBC shareholder, you need confidence in the bank’s ability to maintain asset quality and grow its Canadian core while unlocking value from digital and U.S. expansion. The recent suite of retirement portfolios and DealMaker financing reinforce CIBC’s innovation push, but these announcements do not materially alter the primary near-term catalyst, Canadian mortgage performance, or the key risk, which is potential credit losses if the domestic housing market weakens.

The introduction of the CIBC Target Retirement Date Portfolios stands out, as it underscores the bank’s goal to capture more wealth management business amid demographic shifts and rising demand for retirement solutions. This development ties directly into efforts to increase fee-based revenues and reduce reliance on net interest income, important as the competitive pressures from fintechs and banks persist.

However, while product expansion creates opportunities, investors should be mindful of the potential downside if Canadian residential mortgage delinquencies continue to rise in...

Read the full narrative on Canadian Imperial Bank of Commerce (it's free!)

Canadian Imperial Bank of Commerce's outlook projects CA$29.7 billion in revenue and CA$8.8 billion in earnings by 2028. Achieving this requires 4.5% annual revenue growth and a CA$1.0 billion increase in earnings from CA$7.8 billion currently.

Uncover how Canadian Imperial Bank of Commerce's forecasts yield a CA$110.01 fair value, a 6% downside to its current price.

Exploring Other Perspectives

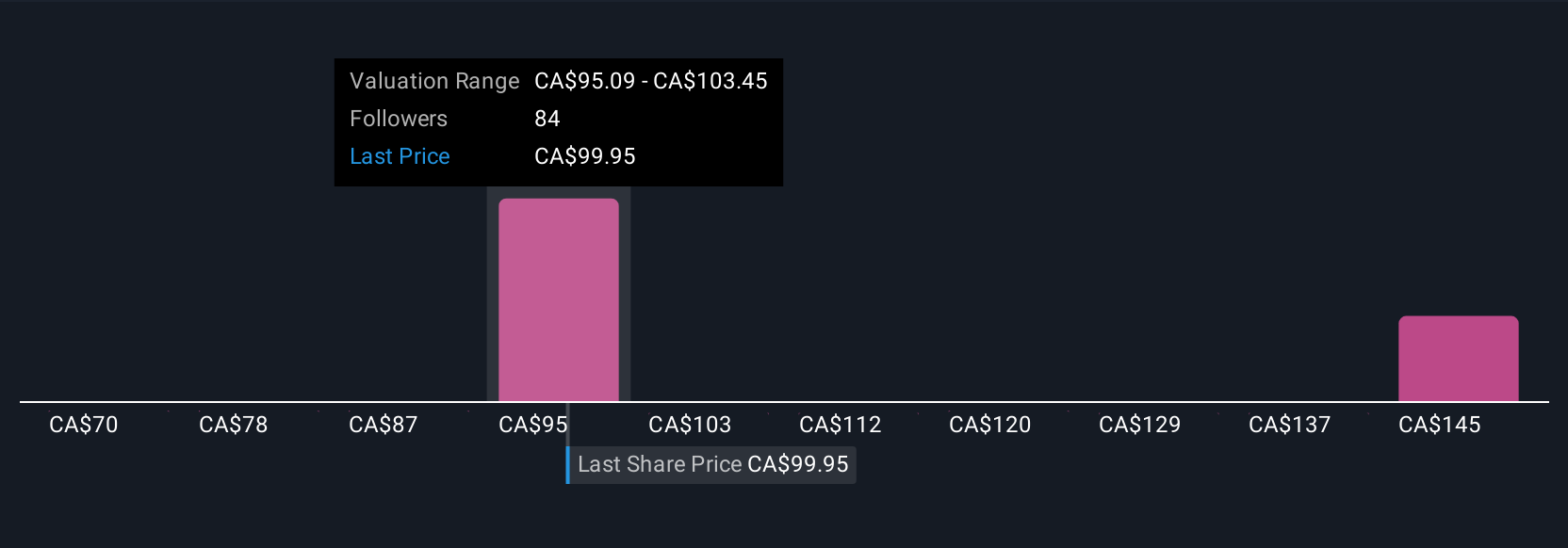

With four different fair value estimates from the Simply Wall St Community ranging from CA$94.57 to CA$176.83, opinions on CIBC’s outlook span a wide spectrum. Your view on the risks tied to Canadian mortgage exposure could have a significant impact on your assessment of CIBC’s future performance, explore how your approach compares to other investors’ perspectives.

Explore 4 other fair value estimates on Canadian Imperial Bank of Commerce - why the stock might be worth 19% less than the current price!

Build Your Own Canadian Imperial Bank of Commerce Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Canadian Imperial Bank of Commerce research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Canadian Imperial Bank of Commerce research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Canadian Imperial Bank of Commerce's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CM

Canadian Imperial Bank of Commerce

A diversified financial institution, provides various financial products and services to personal, business, public sector, and institutional clients in Canada, the United States, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives