Scotiabank (TSX:BNS): Valuation in Focus After Earnings Beat, Dividend Declaration, and Share Buyback Completion

Reviewed by Simply Wall St

If you have been watching Bank of Nova Scotia (TSX:BNS) lately, you might be wondering what is driving all the renewed attention. The company’s third-quarter earnings just landed, revealing higher net income and net interest income year-over-year. In addition, management announced its regular quarterly dividend and completed a recent share buyback program. For investors, these moves highlight both the bank’s improving operations and its commitment to rewarding shareholders.

These updates come shortly after a period of steady positive momentum for Bank of Nova Scotia’s stock price. Over the past year, shares have climbed 35%, with especially strong gains since spring. The combination of earnings growth, consistent dividends, and buybacks has been the dominant story for Bank of Nova Scotia this year, creating a sense among investors that confidence is returning after a period of mixed performance. There have also been several bond issuances and strategic initiatives in recent weeks, which have mostly reinforced the core narrative of stability and growth.

Given the recent run-up, the question remains whether there is still value left in Bank of Nova Scotia or if the market has already priced in the bank’s next phase of growth.

Most Popular Narrative: Fairly Valued

According to the most widely followed narrative, Bank of Nova Scotia is currently trading at a price that is very close to its estimated fair value. This assessment is based on analyst expectations of future earnings and revenue growth. It suggests that investors may be largely in agreement with the consensus outlook for the company at present levels.

Expansion of banking and wealth management services in high-growth Pacific Alliance countries (Mexico, Peru, Chile, Colombia) positions BNS to capture revenue growth from increasing financial inclusion and rising middle-class demand for loans and investment products. This supports future top-line and earnings expansion.

This stock’s fair value calculation has an unexpected story behind it. There is a series of bold assumptions about future growth that set the stage for its current pricing. Want to know which overlooked factors might be influencing these analyst targets? The numbers behind this valuation might just surprise you.

Result: Fair Value of $87.07 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, exposure to economic volatility in Latin America and ongoing weakness in Canadian loan growth could still challenge Bank of Nova Scotia’s outlook.

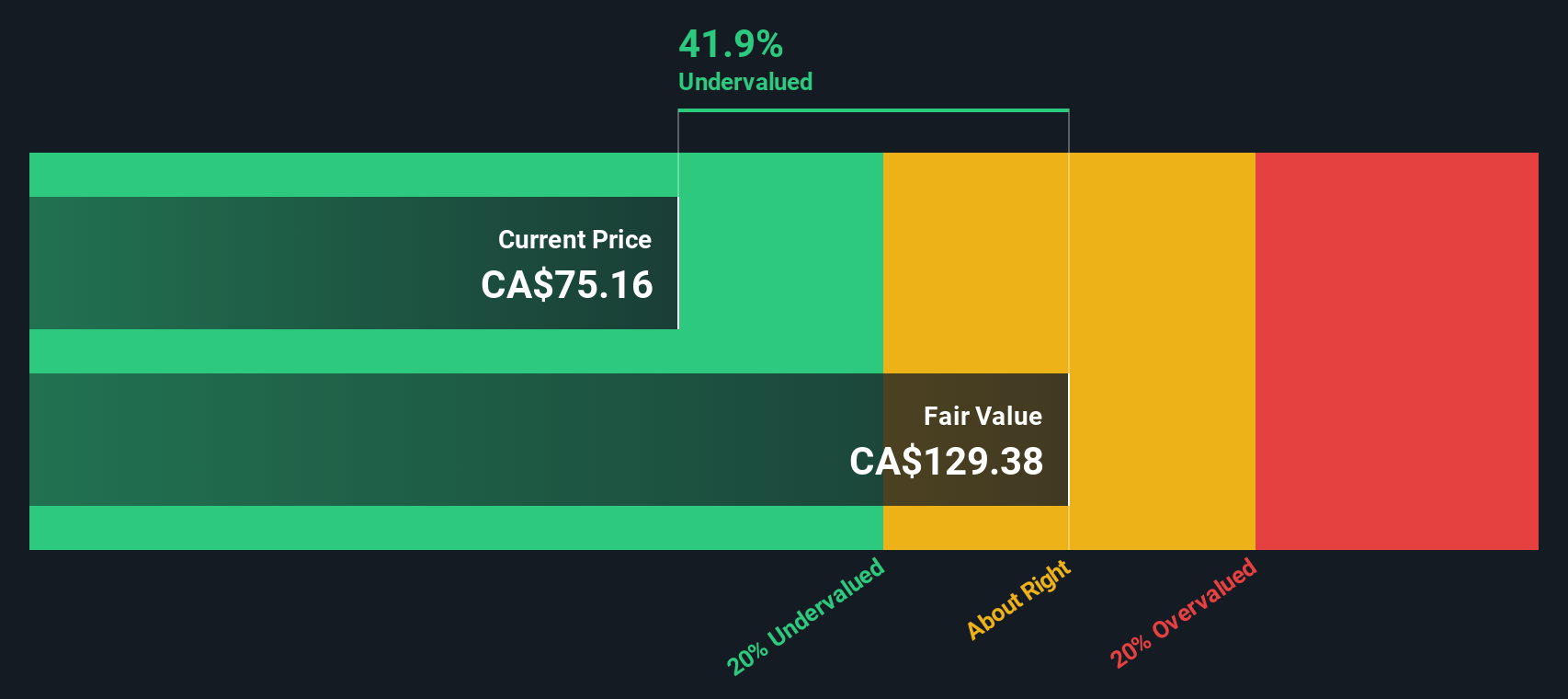

Find out about the key risks to this Bank of Nova Scotia narrative.Another View: SWS DCF Model Suggests Undervaluation

While many analysts say the current price closely matches Bank of Nova Scotia’s fair value, the SWS DCF model tells a different story. It sees the shares as undervalued. Could the market be missing something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bank of Nova Scotia for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bank of Nova Scotia Narrative

If you feel differently or want to reach your own conclusions, the tools are there to build your own take in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Bank of Nova Scotia.

Looking for more investment ideas?

Set yourself up for smarter investing by tapping into unique strategies on Simply Wall Street. Uncover potential winners and get ahead of the crowd with these proven opportunities.

- Catch income opportunities by targeting companies with steady cash payouts using our dividend stocks with yields > 3%.

- Jump into the next wave of digital disruption by screening market innovators in blockchain and cryptocurrencies via our cryptocurrency and blockchain stocks.

- Spot hidden bargains the market has missed and maximize your value potential with help from our undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Nova Scotia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSX:BNS

Bank of Nova Scotia

Provides various banking products and services in Canada, the United States, Mexico, Peru, Chile, Colombia, the Caribbean and Central America, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives